The recruiting arena has been in upheaval over the past 18 months. Three wirehouses have slashed hiring efforts, the Broker Protocol’s future has been in doubt following the departure of two major firms, and transition deals have shrunk.

To get a better sense of what career paths are available for advisors now, On Wall Street annually convenes a meeting of top headhunters. Our experts discussed which wirehouses are the least and most advisor friendly, how regulation of brokers is changing and little known business practices at banks.

We held the roundtable in our offices earlier this year in a marathon session. (Our group is a chatty bunch.) This is the second of three segments. See

Our participants were: Elizabeth McCourt, president of McCourt Leadership Group; Mindy Diamond, president and CEO of Diamond Consultants; Mark Elzweig, president of Mark Elzweig Co.; Michael King, president of Michael King Associates; Rick Rummage, president of the Rummage Group; Danny Sarch, president of Leitner Sarch Consultants; and Bill Willis, president and CEO of Willis Consulting.

Below is a lightly edited version of our discussion.

OWS: When Morgan Stanley and Merrill Lynch

WILLIS: I will tell you Merrill never really stopped recruiting. They didn't give up at all. Here's what happened. When Merrill announced their departure from recruiting last spring, they allowed their managers to continue to pursue candidates in their pipeline. And to be considered in the pipeline, candidates had to complete prehire paperwork by a certain date. … The firm then gave their managers until the end of 2017 to close candidates. So any candidate who had completed the prehire paperwork in a timely fashion was able to start with the firm as late as last December.

DIAMOND: But Morgan Stanley is doing that, too.

SARCH: They're just not succeeding. Call it however you want, but it's not succeeding. … It's their position that they’re no longer recruiting. Just like I'm no longer a candidate for the NBA, I gave up that dream so I'm just going to stick to my headhunting world. That's what essentially has happened. They lost and then they said they gave up.

DIAMOND: The big firms are saying, ‘We want franchise players,’ but they've yet to really define what a franchise player is. The bottom line is, they're open for business, but they're not successful. This was a reason plenty of advisors looked at independence. In a perfect world, why wouldn't they want that? They could get more freedom, build equity and have flexibility. But then, the short-term economics were on the side of the wirehouses, not so much because people preferred it, but just because the deals are big enough.

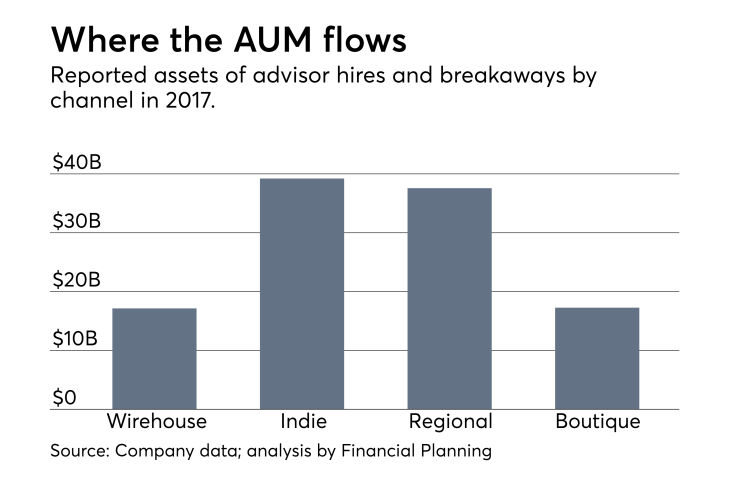

SARCH: But they lost four years in a row. That's my point. For four years ending in 2017, of all the wirehouse departures, fewer than half went to another wirehouse, even as the deals accelerated. … it's like when you're on a plane, right, and they say. ’We’re oversold, guys.’ They start bidding at $500. And eventually get to a point where somebody says, ’Yes, for $5,000, I'll go tomorrow.’

The point is that they gave up. They realized, ‘OK, it's truly uneconomical at these numbers. So we're giving up.’

OWS: Let’s talk briefly about the strengths and weakness of the wirehouses.

WILLIS: Well, one of the strengths of Wells Fargo, who’s my client, is the fact that they have multiple channels. Actually they have four channels. One not so well-known. They have independence. They also have an RIA. They don't advertise, but they will let an independent go RIA with them.

OWS: What’s the RIA called?

WILLIS: I don't think it has a name. Just an RIA arrangement with first clearing the broker-dealer. And if you want to be bank-based advisor, their bank channel is second-to-none, in my opinion. … I think with the toolbox that they have, they're creating a lot of big producers in their space. … The bad points are the scandals, especially the poor way they have been handled.

SARCH: All we know is that they weren't caught before. Considering what we know now, maybe it's been going on for a long time.

WILLIS: Those of you who do much in banking know that a lot of banks do make up accounts and send them out to people. Unfortunately it's a common practice.

RUMMAGE: I’ve worked for five banks, and they all did that.

DIAMOND: I didn't know that! I don’t think I’m being naive. I'm appalled.

KING: Why would they do that?

RUMMAGE: When you go in and open up a checking account, sometimes, you qualify in their system for a credit card, or a debit card. So even though they're supposed to tell you you're getting these, some client service associates just forget to tell you. Credit cards, debit card, whatever. Most of them aren’t trying to be dishonest, they do it because somebody else told them to do it.

Among recent career changes, Merrill Lynch lost brokers managing $2.2 billion to rival J.P. Morgan Securities.

OWS: Were those cards ever activated?

RUMMAGE: Some activated them. They get them in their mail. We've gotten them. My wife just asked me about one the other day.

OWS: I mean, did bank staff activate those cards?

RUMMAGE: I'm sure there are some, but no, not usually. What they're doing is wrong, obviously, but they're not trying to embezzle money. They're just trying to hit a sales goal. … They need to revamp the incentives for all these people. And they have at Wells.

WILLIS: Wells had a lot of pressure on these people to open accounts, but they weren’t so good at the compliance of making sure it was done right. But I would say that the financial advisors had nothing to do with any of this. In most cases, they didn't even know about it, they were blindsided by this. And that's the worst thing about working there, having your name negatively in the news. Clients call and ask, ‘What the hell is going on?’ Or worse yet, they don't call you at all, they just leave.

OWS: Let's move on to Merrill Lynch.

WILLIS: Merrill Lynch is to the brokerage world as Kleenex is to facial tissues. If you asked for the name of one brokerage firm, most people will say Merrill Lynch.

KING: Yeah, it is has the most recognition. But for wealthy clientele, Morgan has a good name.

RUMMAGE: We explain it to advisors in terms user friendliness — we rank them in this order. Merrill was the least user-friendly for advisors, with a culture of ‘no, no, no.’ Morgan Stanley would be next, then UBS, then Wells Fargo. Wells Fargo has more of a culture of ‘yes.’ So, Wells is the most user-friendly. Then you add the fact that they have different models, it makes it even better.

OWS: Let’s move on to more strengths and weaknesses

MCCOURT: Well, for UBS, I was just reading that headcount was down, but profitability was up. I’m sure they're thrilled about that.

OWS: Production per advisor there is about $1.2 million,

MCCOURT: They have been positioning themselves in the past, say, 10 years — to be that high-end boutique advisory firm. They want to have that million-plus advisor. And I think they're accomplishing that.

DIAMOND: As far as positives and negatives about the wirehouses, I think in a lot of ways they're interchangeable. … If an advisor is motivated to make a move and go to another wirehouse, he will just go to the highest bidder because, by-and-large, they're the same.

OWS: The fiduciary rule is set to go into full effect next year. But would regulators be better off trying to root out the relatively small number of bad apples ruining the batch? (Since our roundtable, a federal court unexpectedly struck down the rule, likely killing it. Since that decision can still be appealed until early May, and the SEC is still mulling its own fiduciary rule, we left a shortened version of this part of the discussion to give context on the thinking of these industry insiders.)

SARCH: The industry has done a terrible job of policing their own. We all know big producers who are bad guys. The biggest testament to this is that you talk to a big producer in an office and say, ’OK, if you're hit by a truck, you have a 50-person office, how many people do you trust to handle your family's money? ... They’ll lower their voices, and they'll say ‘five.’ It's embarrassing.

ELZWEIG: I would say the industry has done a pretty good job, especially compared to years ago. Because if you look at FINRA's own data, you'll see even after the market crashed in 2008, the number of investor lawsuits keeps going down. Firms are extremely particular who they hire. Years ago if you were terminated from a wirehouse, maybe you end up at a regional firm. If you're terminated from a wirehouse now, you have to work at a really obscure broker-dealer. So it seems to me that the industry is very concerned about compliance.

WILLIS: I've been around the industry 25 years, and I think the number of bad folks has dropped dramatically. They're just not tolerated anymore. The firms have decided the reputation risk isn’t worth it. Are there some people who occasionally touch the edge, who may not be trusted by their fellow advisors? Yeah. But in terms of people having a bunch of marks, doing bad things — those people are being drummed out of the industry. I get a call every Friday about somebody getting fired. It's becoming nearly impossible to place them.

SARCH: I agree with most of that, but if the people with bad marks are able settle them quietly, they still let them slide. … The industry has done a bad job explaining to the regulators why commissions are sometimes preferred. … A basic financial product like life insurance is a commission product. So if you're doing your job — whether for a high-end client who needs it for estate purposes or a wage earner for his family — life insurance will mean a commission. Therefore it's evil.

WILLIS: I think any explanation kind of falls on prejudiced ears.

SARCH: I just don't think they tried to explain the concentrated position argument versus the retirement account. I spoke to a guy who had a secretary who was like the eighth person hired at Apple. So this woman who the most she ever made in a year is like $80,000, but she holds a position in Apple that was in double-digit millions. And on occasions she would sell and pay for a piece of real estate for her kids. … They would have an advisor charge a fee on the account? How would that make any sense for this person?

Check back next week for the third, and final, installment of our Recruiters Roundtable.