-

The case against Centaurus Financial comes after the industry and consumer advocates decried the previous administration’s approach for different reasons.

June 10 -

The litigation reveals how wealth managers’ deals with product sponsors work and how one with a former Voya unit went awry.

April 29 -

The moves come just one day after BlackRock announced reductions on $7.6 billion of its style funds.

March 26 -

The firm has been locked in a contest with runner-up Vanguard for flows, with the latter winning last year for the first time since 2013.

March 22 -

SEC cases that go beyond faulting firms for their failure to disclose conflicts of interest have drawn pushback from the industry.

December 30 -

The allegations involving 12b-1 fees, cash sweeps and commissions also include violations of best execution rules.

December 23 -

In a bid to attract clients left out by AUM fees, IBDs are enabling advisors to take approaches first made popular in the full RIA channel.

December 1 -

But the regulator also ordered record payouts in 2020, including restitution through a self-reporting program that drew industry ire.

November 5 -

CEO Jamie Price says the change will reduce potential conflicts of interest related to transaction fees and come with lower prices in wrap accounts.

October 29 -

Lower transaction costs can often come with higher expense ratios at the nation’s largest IBD.

August 26 -

The regulator charged a $1.4 billion hybrid firm over disclosure of its cash sweep arrangements with its clearing firm.

August 18 -

A combination of GLD’s higher fees and an almost relentless demand for the yellow metal have catapulted it from fourth on the revenue leader board in 2017.

August 3 -

The firm allegedly didn't disclose its parent company paid a teacher union entity $10,000 a month “for its exclusive endorsement” as its preferred financial services partner, according to the regulator.

July 29 -

Northwestern Mutual’s practices raise difficult questions about the nature of retail advice just as wealth management faces greater scrutiny under new rules.

July 17 -

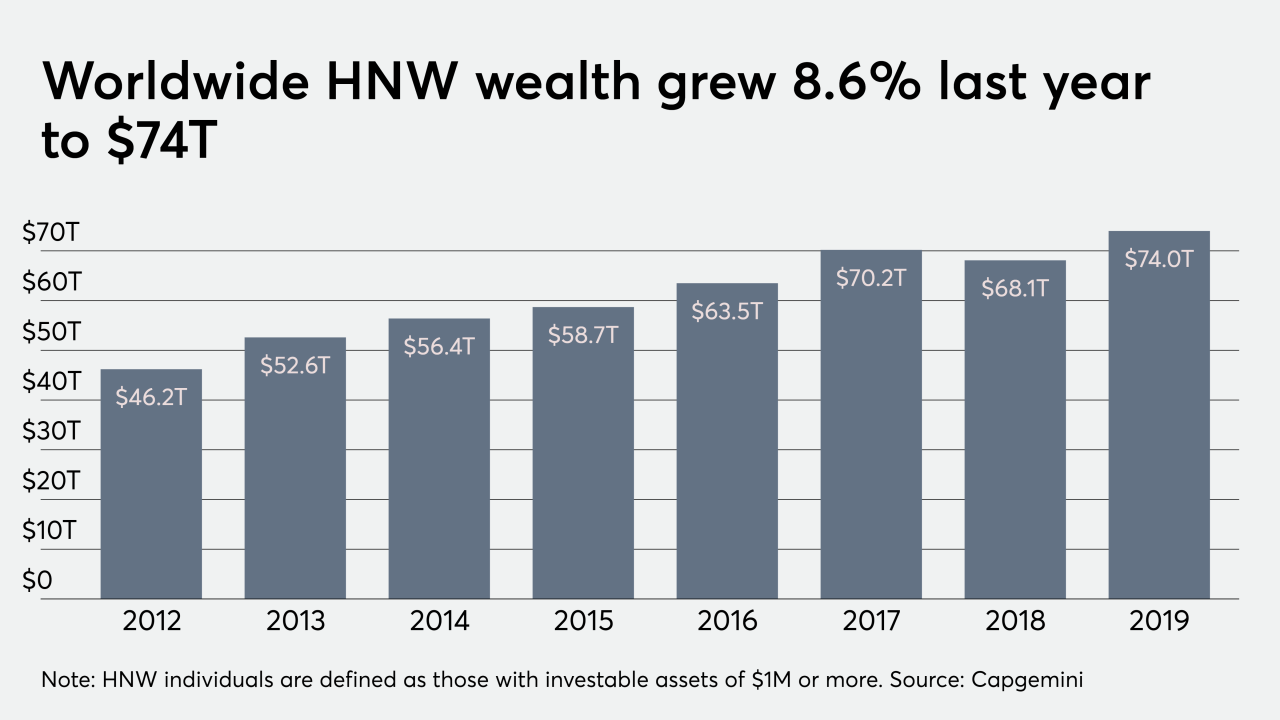

Affluent investors are concerned about transparency, performance and value, according to a new report by Capgemini.

July 9 -

Many financial advisors aren’t aware of serious conflicts of interest affecting the majority of retail clients, Northeastern University Professor Nicole Boyson says in a Financial Planning Podcast.

May 19 -

“This is all about having the flexibility and having multiple options for our investors,” says GSAM’s head of ETF strategy.

May 12 -

Analysis of their performance — and fees — may reveal some surprises.

April 27 -

Firms are spending millions to comply with a controversial rule that is facing a legal challenge while state regulators push their own stringent regulations.

April 27 -

With the industry facing ridicule for high fees and low returns, clients have pulled a net $33 billion from the industry in the first quarter, the most over a decade.

April 24