-

Secretary of Labor Eugene Scalia said retirement plans aren’t for “furthering social goals or policy objectives that are not in the financial interest of the plan.”

June 25 -

The Labor Department issued guidance Wednesday effectively allowing retirement plans to invest in buyout firms.

June 4 -

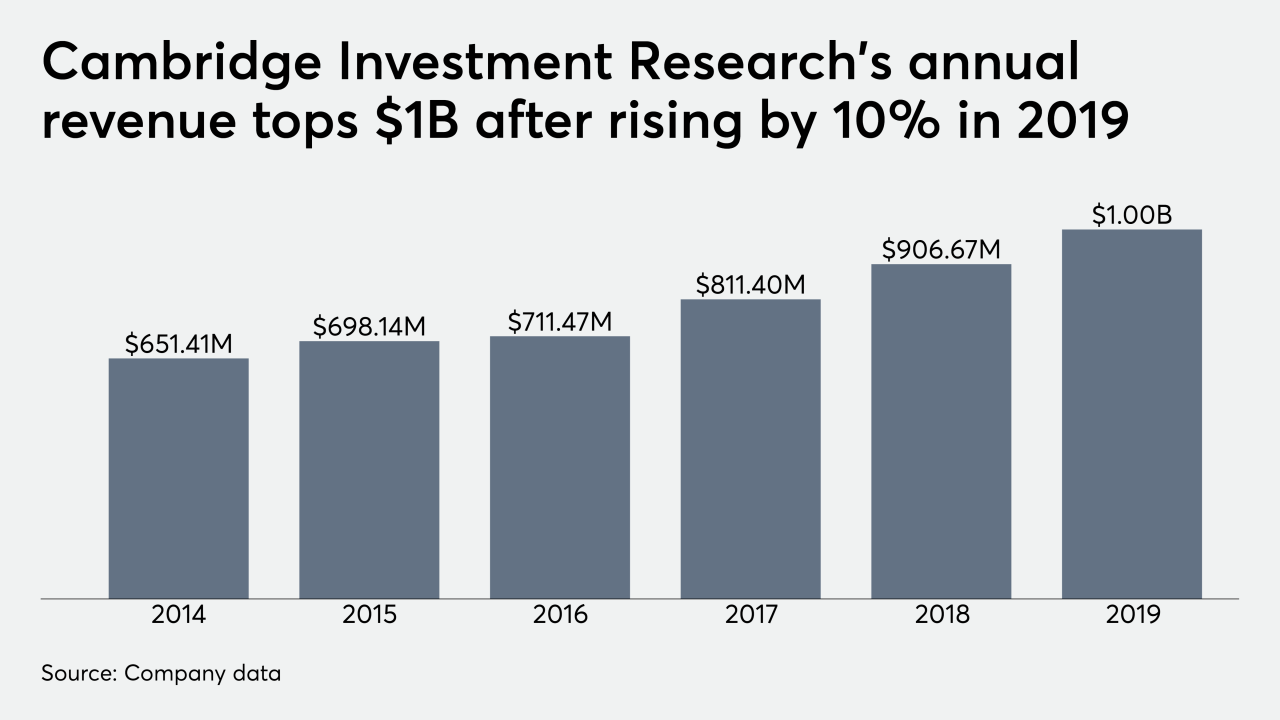

The privately held firm recruited more than 160 reps in the first quarter on the strength of its balance sheet, CEO Amy Webber says.

May 6 -

Private equity points to the birth of the advisor independence movement as proof they’re in it for the long haul.

April 20 -

The fintech giant fattened its war chest with a $40 million investment.

March 26 -

“We’re going to see more restructuring of deal terms,” says investment banker Steve Levitt.

March 18 -

In a cut throat market, the RIA can now offer cash for M&A deals.

March 12 -

Roughly two-thirds of the $1.2 billion contributions to the firm in 2019 came from appreciated assets.

March 6 -

The asset manager is targeting as much as $1.5 billion in volume annually, up from about $300 million per year about three years ago, the firm says.

March 4 -

Two years after the tax law eliminated write-offs for investment costs and advice, lawyers say they have found a loophole hidden in years-old IRS case law.

February 24 -

OneDigital’s acquisition of Resources Investment Advisors shows a convergence between two major spaces within financial services.

February 13 -

CEO Peter Mallouk wants to create a “reserve” to see the RIA through any economic downturn.

February 12 -

A rare appearance by one of the investors reshaping the IBD sector drew questions from rivals — and insights into the firms’ approach.

February 7 -

After years of internal deliberations, Vanguard has decided to open its very first private-equity fund.

February 7 -

The search is on for "potential strategic partners" says the robo advice provider's CEO, Rich Cancro.

January 31 -

The firm's chief Eric Clarke says there are multiple suitors.

January 16 -

Since selling a majority of his firm to HighTower, John Egan's AUM has soared 50% and he’s lost 15 pounds. Will other advisors reap benefits from similar deals?

January 10 -

From closed-end funds to Reg BI, here's what could be playing out this year.

January 7 -

Direct lenders, including hedge funds and buyout firms, are prepared to spend billions to lure borrowers away from the $1.2 trillion leveraged loan market.

December 18 -

Mergers and acquisitions involving wealth advisors and brokers reached a seven-year annual high in November, according to data compiled by Bloomberg.

December 5