-

The rare move to set aside the regulator’s ruling came more than a decade after the rep ran into trouble by adding notes about his client into a software program.

March 11 -

The dispute highlights the complicated nature of non-solicitation carve-outs when advisors switch firms.

February 22 -

The legal tussle represents the latest effort by a brokerage firm to enforce non-solicitation agreements against advisors.

February 11 -

Beverley Schottenstein accused the bank and the brokers of unauthorized trading of “multiple auto-callable structured notes and various other securities,” among other alleged misconduct.

February 10 -

The troubled alts manager’s charges will trigger many more arbitration proceedings and potential regulatory cases, plaintiff attorneys say.

February 9 -

Wealth managers acting as “downstream broker-dealers” allegedly made $187 million in commissions and other selling fees on GPB Capital investments.

February 4 -

Although in-person hearings aren’t banned outright, none have taken place since the onset of the coronavirus pandemic.

October 23 -

The firm’s talent-analytics associate director had claimed the company hired fewer women than men and that she was paid less than her male counterparts.

September 18 -

The bank was seeking to overturn some $400,000 in attorney fees awarded to four advisors as part of a $2 million case.

September 17 -

Pressing the bank for examples of non-solicitation violations, the judge cut off JPMorgan’s attorney: “you are dancing all around my question.”

August 25 -

Yes, they’ll be going up in September — but not as much as you may have heard.

August 14 -

The advisor is asking a judge to reconsider the order, saying he wasn’t given a chance to defend himself against accusations of violating a non-solicitation agreement.

August 11 -

A court ruling may also potentially help dozens of other advisors in their efforts to claim what they say is millions in deferred compensation they are due.

July 21 -

Earlier this year, FINRA arbitrators granted the former advisor’s expungement request, but still sided with the firm on its demands for repayment of two promissory notes.

July 14 -

The lost assets represent a big hit to the firm’s operations in the small Missouri town where the advisor was based, ex-employer claims.

May 6 -

The policy change may prompt more defendants to reach settlements, an attorney says.

March 25 -

Stipulated agreements by BDs and advisors looking to fast-track the arbitration process are becoming increasingly common.

March 24 -

Wealth management firms should track the lives they impact beyond the size of their client books, KMS Financial Services CEO Erinn Ford says in an episode of Financial Planning’s Podcast.

March 17 -

Some attorneys say it's welcome relief, but how long will it take to get new hearing dates?

March 17 -

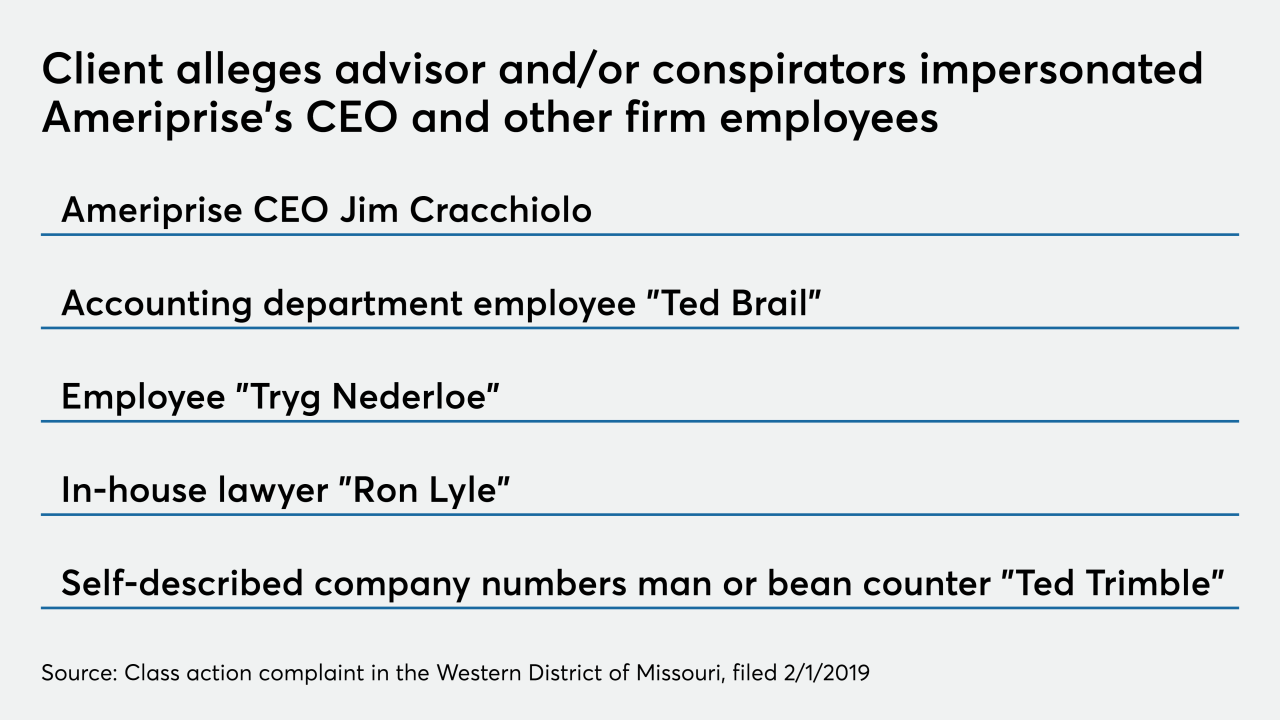

Five years of alleged promises, checks that never arrived, and a mysterious employee named “Tryg Nederloe” add up to a bizarre saga with wide ramifications.

March 2