Ameriprise capped a busy first quarter for recruiting, adding two teams with $463 million in combined assets under management.

John Brewster and his son jumped from UBS to a suburban New York City branch, while the six advisers of FMB Advisors in Atlanta joined the company from Next Financial Group, a Houston-based IBD. FMB went to Ameriprise's franchise channel, while the Brewsters moved to the employee channel.

After a year that

For Larry Minogue and Arthur Farr, the partners who launched FMB, the decision stemmed from

“It’s just that we recognize that the industry is going through consolidation. We wanted to make the consolidation of our choosing,” says Farr, 61. “We’ve got nothing but good things to say about Next, and this was probably the toughest decision I’ve had to make in my career.”

The firm also recruited an international wealth management team that oversaw $576 million, according to our latest roundup of recent hires and moves.

LOOKING FOR FLEXIBILITY

In the other move, John and Randall Brewster left UBS after a decade, making 13 ex-wirehouse brokers to exit for Ameriprise’s employee channel in the first quarter. The father-son team opted for the Saddle Brook, New Jersey, branch to get more flexibility than at the wirehouses, the elder Brewster says.

“They were focusing more and more on what I would consider the ultrahigh-net-worth space and less and less on the people I work with,” says Brewster, 69.

Representatives for UBS and Next did not respond to requests for comment on the two teams’ departures Wednesday afternoon.

-

The regional broker-dealer has added at least a dozen ex-wirehouse advisers so far this year.

March 15 -

Wirehouse brokers and teams from Kestra and MSI Financial led the way in a flurry of hires.

February 28 -

The firm picked up one adviser each from Merrill Lynch and UBS.

February 17 -

The new recruits joined the firm's independent and employee channels.

January 25

Farr spent 14 years at Next, 10 of them on the board of directors. His team, which has $202 million in AUM, includes Minogue, Richard Arno, Kyle Welker, Scott Kallish and Bob Carter. Minogue spent 17 years at Next and Arno was with the company for 13 years, according to FINRA BrokerCheck records. FMB also includes four other staff members, and the team reports to Michael Barker.

Randall Brewster started in the industry at UBS in 2007. His father began his career at Lehman Brothers in 1984, working there for nine years before going to Citigroup for 13 years. Their team, which includes sales representative Susan McGeachen, has $261 million in AUM, according to their new firm.

Both Farr and Brewster cited the size and profitability of Ameriprise, which had a price of $127.38 per share at market close on Wednesday. The advice and wealth management division of Ameriprise Financial disclosed pre-tax profits of $911 million in 2016, a 21% increase from the prior year.

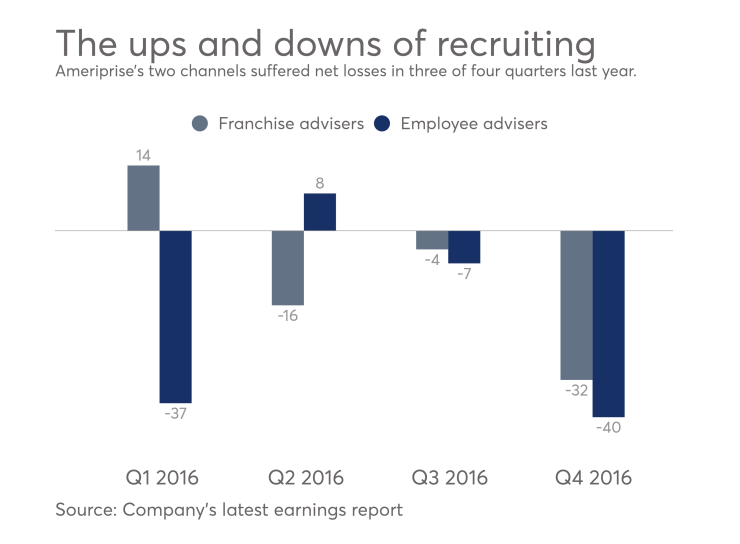

The division’s AUM grew by 11% to $199.7 billion from $179.5 billion last year. At the same time, the firm lost 114 advisers in 2016, with 76 leaving from the employee channel and 38 from the franchise channel.