-

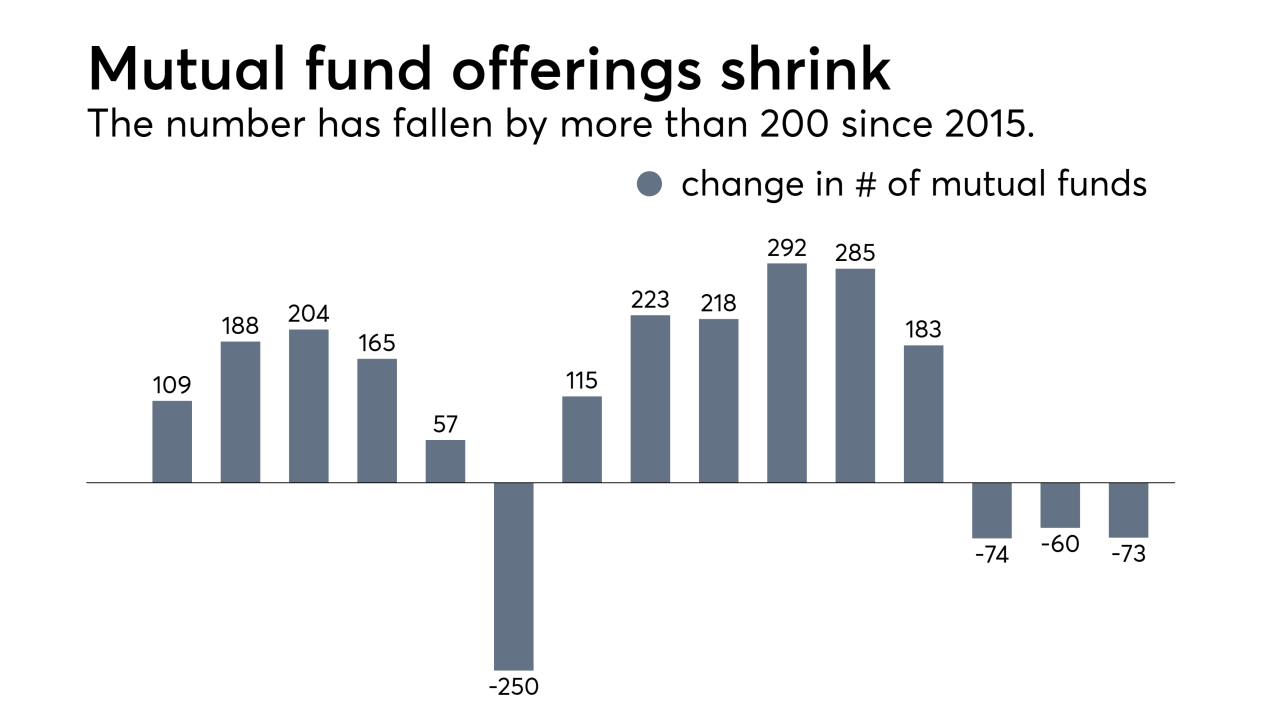

There are at least 200 fewer products available since 2015. Some advisors haven’t noticed. But should they?

November 1 -

Factors including low interest rates may have contributed to success.

October 24 -

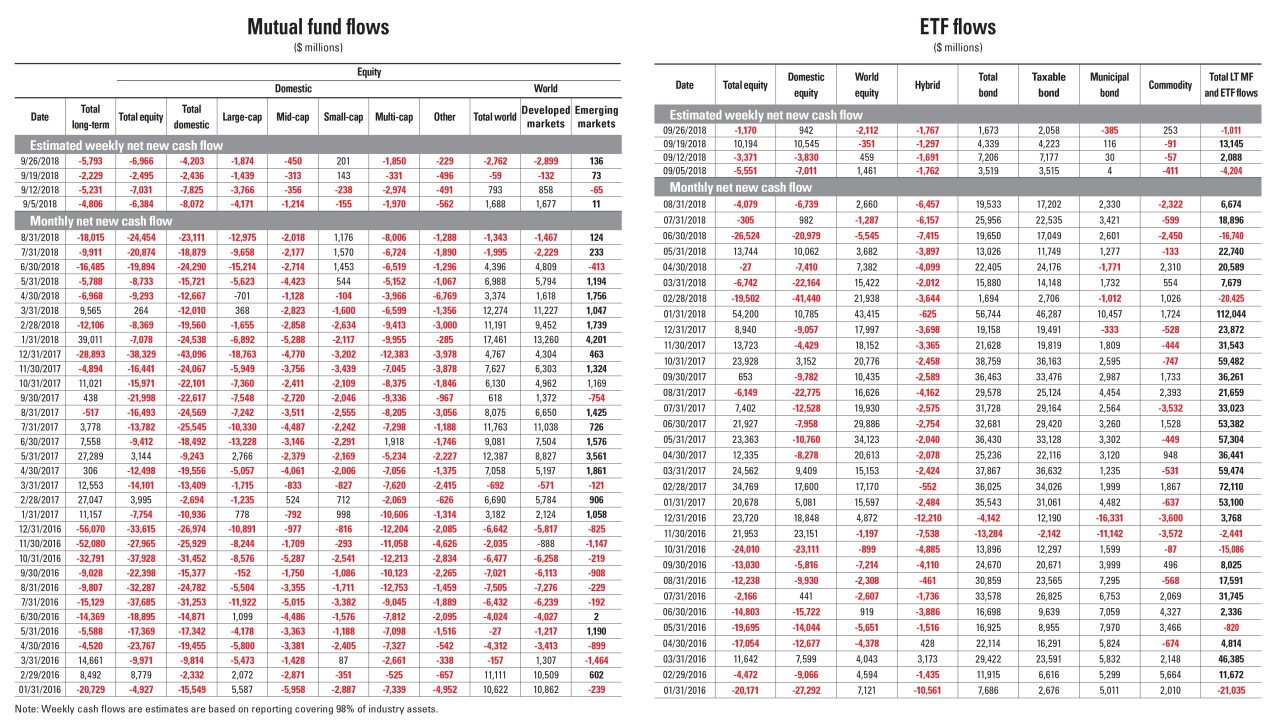

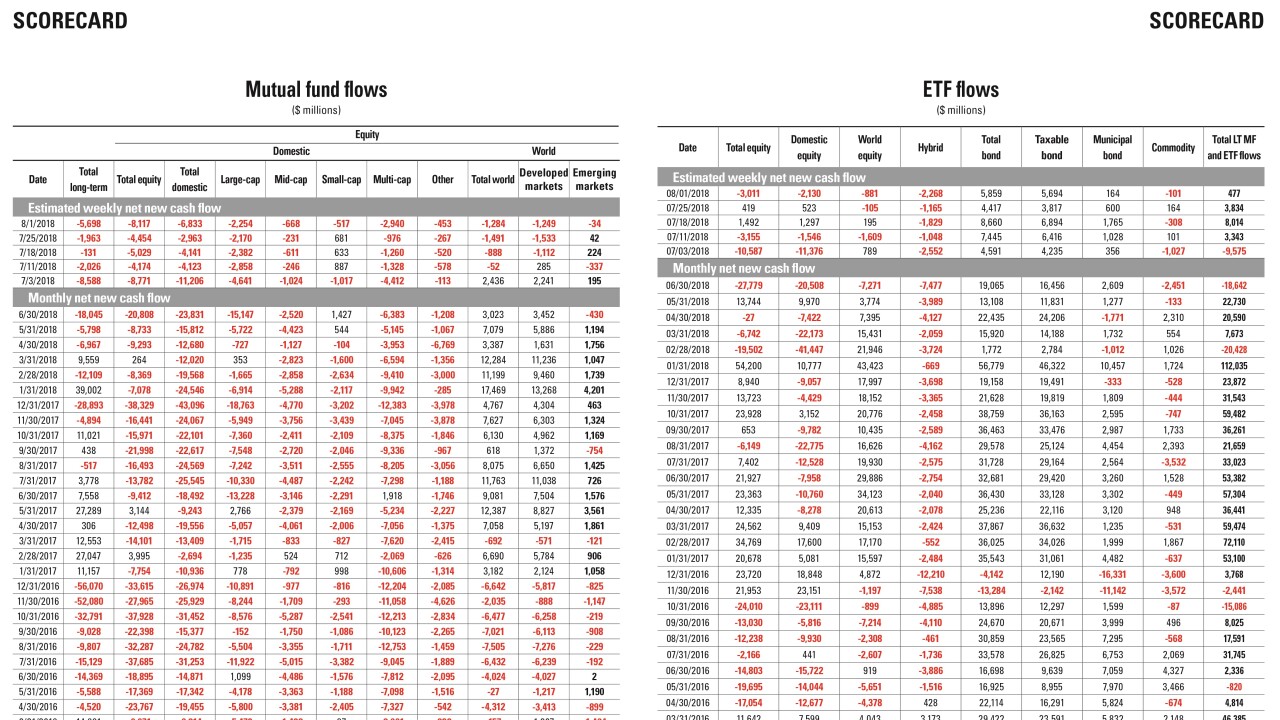

Data reported by the Investment Company Institute.

October 5 -

Investors flocked to ultra-short bond funds as few are willing to bet against persistent rising rates.

October 5 -

-

The IRS estimates alternative minimum tax filings will decrease to 1 million from 10 million as a result of the law.

September 19 -

The equal-weighted nature of XBI gives the fund greater exposure to developing companies than similar products.

September 18 -

Use this checklist to help clients avoid the bill from surprise capital gains distributions.

September 7 -

Fees were nearly half the price of the top-performing active funds.

September 4 -

The SPDR fund’s assets have surged over 23% this year to a record $16 billion as the retailer inches closer to America’s second trillion-dollar company.

August 31 -

The fund took in about $22 million in August.

August 30 -

The fund hasn’t seen a day of inflows since June.

August 27 -

The liquidations are part of an ongoing process to ensure its products meet their clients' evolving needs, the firm says.

August 23 -

With $145 million of net inflows, the fund is on track for its best month since June 2017.

August 21 -

Funds with disproportionate exposure to FANG stocks are up big in 2018.

August 16 -

These expense ratios were closer to the average fund fee in 1996.

August 15 -

Data reported by the Investment Company Institute.

August 10 -

The legendary manager’s Unconstrained Bond Fund ended July down almost $1 billion from its February peak.

August 10 -

Many sectors have rallied the past decade, but tech and health care outperformed.

August 8 -

The biggest losers so far? High yield bond and large value products.

August 1