-

The barred ex-rep funneled clients’ money into a shell company he falsely called a sub advisor, according to investigators.

June 4 -

The barred ex-Mutual of Omaha rep stole from 27 mostly older fellow members of his church, YMCA and local business organizations, investigators say.

June 4 -

FINRA arbitrators ordered the wealth manager and closed-end funds manager to pay damages as it resolves outstanding claims stemming from the island’s fiscal crisis.

May 21 -

After Brooklynn Chandler Willy recommended that the clients invest $100,000 into an LLC, its principals were arrested on federal fraud charges, the filing says.

May 20 -

The giant retirement plan recordkeeper’s BD didn’t adequately file suspicious activity reports for more than three years, according to investigators.

May 18 -

A barred broker’s alleged version of the “infinite banking” strategy recommended that clients liquidate their 401(k)s or IRAs to buy variable annuities.

May 13 -

Anthony Diaz began the sentence immediately after a hearing in which a victim said he should “rot in hell” for the felonies.

March 30 -

The wealth managers paid victims restitution prior to one barred rep’s guilty plea and another one’s sentencing.

March 23 -

The broker allegedly spent his client’s money on luxury items then pivoted to a Medicare fraud scam a couple of years later.

March 16 -

The rare move to set aside the regulator’s ruling came more than a decade after the rep ran into trouble by adding notes about his client into a software program.

March 11 -

The 33-year-old advisor allegedly spent clients’ money on luxury items and business expenses for his startup.

February 11 -

Interim CFPB Director Dave Uejio expressed concern that financial institutions have dragged their feet in resolving disputes with consumers for service issues during the pandemic.

February 10 -

The troubled alts manager’s charges will trigger many more arbitration proceedings and potential regulatory cases, plaintiff attorneys say.

February 9 -

Wealth managers acting as “downstream broker-dealers” allegedly made $187 million in commissions and other selling fees on GPB Capital investments.

February 4 -

SA Stone Wealth Management representative Gregory Frank Estes had already registered as a sex offender after a 2002 conviction, records show.

January 21 -

The firm’s use of third-party compliance vendors came under scrutiny after an ex-rep pleaded guilty to bilking clients out of $5 million.

January 5 -

The wealth manager whose parent firm also owns an insurer and asset manager settled its third case involving the same time period.

December 23 -

The allegations involving 12b-1 fees, cash sweeps and commissions also include violations of best execution rules.

December 23 -

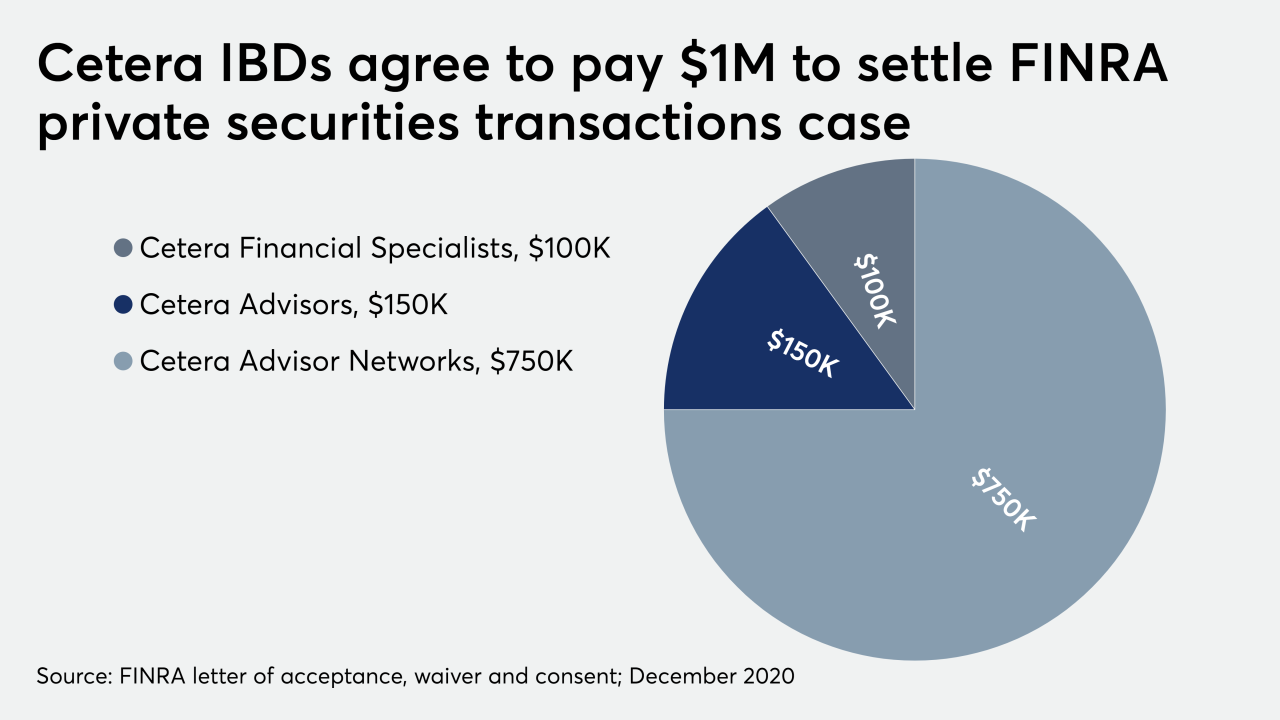

Despite pledges, the IBD network didn’t collect enough data for suitability reviews of the outside transaction for more than five years, according to the regulator.

December 22 -

The state’s securities regulator claims the popular app uses “gamification” to manipulate customers and fails to prevent frequent outages on its trading platform, among other misconduct.

December 16