-

Some 225 funds traded for the first time over the past 12 months, down for a second-straight year.

December 31 -

Investors are pulling money at an accelerated pace as high fees and mediocre returns send them searching for yield elsewhere.

December 30 -

Now, armed with data from the rule’s rollout in Europe, asset managers in the U.S. have a better sense of each analysts’ worth — fairly or not.

December 19 -

While these 20 dizzying changes will throw some for a loop, financial advisors and their clients grow more powerful each year.

December 18 -

Fund industry Darwinism should be seen as healthy and natural in a thriving — albeit brutal — market, an expert says.

December 2 -

The fact that it’s impossible to track the amount of revenue sharing kickbacks demonstrates the problem, says the research firm’s lead policy wonk.

November 18 -

The changes follow the firm’s recent move to cut some client fees on separately managed accounts.

November 5 -

It's no exaggeration to say rock-bottom fees are an existential threat to many asset managers. However, technology could still save the day.

November 1 Broadridge

Broadridge -

With tens of thousands of certificants affiliated with giant BDs, the documents required by the new standards are making their conflicts of interest plain as day.

October 31 -

Jason Wenk, founder of Altruist, is ramping up for an end-of-year debut.

October 31 -

The regulator’s expanding number of share-class cases fill in the details it says have been missing from Form ADV disclosures about conflicts of interest.

October 18 -

In a little-noticed rule change, mutual funds no longer disclose their shrinking BD commission load-sharing payments.

October 16 -

Since this March, almost 100 firms have settled with the regulator for approximately $173 million. Other cases are still pending.

October 8 -

More than 70% of U.S. ETF assets are in funds that charge 2 basis points or less, data show. But free isn’t an automatic ticket to success.

October 8 -

The indexing giant’s pilot Digital Advisor will be priced at 15 basis points, but allocate client assets almost entirely in proprietary funds.

September 20 -

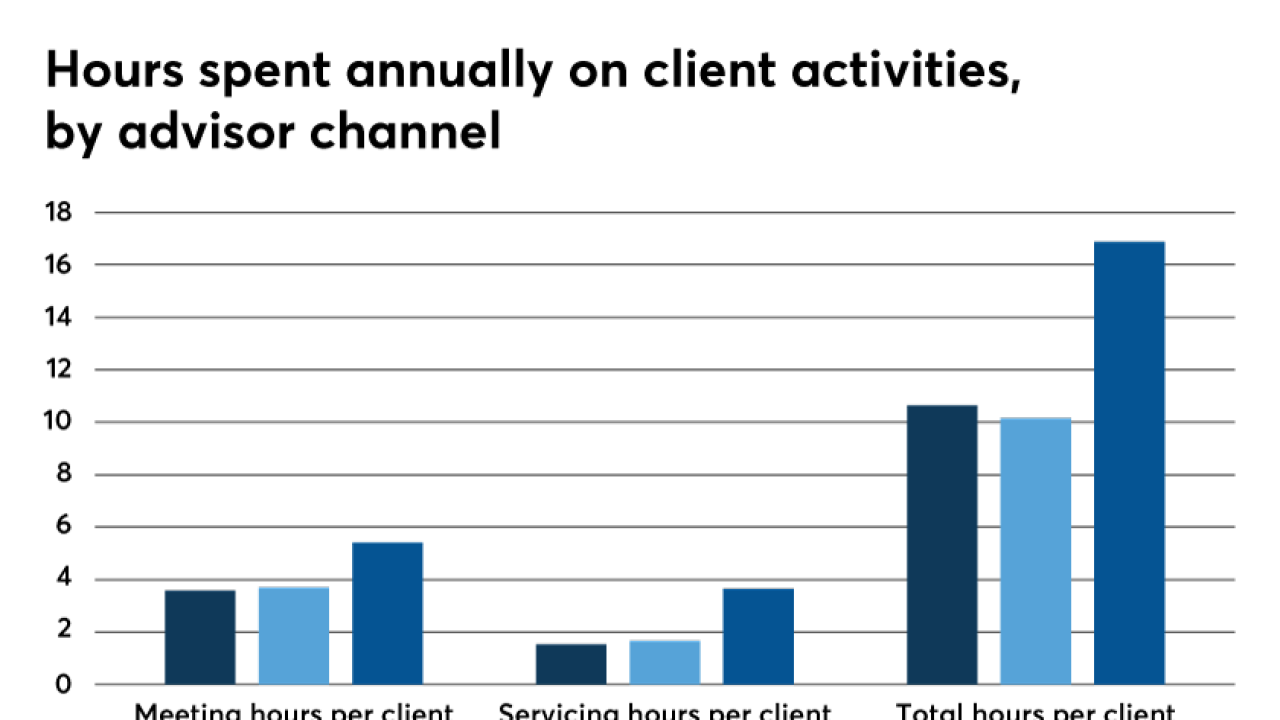

Alternative compensation structures may provide more consumer protection, and drive higher client satisfaction.

September 16 -

The SEC’s 564-page rule shows the new disclosure could prove time-consuming, even vexing, for firms.

July 17 -

The transition is expected to take place within the next 12 to 18 months, however the firm says it will still manage the products’ underlying investments.

July 16 -

The firm’s complicated relationship with these fees is indicative of the industry’s overall struggle to find a balance between appropriate compensation and transparency.

July 10 -

An unprecedented 58 funds were closed in the six months through June, marking the industry’s worst-ever start to a year.

July 3