-

Only a firm “actively swindling funds” would trigger an onsite visit, according to Peter Driscoll.

March 25 -

Regulatory relief applies to advisors and investment funds but the commission stresses that fiduciary obligations still apply.

March 19 -

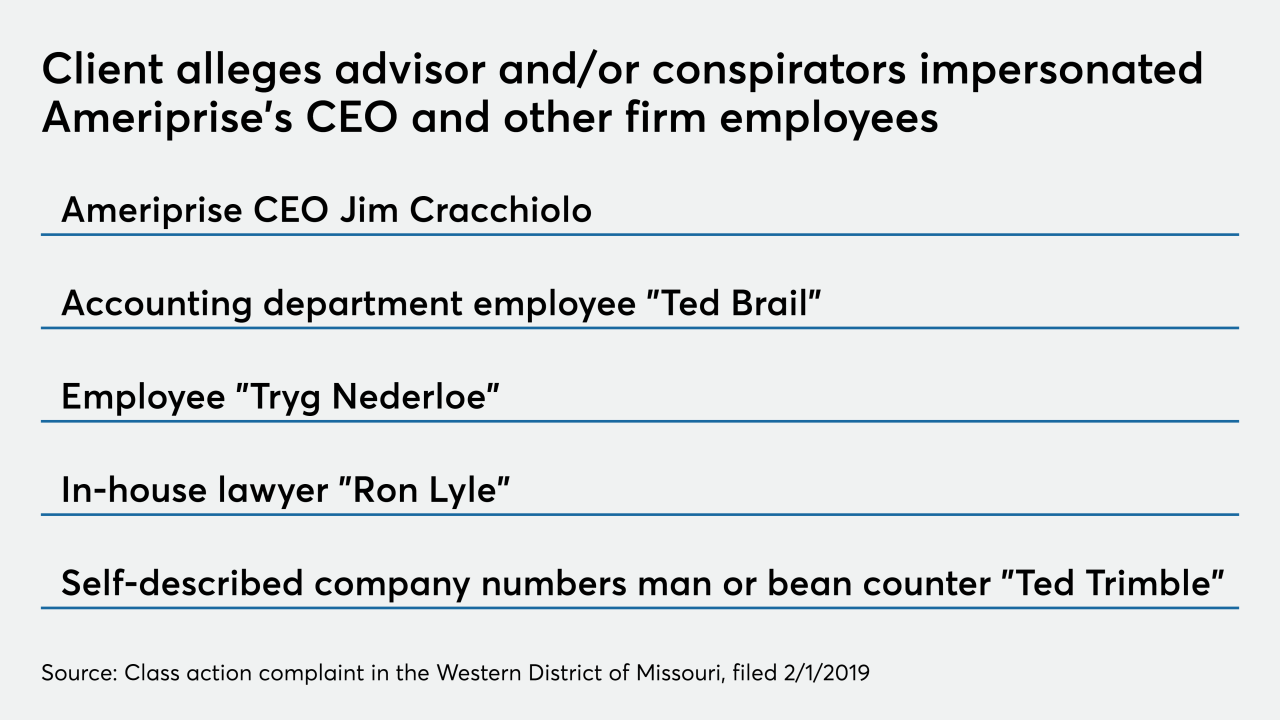

Five years of alleged promises, checks that never arrived, and a mysterious employee named “Tryg Nederloe” add up to a bizarre saga with wide ramifications.

March 2 -

That would be a big “no,” in most cases, according to FINRA, but gives rise to another question…

February 28 -

The bank failed to implement its own supervisory procedures around single-inverse ETFs, costing clients millions, the SEC says.

February 27 -

The major custodian lost its second arbitration case — with even more filings likely — over the services it provided to a brokerage later proved to be engaged in massive fraud.

February 27 -

The agency will send several dozens agents to make at least 800 face-to-face visits in February and March of this year.

February 24 -

For many, the document is a significant source of confusion. Fortunately, one of the most persistent errors is easily correctable.

February 24 -

Undisclosed payments from alt managers should have been explained to clients in Form ADV, the regulator says.

February 20 -

The wealth manager claimed bank management knew a customer had a history of sexual harassment, but allowed him to continue doing business at the branch anyway.

February 14 -

“It’s like nuclear fallout. The bomb didn’t drop on you but you were within five miles of it," said Alan Johnson, managing director of compensation consultant Johnson Associates.

February 6 -

Faced with the retention risk from the RIA-only channel, firms are trying to alter their company cultures and questioning traditional approaches.

February 5 -

The IBD advocacy group expects no letup in enforcement by the regulator — with wide ramifications across wealth management hanging in the balance.

January 28 -

Make sure not to confuse it with the SEC’s self-reporting program.

January 28 -

It’s been a long tail for the firm that began with the 2016 revelation that employees had opened millions of fake accounts to meet sales goals.

January 27 -

FINRA blocked the influential advisor and wealth management entrepreneur on one case, but an arbitrator backed him on another.

January 22 -

The SEC examined approximately 2,180 RIAs in 2019.

January 16 -

SEC-mandated disclosures for dual registrants could put clients off brokerage options, some suggest.

January 8 -

From closed-end funds to Reg BI, here's what could be playing out this year.

January 7 -

The top brass being unaware of this stuff happening on their watch doesn’t inspire confidence.

December 23