-

Raymond James, RBC and Ameriprise were among the industry players to lure away talent from Merrill Lynch.

May 8 -

The duo launched a new independent practice with the firm's Investment Advisors Division.

May 5 -

The new recruit joins after the regional firm paid $150 million to settle a lawsuit brought by an SEC receiver.

May 4 -

The firm reported record revenues, net income and client assets for the first quarter.

April 19 -

At least 17 ex-wirehouse brokers bolted for the firm’s employee channel in the first quarter.

April 18 -

A look at starting payouts for elite wealth managers.

April 17 -

The elite brokerage unit picked up three veteran advisers, On Wall Street reports exclusively.

April 11 -

HighTower and Dynasty added big platform clients as wirehouse brokers continued to flee.

April 10 -

The executive, who oversees the investment bank and retail brokerage units, was paid $15.3 million in 2015.

April 10 -

A close look at what's driven the advisers at the top of this year's ranking.

April 6 -

The new hires joined the wirehouse from J.P. Morgan Securities, On Wall Street learns exclusively.

March 30 -

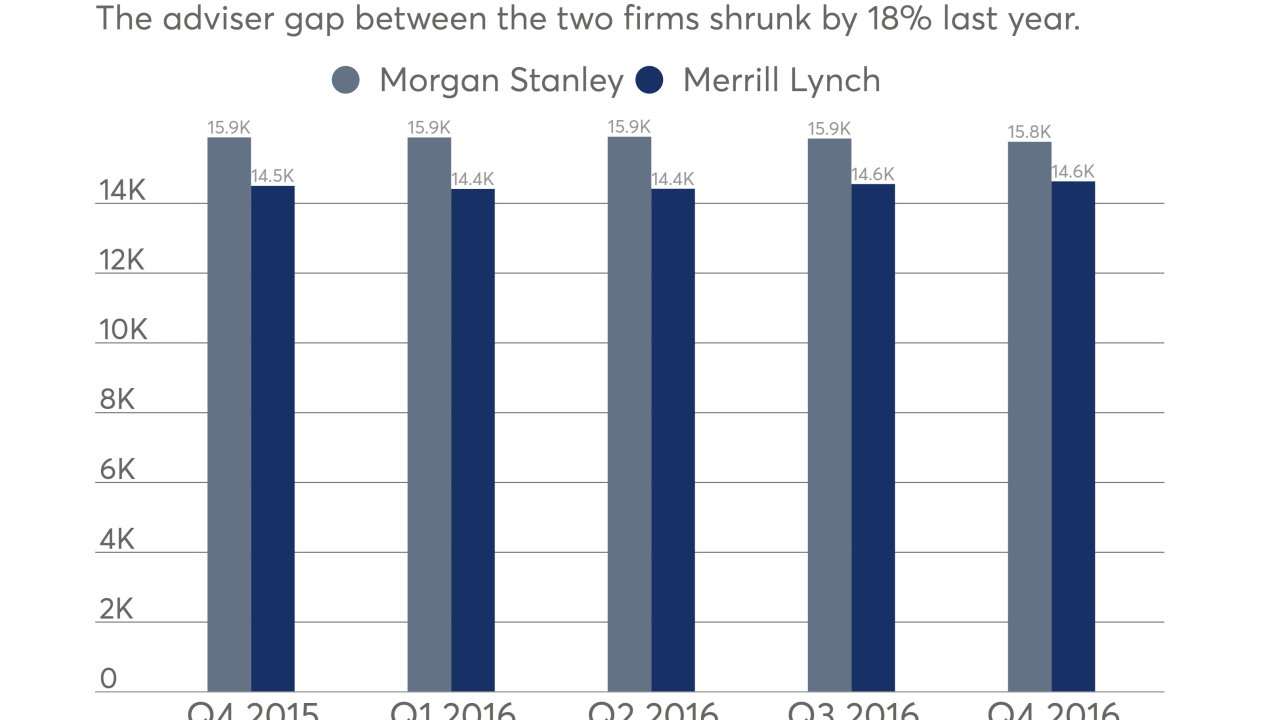

At least 16 advisers have shuttled between the wirehouse firms so far this year.

March 24 -

The ex-Morgan Stanley advisers say their niche practice, which is geared toward women and divorcees, will be better supported by Raymond James' platform.

March 23 -

The broker slashed her payment by pressing for funds she said the firm promised but never paid.

March 13 -

Morgan's latest hires oversaw about $575 million, On Wall Street learns exclusively.

March 13 -

Keith Rowling ranked No. 2 on the 2016 list of the industry's top young producers.

March 6 -

The independent firm has recruited a number of wirehouse brokers and grown to $3 billion in client assets, according to the company.

March 6 -

The six-member team serves ultrahigh-net-worth investors and families.

March 6 -

The group previously generated over $1 million in annual revenue.

March 3 -

Morgan Stanley is in “advanced discussions” with the IRS to resolve any client tax underpayments, according to an SEC filing.

February 28