-

Seniors are advised to combine multiple tax-deferred accounts, such as traditional IRAs and 401(k)s.

August 13 -

“We can’t overestimate the influence of having access to employer-sponsored retirement plans," an expert says.

July 29 -

Clients who want to save for their children’s education may be better off using a 529 plan than a Roth IRA.

July 26 -

The IBD network joins asset managers and other companies developing new methods to display how the products integrate into client portfolios.

July 26 -

The asset management and software giants plan to start the rollout of their 401(k) tool and app later this year.

July 17 -

The transition is expected to take place within the next 12 to 18 months, however the firm says it will still manage the products’ underlying investments.

July 16 -

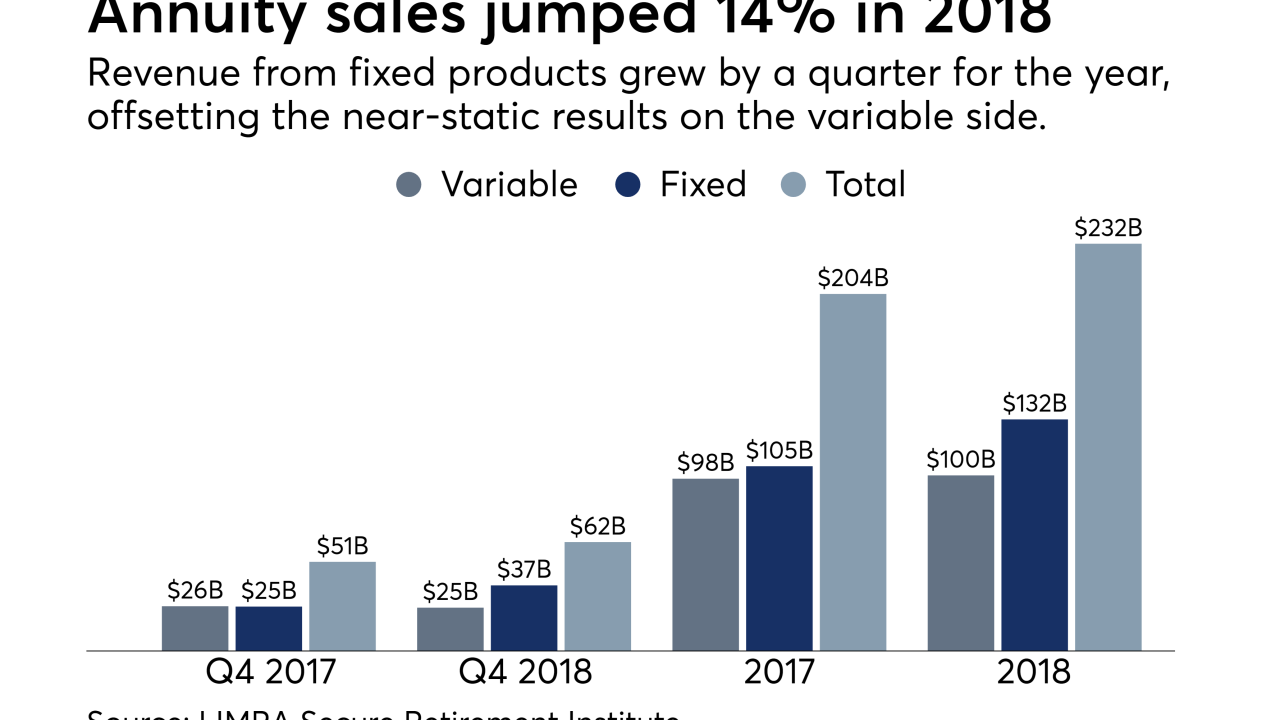

New contracts reached a 10-year high as key stakeholders praised a bill before the U.S. Senate which could expand the products to more 401(k) plans.

June 17 -

There's a lot to navigate when it comes to assuring clients that the benefits outweigh the headaches.

June 14 -

With income taxes attached to hardship withdrawals, they are often advised to carefully weigh other options.

May 28 -

The misconceptions about Social Security are alarming. says an expert. The number of people relying on the program to be their main source of income "is scary."

May 8 -

Grandparents are advised to give cash gifts without putting their future financial security at risk.

April 11 -

An educational campaign aims to place the products front and center amid increasing longevity — but sales figures show they’re already in the limelight.

April 8 -

Annuities with guaranteed lifetime withdrawal benefits tout longevity protection, but naysayers warn of added complexity on an already confusing instrument.

April 3 -

Advisors need to be willing to take a financial hit for clients

April 2 Retirement Matters

Retirement Matters -

As an alternative to placing restrictions on lump sum withdrawals, clients could provide retirees more distribution flexibility.

March 28 October Three Consulting

October Three Consulting -

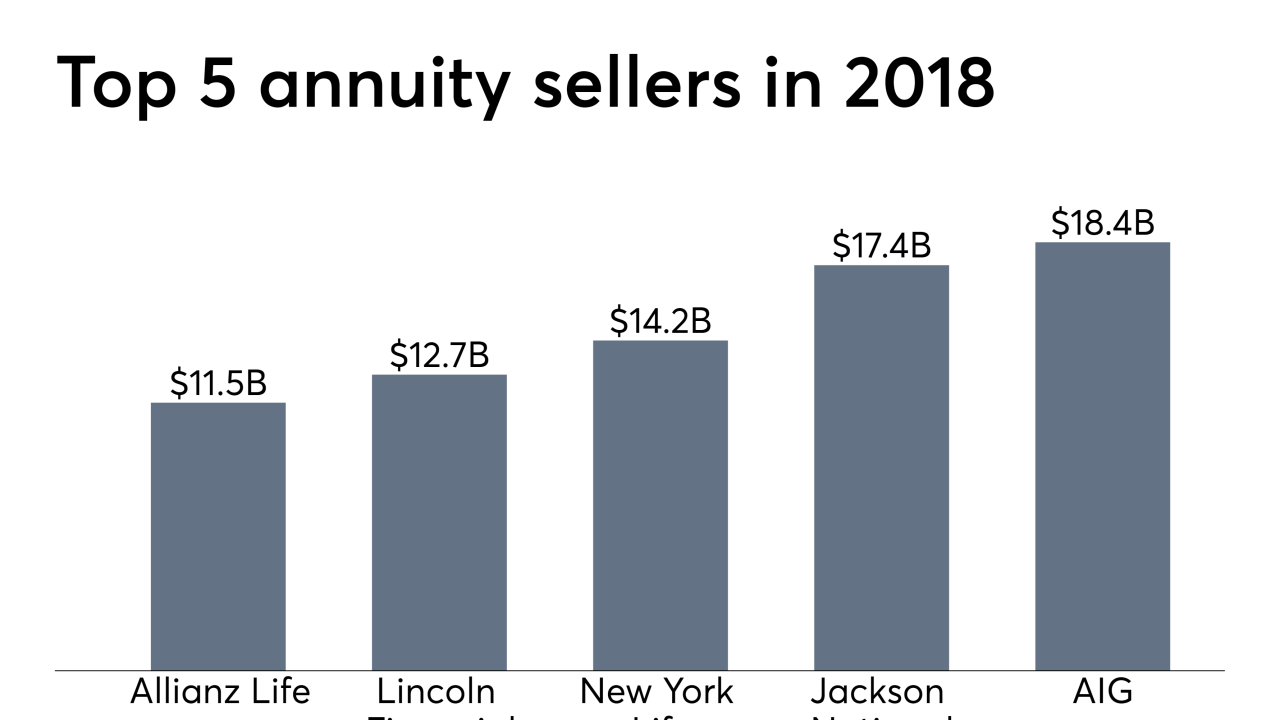

Growing fixed products, along with new fee-only offerings, are changing the shelf and the carrier rankings.

March 28 -

Seniors will face a 20% penalty on top of income taxes if they withdraw funds from a health savings account for non-medical expenses before the age of 65.

March 11 -

Fixed and variable contracts ended 2018 at nearly reverse levels of revenue from their totals three years earlier.

February 25 -

Although earnings in a deferred annuity will not be included in an investor's adjusted gross income, future withdrawals from the annuity could trigger a bigger tax bill.

February 14 -

Getting clients to think realistically about their post-work years is tough, but this one question quickly gets to the heart of the matter, says Trilogy Financial CEO Jeff Motske.

February 1