Most clients choose ETFs to reach their long-term goals

Demand for ETFs is

“As investors have become more familiar with the versatility of ETFs, their confidence levels have grown,” said Heather Fischer, vice president of ETF and mutual fund platforms at Schwab. “Half of ETF investors consider their understanding of ETFs at an intermediate level, and almost all (93%) are now fully confident in their ability to choose an ETF that is right for their investment objective.”

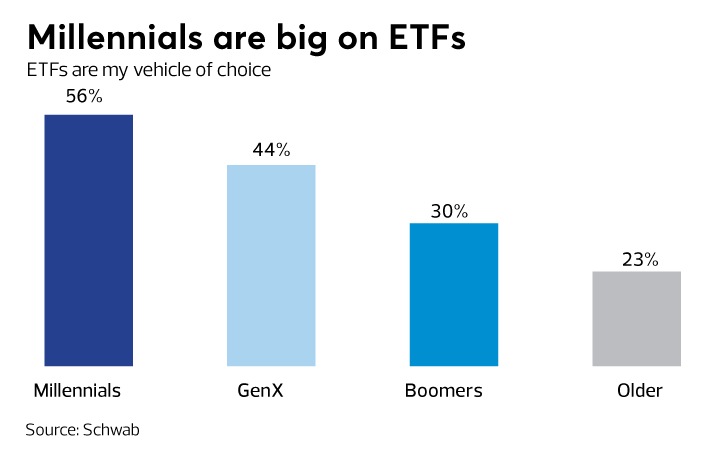

Of all age groups polled, millennials are most likely to include the funds in their portfolios. Nearly 60% said they expect to use ETFs to reach their long-term investing goals. Sixty-two percent said they would rather hold ETFs than individual securities, according to the report.

“Millennials continue to lead the charge when it comes to ETF adoption,” Fischer said, adding that because the age group has grown up with the funds, “they seem to be more comfortable than other generations in embracing them as their investment vehicle of choice — and enjoying the benefits of low costs, tax efficiency and transparency.”

Scroll through for the most significant findings on ETFs reported in the study.

Confidence in ETFs on the rise

Preference for ETFs taking hold across age groups

What’s attractive: Low expense ratios, costs and reputation

Almost half say ETFs are everything

Niche appeal

Desire to do good