-

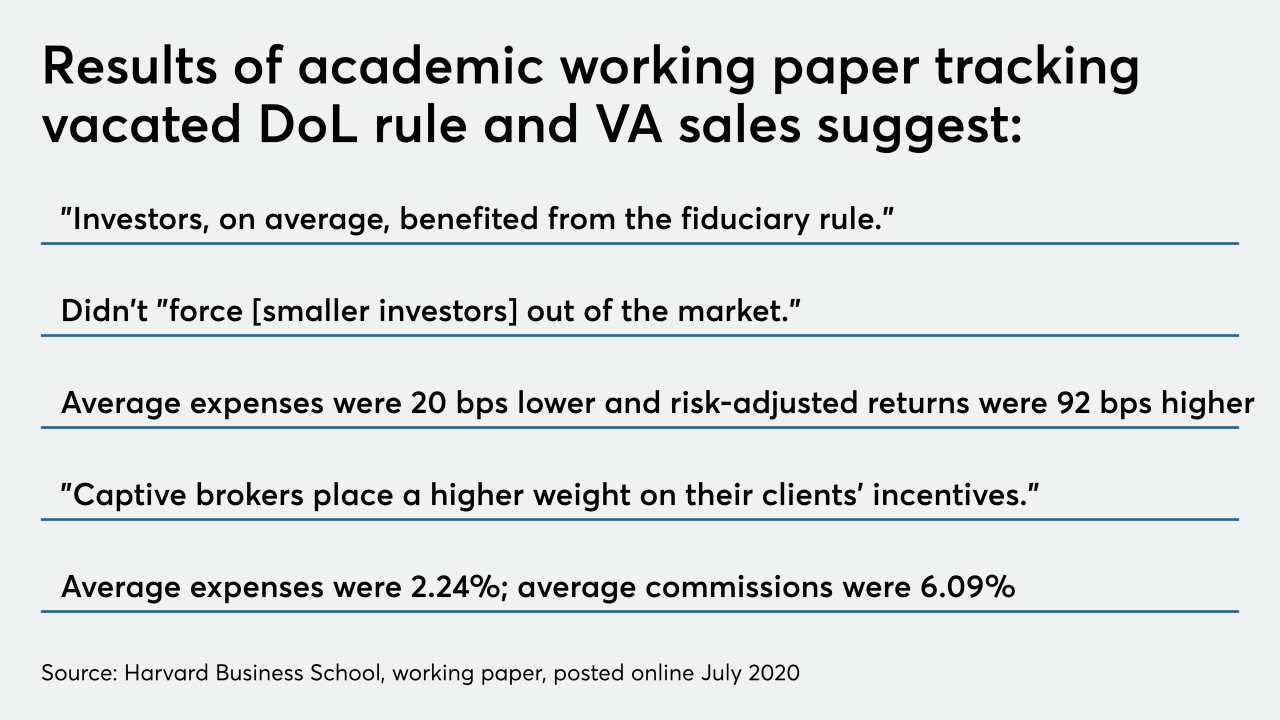

Expenses fell by 20 basis points and risk-adjusted returns climbed 92 bps, according to the study.

September 24 -

Investor advocates, religious groups and proponents of ESG investing argue the changes are a gift to business lobbyists that will muzzle corporate critics.

September 24 -

The broker hasn't been registered in over a decade, and was using clients’ usernames and passwords to make trades in their self-directed brokerage accounts, according to the regulator.

September 14 -

A rising appetite for achieving specific investment objectives, such as sustainable investing, is the main driver behind the projected rise in their popularity.

September 14 -

The former broker allegedly also used his client’s money to pay bills at gas stations, grocery and hardware stores, according to the regulator.

September 11 -

Industry veterans have warned that packaging the loans into funds that are easily accessible could pose a risk to retail investors unfamiliar with collateralized loan obligations.

September 10 -

After an SEC lawsuit, Dan Kamensky now faces criminal charges including securities fraud, extortion and obstruction of justice.

September 4 -

The passively managed fund will be made available to qualified purchasers through family offices, RIAs and other institutions, a person familiar with the matter says.

August 27 -

Previously, criteria focused on an investor’s wealth. Now, a broader group has access to investments that include private company offerings and certain private equity funds.

August 26 -

Lower transaction costs can often come with higher expense ratios at the nation’s largest IBD.

August 26 -

It’s the latest dramatic twist in the story of USO, which was at the center of the storm as crude prices plunged earlier this year.

August 20 -

The regulator charged a $1.4 billion hybrid firm over disclosure of its cash sweep arrangements with its clearing firm.

August 18 -

With employees working remotely, firms may need to adapt their procedures to deal with heightened fraud risks outside of company systems.

August 14 -

While Guinness Atkinson pursues the first full mutual fund-to-ETF conversion, similar moves have begun elsewhere in the fund industry.

August 12 -

During rapid growth, the firm allegedly failed to detect a cascade of red flags.

August 10 -

The number of advisors registering with FINRA has fallen since 2016, as more planners elect a fee-only model.

August 4 -

The firm allegedly didn't disclose its parent company paid a teacher union entity $10,000 a month “for its exclusive endorsement” as its preferred financial services partner, according to the regulator.

July 29 -

If approved, the firm would be able to issue its own ETFs, although they haven’t registered any individual funds yet.

July 28 -

The party’s draft party platform criticizes lax standards implemented by the Trump administration, and vows to strengthen Social Security.

July 27 -

This is the latest case to involve improperly allocating bonds meant for retail customers and instead selling them to other market participants.

July 23