-

The recent tumult involving GameStop and Robinhood has raised questions about whether broader risks for the financial system are brewing.

February 3 -

Regulators and Washington policy makers are sure to up scrutiny once the dust settles on the market turmoil that has buffeted GameStop and others.

February 2 -

A dead client, an advisor accused of murder and fraud, and an industry that didn’t see it coming.

February 2 -

The looming threat for Biden’s SEC pick is that the good times could end on his watch, triggering a crash that hits retail investors who’ve contributed to the boom.

January 28 -

Jacob Glick is accused of breach of fiduciary duty and misappropriating client funds, among other alleged misconduct.

January 22 -

President Biden has picked Allison Herren Lee, a member of the Securities and Exchange Commission, as the acting chair of the SEC, as nominee Gary Gensler waits in the wings as a more permanent chair once he is confirmed by the Senate.

January 21 -

The pending nominations send a clear signal that the rule-cutting and lax enforcement the industry has grown accustomed to under President Trump are over.

January 19 -

Biden's expected nomination for chairman is known for pushing back at banks and corporations in search of greater investor protections.

January 15 -

“The sheriff is coming to the preeminent financial regulator in the world,” said Justin Slaughter, a consultant at Mercury Strategies. “It means regulation and enforcement are about to get much tougher.”

January 14 -

The work-from-home phenomenon has triggered a fresh frustration for U.S. corporations: Americans are blowing the whistle on their employers like never before.

January 13 -

If confirmed by the Senate, the former CFTC chairman would be the new administration’s front-line regulator for Wall Street.

January 12 -

The move is about “expanding access to high quality growth investing to non-accredited investors,” says Upholdings CEO Robert Cantwell.

January 8 -

VanEck’s proposal comes at a time when the cryptocurrency has continued to set record highs.

January 4 -

Long-awaited advertising regulations allow for online testimonials but also increased risk of audits, observers and commissioners say.

December 30 -

SEC cases that go beyond faulting firms for their failure to disclose conflicts of interest have drawn pushback from the industry.

December 30 -

Attorneys, compliance experts and marketers weigh in on the regulator’s first update to advertising compliance in decades.

December 24 -

The allegations involving 12b-1 fees, cash sweeps and commissions also include violations of best execution rules.

December 23 -

“We look forward to our day in court and will not be bullied by the regulatory thugs at the SEC," the firm's co-founder says.

December 23 -

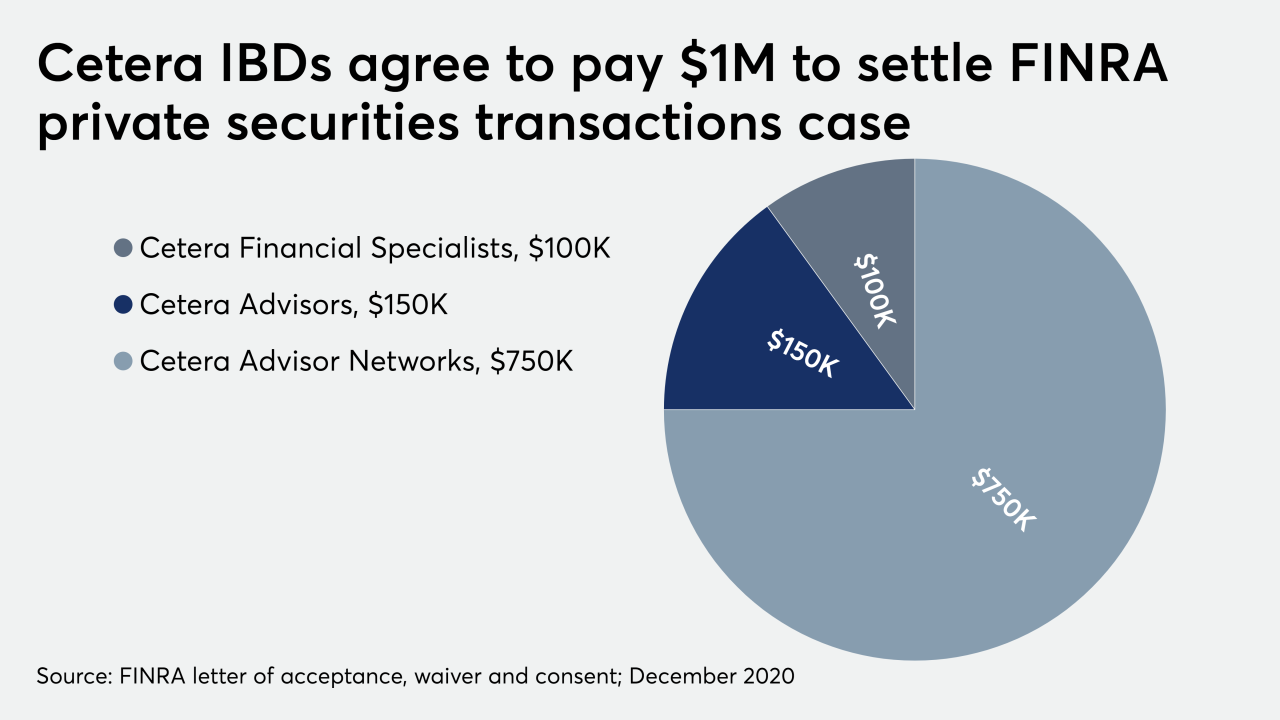

Despite pledges, the IBD network didn’t collect enough data for suitability reviews of the outside transaction for more than five years, according to the regulator.

December 22 -

The revelation is buried in an SEC enforcement action that accused Robinhood of hiding for years how it made the bulk of its revenue.

December 18