As more wirehouse advisors continue to break away from their firms, it's worth remembering that the majority of current wirehouse advisors will never fully embrace the independent model.

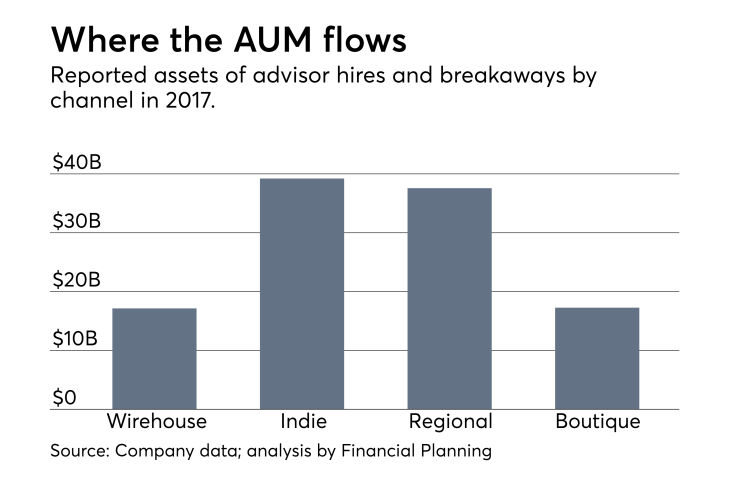

Of course, the stream of advisors going independent has been impressive in recent years. Brokers overseeing approximately $40 billion in client assets left employee brokerages in 2017, according to data collected by On Wall Street. But while that figure is striking, it's still only a drop in the bucket compared to the trillions of dollars held by the four major wirehouses.

It’s a sign that thousands of wirehouse advisors haven’t jumped ship and probably never will.

This remains true despite the well-publicized benefits of independence. According to Schwab data, 70% of advisors who went independent report that they increased their revenues after the move, and 73% reveal that independence has improved their client relationships. A whopping 90% of advisors assert that they are happier.

In my experience, it's rare for an advisor who has opted for independence to later shutter his firm and rejoin a major wirehouse. Owners of independent practices have more flexibility in crafting the terms of the sale price of their firms and the proceeds are taxed at the more favorable capital gains rate. Should they wish to continue to work after their firm is sold, they have more options to arrange this, as well. Meanwhile, owners of independent firms can often sock away bigger personal contributions to their retirement plans.

Among recent career changes, Merrill Lynch lost brokers managing $2.2 billion to rival J.P. Morgan Securities.

Yet despite the numerous and compelling advantages of the independent model, most wirehouse advisors prefer to remain within the fold of other wirehouses or regional firms. That's because they like the combination of the turnkey platforms and household brand names that come along with the wirehouse firms. They may gripe about the bureaucratic, top-down decision-making process, but in the end, they view setting up and running their own firm as a counterproductive distraction. They want to remain laser focused on servicing clients and gathering new assets. Any other activities are viewed as detrimental to their practices. When these advisors jump ship they tend to favor other wirehouses or regional firms where they can continue with their existing business model. If they do go independent, rather than start their own firms, they are likely to join independent firms that offer the turnkey services and support to which they are accustomed. This is one of the factors behind the recruiting success of firms like

All of life's choices have their positives and negatives. The word utopia in the original Greek means no place. There's a lesson in that. So how do you know if you're NOT suited to go independent? Here are three questions to ask yourself:

1. Do you view setting up your own firm as an unproductive distraction? Advisors who establish their own firms have to decide on the legal structure for their new firm, choose their own technology and employee benefits program and are responsible for their firm's compliance regimen. If these tasks seem like pointless interferences with your primary client-facing role, then pure independence is probably not for you.

There's a lot of extra work to do to set up a new firm. Joining an existing independent firm that already has a lot of this structure in place is probably a better bet. Those advisors with the entrepreneurial DNA are more likely to view these additional responsibilities as surmountable obstacles that must not be permitted to hinder their dream of establishing their own firm. They are willing to sweat these details to achieve a greater goal. Advisors who set up their own firms usually are internally motivated to do so. They don't need recruiters or anyone else to sell them on the idea of starting their own firm. They already feel compelled to do so.

2. Can you self-brand? It takes an above-average level of self-confidence to present yourself to clients as your own brand. Clients of independent advisors typically know the advisor and the custodian, rarely the name of the broker-dealer. Many wirehouse advisors like the power of plugging themselves to clients as part of a recognized, household-name firm. They feel that this helps them attract client assets. If this is not a marketing transition that you feel comfortable making, then independence is not for you.

-

-

Ex-UBS advisor Greg Hersch says opening his own RIA has been among the most challenging tasks of his career.

January 22 -

In a concession to the advisor, he can still respond to client emails and calls, even though he may not initiate contact.

December 13

3. Do you want the big bucks upfront? If you're looking for a sign-on bonus that would make a baseball player blush, then the independent model is not for you.

While there are independent firms that pay some upfront money — and even some that offer equity — those bonuses are far below the level paid by wirehouses, regional firms and high-end boutiques. As described above, going independent is more about the bigger pot of gold at the end of the rainbow. If your motto is, "A bird in the hand is worth two in the bush", then you need to stay in the wirehouse or regional firm world.

It's great that advisors have an abundance of choices when it comes to business models. While the independent channel will continue to grow and is a very worthy choice for many, it's important to recognize that most wirehouse advisors feel that they and their clients will do better if they are not sidetracked by the responsibilities of setting up and running a firm.

There's no right answer here. It's all a matter of perspective.