-

Grandparents are advised to give cash gifts without putting their future financial security at risk.

April 11 -

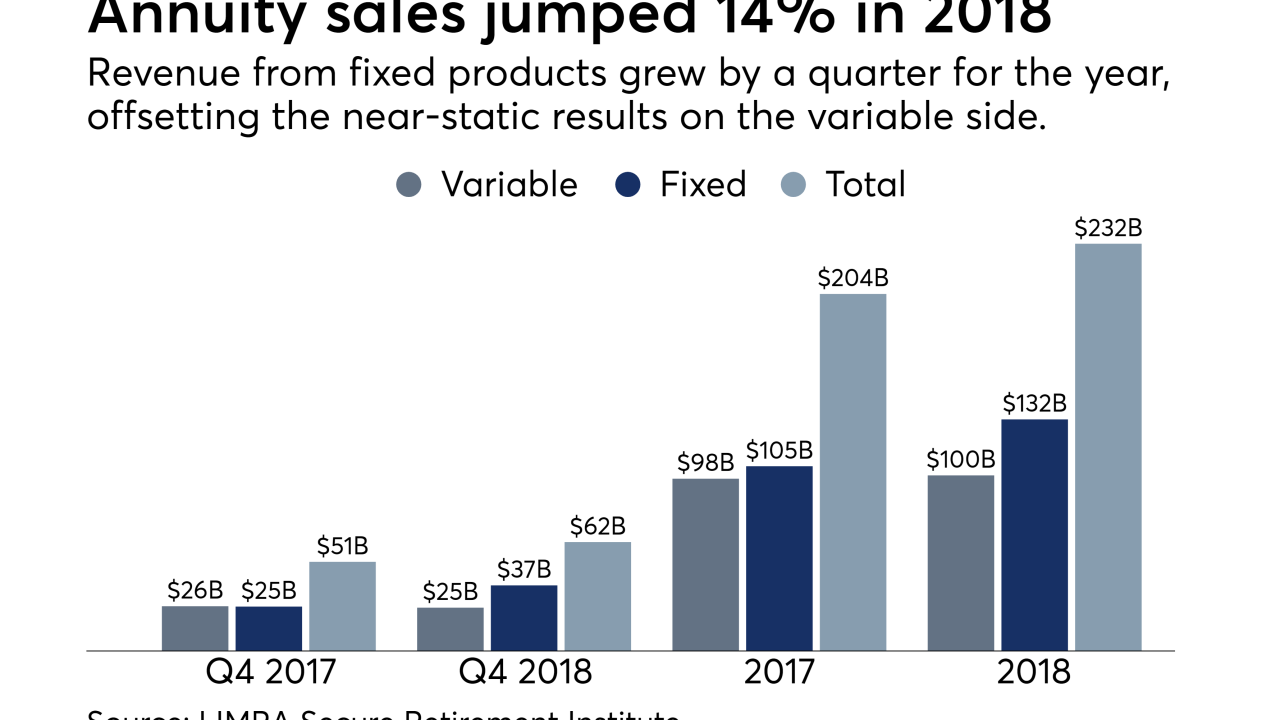

An educational campaign aims to place the products front and center amid increasing longevity — but sales figures show they’re already in the limelight.

April 8 -

Annuities with guaranteed lifetime withdrawal benefits tout longevity protection, but naysayers warn of added complexity on an already confusing instrument.

April 3 -

Advisors need to be willing to take a financial hit for clients

April 2 Retirement Matters

Retirement Matters -

As an alternative to placing restrictions on lump sum withdrawals, clients could provide retirees more distribution flexibility.

March 28 October Three Consulting

October Three Consulting -

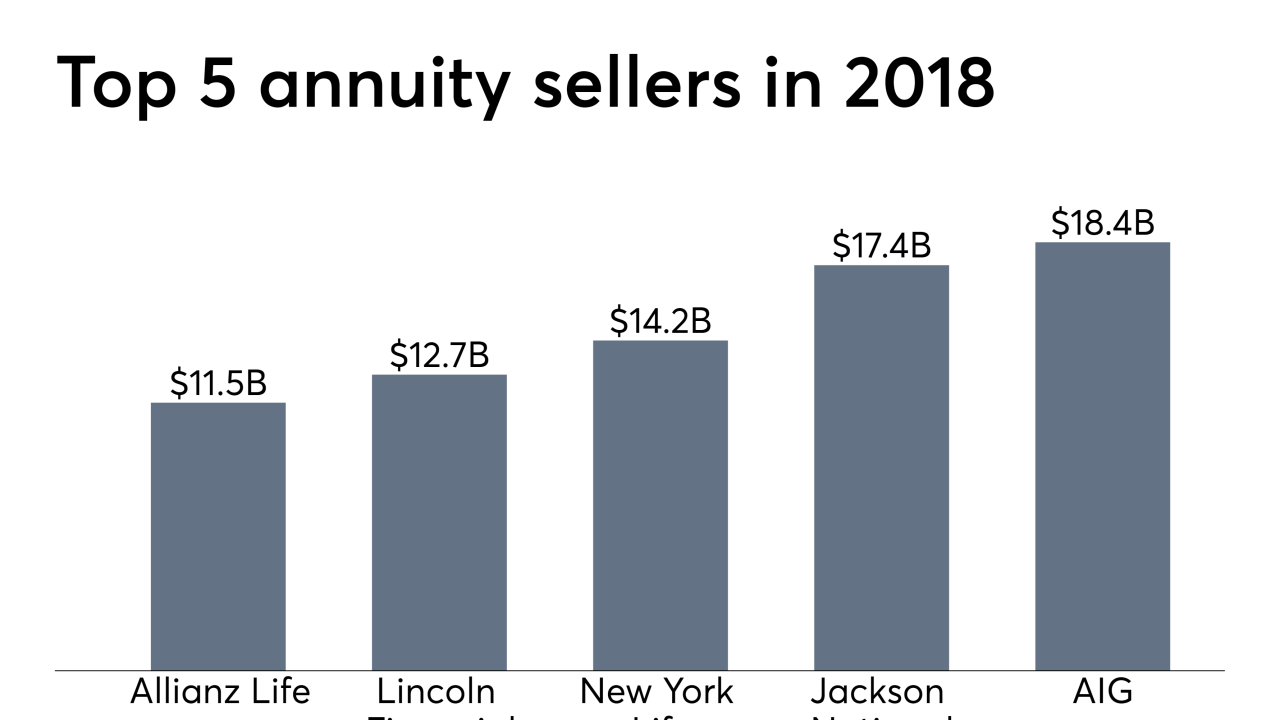

Growing fixed products, along with new fee-only offerings, are changing the shelf and the carrier rankings.

March 28 -

Seniors will face a 20% penalty on top of income taxes if they withdraw funds from a health savings account for non-medical expenses before the age of 65.

March 11 -

Fixed and variable contracts ended 2018 at nearly reverse levels of revenue from their totals three years earlier.

February 25 -

Although earnings in a deferred annuity will not be included in an investor's adjusted gross income, future withdrawals from the annuity could trigger a bigger tax bill.

February 14 -

Getting clients to think realistically about their post-work years is tough, but this one question quickly gets to the heart of the matter, says Trilogy Financial CEO Jeff Motske.

February 1 -

The No. 1 IBD requested that other variable writers “contractually reaffirm their commitments to protecting trails,” an executive says.

January 24 -

A widely held view is that a lot of spending is wasted on “heroic” measures at the end of life, but it’s difficult to know which patients are in their final year.

December 24 -

One of the major provisions of proposed legislation would require 401(k) plans to offer annuities so participants could create new income streams.

December 19 -

Despite Social Security's financial woes, the revenue shortfall can be easily fixed, say experts at Boston College Center for Retirement Research. But it will only go so far in paying for living expenses.

December 17 -

Here’s how to prepare your clients, and your own practice, if dark days come and stay.

November 28 Wealth Logic

Wealth Logic -

This period allows seniors to be more strategic about generating income from their portfolio and minimizing taxes.

November 26 -

LIMRA now predicts VA purchases to increase for the first time in six years while fixed contracts reach unprecedented levels.

November 26 -

Tru Independence is partnering with a marketing organization specializing in the commission-free protection space.

November 15 -

A civil filing by an IBD seeks damages for firms and reps “who devoted significant time and resources to building a book of business,” an attorney says.

November 13 -

The 4,300-advisor network is investing in insurance distribution after benefiting from rising interest rates and record client assets.

November 7