Among the funds with the highest exposure to the insurance sector, the average one-year gain has been 17.9%, with an average three-year return of 9.52%. In the same periods, the S&P 500, as represented by SPY, has posted gains of 17.9% and 10.1%, respectively.

But in the near future, the property and casualty segment of the sector will be looking at major payouts in the aftermath of hurricanes Harvey and Irma. The damage in Florida from Hurricane Irma was predicted to be $58 billion (with an additional $30 billion in the Caribbean), according to Bloomberg, citing statistics from Enki Research. Hurricane Harvey caused $85 billion in damage in the Houston area. Combined, they equal the monetary damage of Hurricane Katrina in 2005, the costliest hurricane to hit the U.S., with $160 billion in damage, based on inflation-adjusted totals.

For this list, we looked at all mutual funds and ETFs with an exposure to the insurance industry of 20% or higher, and then ranked those funds by their three-year returns. Scroll through to see the top 20.

All data from Morningstar Direct.

20. First Trust STOXX European Sel Div ETF (FDD)

1-Yr. Returns: 13.00%

3-Yr. Returns: 2.41%

5-Yr. Returns: 6.20%

Expense Ratio: 0.60%

Total Assets (millions): $509

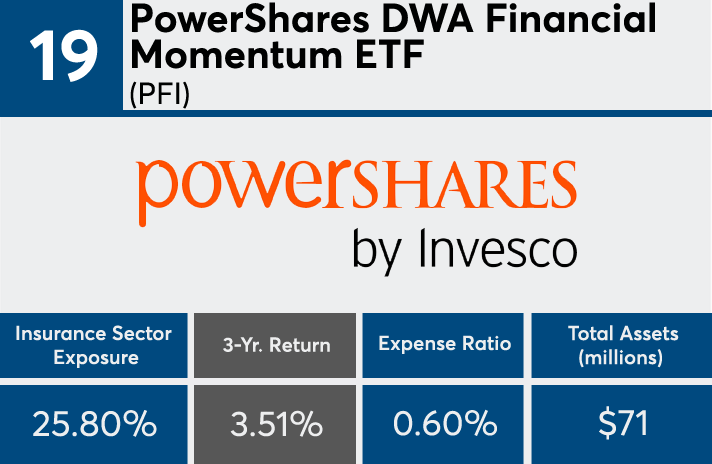

19. PowerShares DWA Financial Momentum ETF (PFI)

1-Yr. Returns: 0.60%

3-Yr. Returns: 3.51%

5-Yr. Returns: 10.08%

Expense Ratio: 0.60%

Total Assets (millions): $71

18. Mount Lucas US Focused Eq I (BMLEX)

1-Yr. Returns: 19.32%

3-Yr. Returns: 3.75%

5-Yr. Returns: 13.07%

Expense Ratio: 0.95%

Total Assets (millions): $11

17. Putnam Global Financial Y (PGFYX)

1-Yr. Returns: 19.56%

3-Yr. Returns: 4.21%

5-Yr. Returns: 10.31%

Expense Ratio: 1.03%

Total Assets (millions): $24

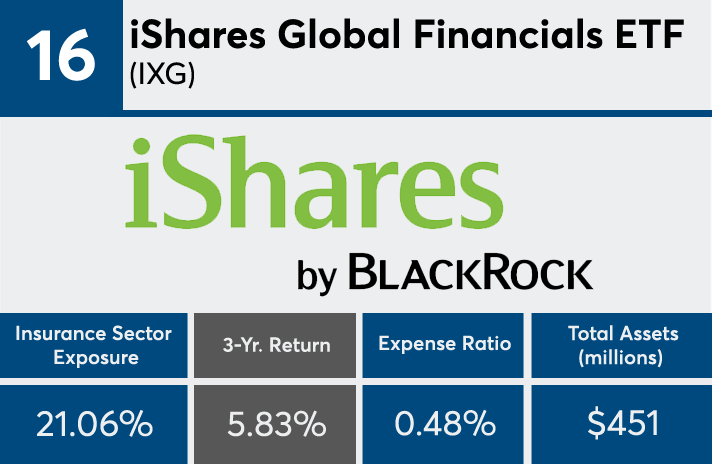

16. iShares Global Financials ETF (IXG)

1-Yr. Returns: 23.28%

3-Yr. Returns: 5.38%

5-Yr. Returns: 11.35%

Expense Ratio: 0.48%

Total Assets (millions): $451

15. Fidelity Select Financial Services Port (FIDSX)

1-Yr. Returns: 19.21%

3-Yr. Returns: 7.15%

5-Yr. Returns: 12.83%

Expense Ratio: 0.76%

Total Assets (millions): $1,070

14. Fidelity Advisor Financial Services I (FFSIX)

1-Yr. Returns: 19.26%

3-Yr. Returns: 7.27%

5-Yr. Returns: 13.00%

Expense Ratio: 0.84%

Total Assets (millions): $373

13. Oppenheimer Financials Sect Revenue ETF (RWW)

1-Yr. Returns: 23.06%

3-Yr. Returns: 8.96%

5-Yr. Returns: 16.19%

Expense Ratio: 0.49%

Total Assets (millions): $33

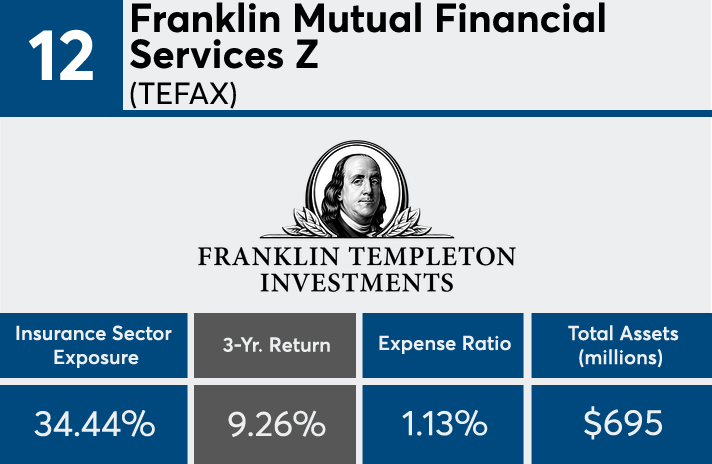

12. Franklin Mutual Financial Services Z (TEFAX)

1-Yr. Returns: 17.95%

3-Yr. Returns: 9.26%

5-Yr. Returns: 13.36%

Expense Ratio: 1.13%

Total Assets (millions): $695

11. T. Rowe Price Financial Services (PRISX)

1-Yr. Returns: 22.01%

3-Yr. Returns: 9.39%

5-Yr. Returns: 14.43%

Expense Ratio: 0.88%

Total Assets (millions): $717

10. First Trust Financials AlphaDEX ETF (FXO)

1-Yr. Returns: 16.53%

3-Yr. Returns: 9.64%

5-Yr. Returns: 14.98%

Expense Ratio: 0.64%

Total Assets (millions): $1,101

9. Davis Financial A (RPFGX)

1-Yr. Returns: 17.03%

3-Yr. Returns: 9.72%

5-Yr. Returns: 14.17%

Expense Ratio: 0.92%

Total Assets (millions): $1,195

8. Global X China Financials ETF (CHIX)

1-Yr. Returns: 18.81%

3-Yr. Returns: 9.96%

5-Yr. Returns: 12.39%

Expense Ratio: 0.65%

Total Assets (millions): $49

7. iShares US Insurance ETF (IAK)

1-Yr. Returns: 16.91%

3-Yr. Returns: 10.17%

5-Yr. Returns: 15.62%

Expense Ratio: 0.44%

Total Assets (millions): $171

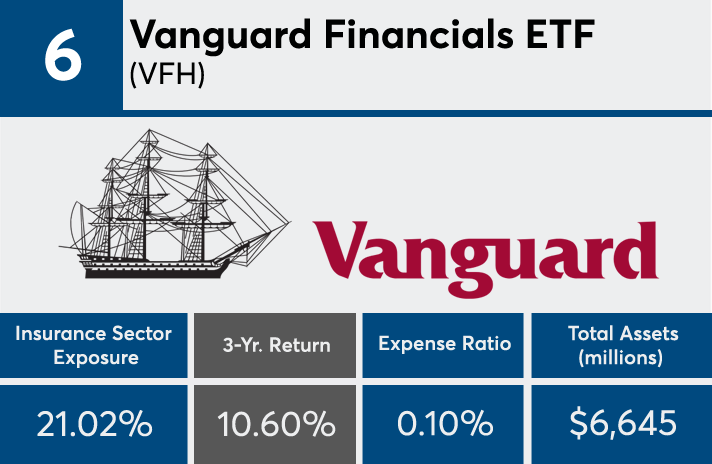

6. Vanguard Financials ETF (VFH)

1-Yr. Returns: 21.93%

3-Yr. Returns: 10.60%

5-Yr. Returns: 15.16%

Expense Ratio: 0.10%

Total Assets (millions): $6,645

5. Fidelity MSCI Financials ETF (FNCL)

1-Yr. Returns: 21.98%

3-Yr. Returns: 10.64%

5-Yr. Returns: N/A

Expense Ratio: 0.12%

Total Assets (millions): $888

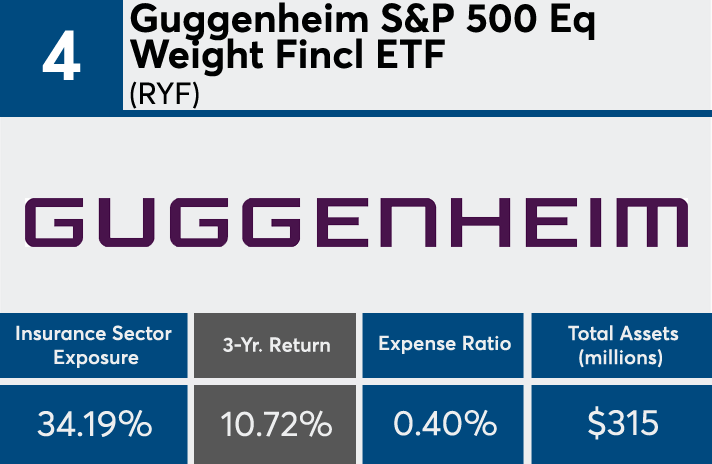

4. Guggenheim S&P 500 Eq Weight Fincl ETF (RYF)

1-Yr. Returns: 22.17%

3-Yr. Returns: 10.72%

5-Yr. Returns: 16.15%

Expense Ratio: 0.40%

Total Assets (millions): $315

3. Fidelity Select Insurance Port (FSPCX)

1-Yr. Returns: 17.17%

3-Yr. Returns: 11.19%

5-Yr. Returns: 16.36%

Expense Ratio: 0.79%

Total Assets (millions): $489

2. SPDR S&P Insurance ETF (KIE)

1-Yr. Returns: 16.79%

3-Yr. Returns: 12.06%

5-Yr. Returns: 17.14%

Expense Ratio: 0.35%

Total Assets (millions): $867

1. PowerShares KBW Prpty & Casualty Ins ETF (KBWP)

1-Yr. Returns: 10.60%

3-Yr. Returns: 14.81%

5-Yr. Returns: 16.60%

Expense Ratio: 0.35%

Total Assets (millions): $89