If you are like me, you have a love-hate relationship with your firm’s custodial bank. You love them because they provide you with asset safety, technology, trading and client statements. You hate them because of the ways they fall short: when they compete with you, when customer service is inconsistent and when their business decisions make you look bad.

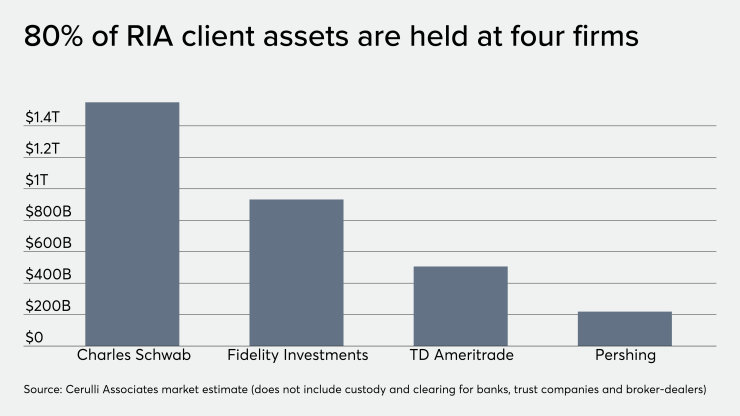

Schwab, Fidelity, TD Ameritrade and Pershing collectively hold 80% of the RIA firms’ $4 trillion in advisory assets, according to Cerulli Associates. In business school, your economics professor would call this an oligopoly. Similar to a monopoly, where a single company has the majority of the industry’s market share, an oligopoly is an industry that is controlled by two or more firms. Oligopolies are a cousin of the monopoly – they can block new competitors from entering the market, slow-down innovation, and increase prices, all of which harm customers.

The prices for oligopolies’ products or services often appear to be coordinated within the group. A perfect example: the reaction when

Many cheered the move to zero commissions. It was the logical next step in an industry where trading costs have been declining steadily since the mid-1970s. However, smart RIA advisors asked “what’s the catch?”.

No advisor is naïve enough to believe custodians work for free. Trading fee revenue only accounted for 8% of Schwab’s total revenue, according to Morningstar, a relative drop in the bucket. Nearly 90% of Schwab’s revenue comes from net interest (57% of sales), the profit spread made on lending against client cash balances, and asset management (32% of sales). In other words, Schwab’s bread and butter would remain intact if trading revenue sagged.

Cash is a big business for RIA custodians. According to Goldman Sachs, 13.6% of Schwab’s client assets are in cash and the Schwab One bank deposit product AUM has grown by 12% per annum since 2015, outpacing the firm’s overall asset growth. At Fidelity, money market funds earn the firm as much as 42 basis points per year in fees -- that is the type of fee you would expect to pay for an actively managed bond fund.

Profiting at your clients’ expense

Many advisors feel custodians make business decisions that benefit the bank at our clients’ expense. For example, in January 2018, Schwab announced it would no longer allow client cash balances to sweep automatically into money market funds – instead the cash would default to its own bank deposit product. At the time, this bank deposit product yielded considerably lower interest for clients than prevailing money-market fund rates. Advisors who wanted to keep their clients in the higher yielding money-market funds would have to go through the cumbersome process of submitting trade orders to buy and sell the funds.

Consider the example of a client who transfers $10,000 to buy stock and fund a wire. Prior to January 2018, when the client would transfer the cash, it would sweep into a money market fund by default. The fund would automatically be redeemed when a trade or wire was requested.

Now an advisor needs to make three trades: Buy $10,000 of the money market fund, sell the money fund to settle the buy order, then sell more of the money market fund to complete the wire transfer. Many well-intentioned advisors have stopped utilizing money market funds — costing their clients countless dollars in lost interest income — because of the time constraint.

Making you look bad

Earlier this year, Pershing introduced custody fees to their RIA clients and Fidelity announced it would begin charging custody fees to a larger percentage of their RIA clients. These moves prompt new conversations with clients about fees that you never had to discuss in the past. These discussions are more tenuous if they coincide with periods of heightened volatility when client portfolios are already in the red.

Competing with you

Three out of the top four RIA custodians compete directly with their RIA clients through their networks of branch offices and call centers. Most advisory firms accept this conflict -of interest because the firms promise not to go after their RIA clients’ end clients. We also appreciate that much of the benefits received by the retail investors of these firms will also accrue to our RIA clients. But sometimes, the custodians hold back on the offerings that are extended to RIA clients.

In 2015, Schwab launched a robo-advisor platform that could be used by both its retail clients (Investor Services) and RIA clients. While this sounds like a great benefit to RIA firm-owners, many were shocked to learn that they would be charged a higher fee for the platform than the fee charged to retail clients. Another example is when Schwab began offering fractional shares through its Stock Slices program earlier this year; many advisors were disappointed to learn the offering was not available for their clients.

Slow Innovation

Though TD Ameritrade was the smallest of the 4-firm oligopoly, they were well known for their innovative practices. Their trading platform has been widely hailed as one of the best in the industry. They did not charge a fee for their advisor conferences, which was a welcome departure from the practices of other custodians. And they had a very successful lead generation program that helped funnel leads from TD branches into the arms of the firm’s RIA clients -- In fact, I met one advisor who claims to have received more than $50 million in leads over the years from TD. As the oligopoly consolidates, I wonder if some of this innovation will be lost.

Benefits of an Oligopoly

Pricing is one way that firms compete within an oligopoly. Another way is through differentiation. Now that trading costs are near zero, there is a huge opportunity for RIA custodians to distinguish themselves in other areas like customer service, technology and through strategic consulting to help their RIA clients grow their businesses.

Not All Bad

As much as we beat up on our custodians, they have been solid partners. My primary custodian was flexible with minimums and took a chance in 2012 that my upstart firm would one day become a sizable client. Their rock-solid asset safety helped me overcome the skepticism of would-be-clients who were accustomed to dealing with bulge bracket firms. Their client-facing customer-service teams helped add operational capacity to my firm. Additionally, I have received numerous discounts on everything from shipping to technology by simply name-dropping my association with them. I literally would not be in business were it not for my custodian.

Ultimately, we all desire for our custodians to treat us and our clients as a priority, and if they don’t serve us well, we need a range of viable replacement options. As the industry consolidates we just hope we aren’t taken for granted by these behemoths.