Four Wells Fargo brokers who generated about $3.8 million in annual revenue bolted from the firm’s dwindling Profit Formula platform for Raymond James.

John Watts, Steuart Evans, Russell Henshaw and Bradford Flowers opened a new Huntsville, Alabama, branch of the regional firm’s Advisor Select division, a part of the company’s employee channel, Raymond James announced Tuesday. The firm had

Advisor Select, also known as the “independent employee” division, has

Wells Fargo has focused in recent months on its traditional brokerage force and the independent Wells Fargo Financial Network. The firm is

“They haven’t really been supporting and funding it,” says Bischoff of the roughly 15-year-old program. “There was a rumor that they were going to bring it back, because everyone thought it was revolutionary and innovative when they started it.”

A spokeswoman for Wells Fargo declined to comment on the Alabama team’s departure or the company’s plans for the platform.

A comparison of starting payouts under this year's compensation plans.

HYBRID UNIT

The Raymond James unit provides employee status and benefits while allowing advisers to choose their office’s location and control their branch’s P&L, according

The four new Raymond James advisers are all industry veterans and managed more than $700 million in client assets at Wells Fargo. The team now reports to Michael Turnbough, Raymond James’ Alabama complex manager.

-

Three advisers joined the firm's Advisor Select channel, where they are employees but can make additional business-decisions for their practice.

September 1 -

The group, led by two brothers, joined the firm as partners and opened a new office for Noyes. It's now the firm's largest branch.

November 21 -

The group includes a father-daughter duo who have worked together for 25 years.

April 13 -

The settlement is the third major regulatory payment the BD has incurred in the past year. A branch manager associated with the Jay Peak case has also left the firm.

April 17

Members of Evans, Watts, Henshaw and Flowers Wealth Management Group made the move on March 17, according to FINRA BrokerCheck.

“We wanted a firm which was adviser-centric as well as client-focused; a firm which respected its advisers and trusted them to do the right thing for their clients,” Watts said in a statement.

Watts started at Wells Fargo in 2001, following tenures at Prudential Securities, Robinson-Humphrey and Morgan Keegan. Evans began his career at Robinson-Humphrey in 1991, spending a decade there before moving to Salomon Smith Barney and, subsequently, Wells Fargo in 2003.

Flowers joined the firm the same year after two years with Prudential and 11 with Merrill Lynch, while Henshaw came aboard at Wells Fargo in 2009. Henshaw previously had worked at Smith Barney, Legg Mason and Dean Witter, breaking into the industry in 1996.

Client service associates Celesta Freeman, Stephanie Akin and Deborah Mosley make up the rest of the team at the office in Huntsville, roughly 100 miles north of Birmingham.

HEADCOUNT UPS AND DOWNS

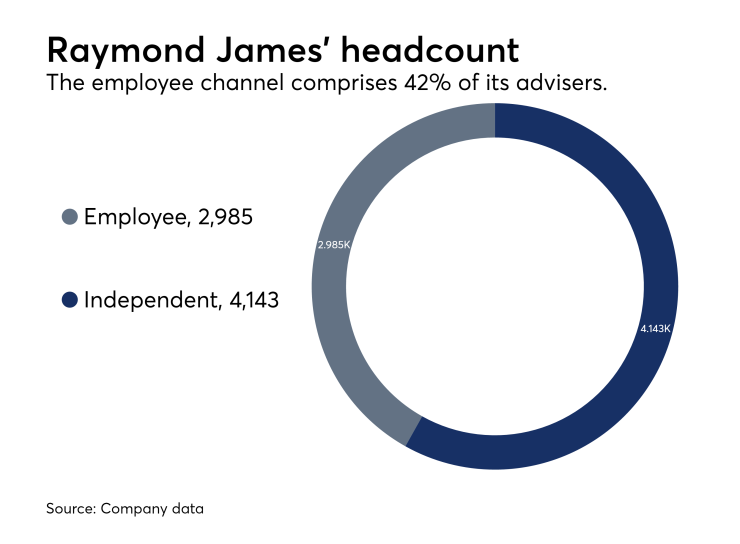

Raymond James’ adviser headcount ticked down to 7,128 at the end of 2016 from 7,146 at the close of the third quarter, according to its latest earnings report. Assets under administration in the private client group grew to $585.6 billion from $574.1 billion over the same period.

The other Wells Fargo team to lately join Raymond James switched between the independent channels of the two firms. Another Wells Fargo adviser recently