-

Angst over the Fed’s decision to lower borrowing costs has seeped into the $3.8 trillion market for municipal bonds.

August 21 -

Just five asset managers hold about 80% of the new money added to the municipal-bond market this year.

July 24 -

Defined-maturity funds offer traditional fixed-income interest payments.

July 1 -

Activist investors have taken large stakes in at least 100 of the products so far this year.

June 7 -

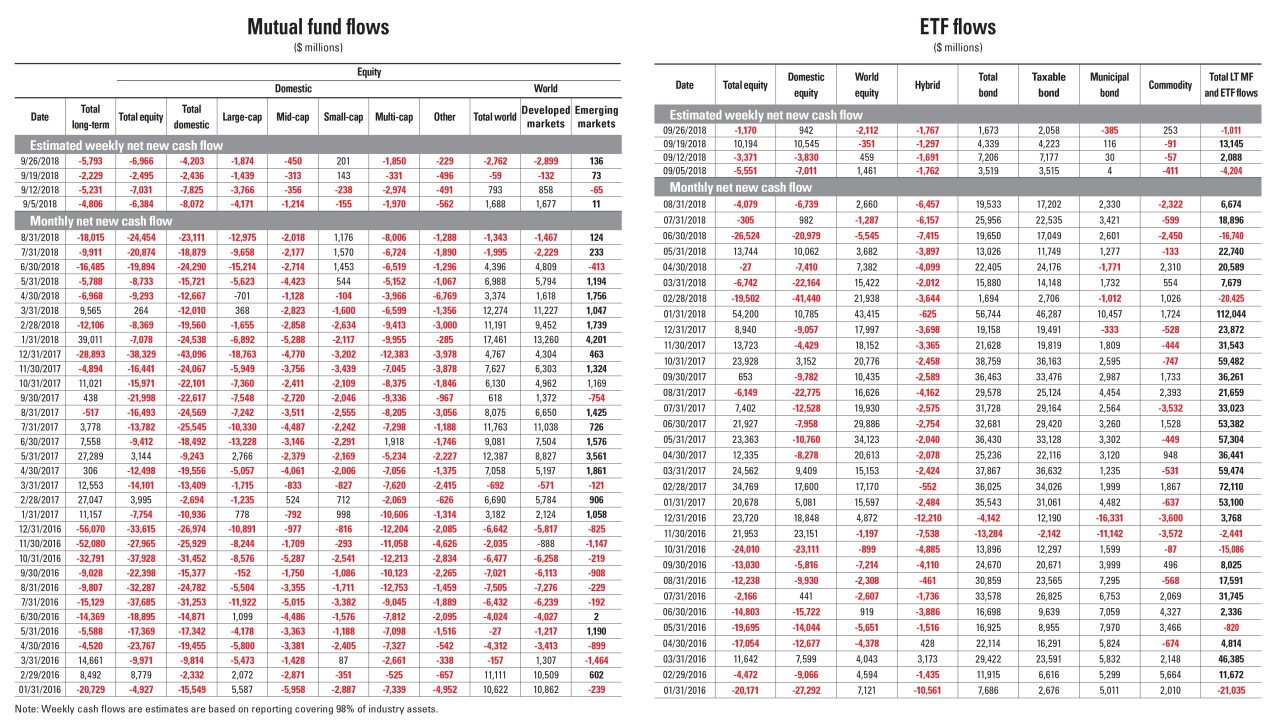

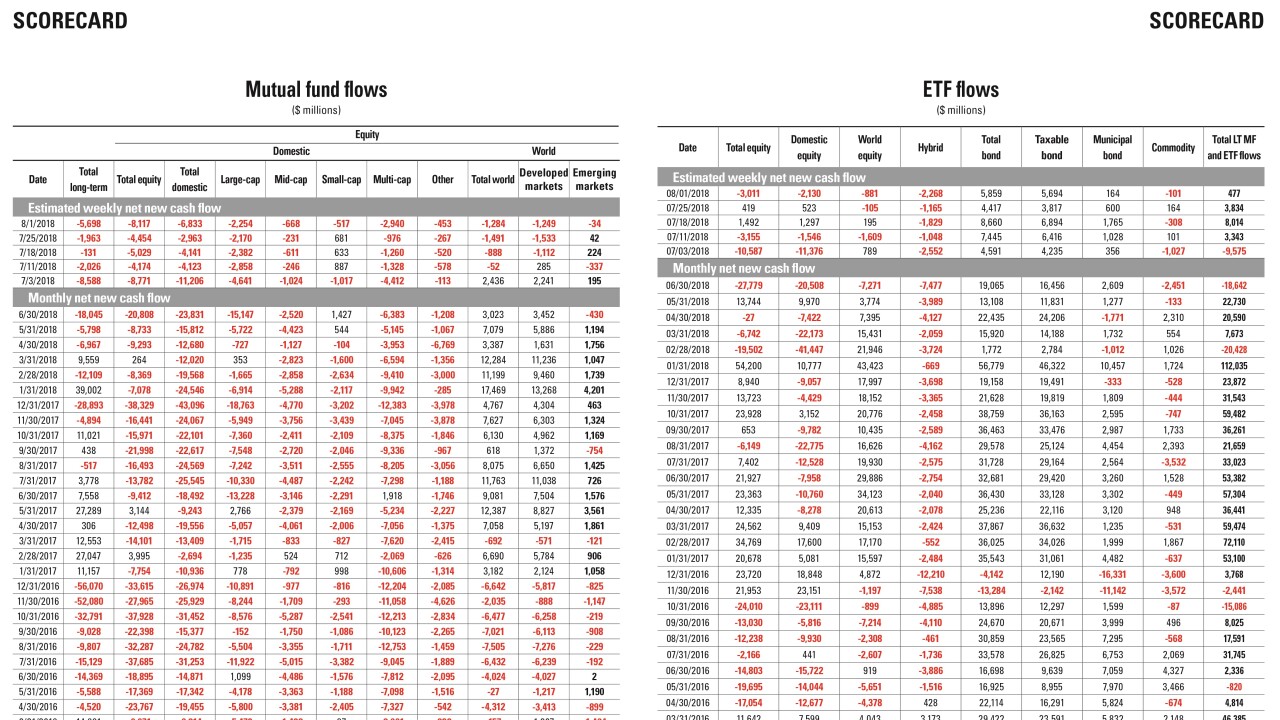

Data reported by the Investment Company Institute.

March 28 -

Data reported by the Investment Company Institute.

March 1 -

Data reported by the Investment Company Institute.

February 6 -

The funds include a wide range of offerings from emerging markets to precious metals, multi-strategy and REITs.

January 14 -

Data reported by the Investment Company Institute.

January 10 -

Data reported by the Investment Company Institute.

November 20 -

New actively managed municipal bond ETFs from the firm have attracted $50 million in assets since their inception in October.

November 16 -

Recently, higher interest rates and stock market volatility have undermined gains.

November 14 -

The good times in munis aren’t likely to last as the Fed’s push to boost interest rates will hamper future results, an expert says.

November 7 -

Data reported by the Investment Company Institute.

October 5 -

Data reported by the Investment Company Institute.

August 10 -

Data reported by the Investment Company Institute.

July 13 -

Clients may be compelled to sell their shares as nearly 90% of the products have experienced losses this year.

July 6 -

Morningstar’s annual study reveals how investors are catching up to funds by making better-timed trades.

June 13 -

Data reported by the Investment Company Institute.

June 8 -

Even profitable bond managers will have to up their game to remain relevant because in many cases investors have better options.

June 7