Recruiting

-

Even with those challenges, rep productivity and client cash balances expanded in the third quarter.

October 30 -

The former wirehouse advisors specialize in financial strategies for high-net-worth clients, families and businesses.

October 28 -

The firm currently fields 40 teams, most of which have joined this year.

October 26 -

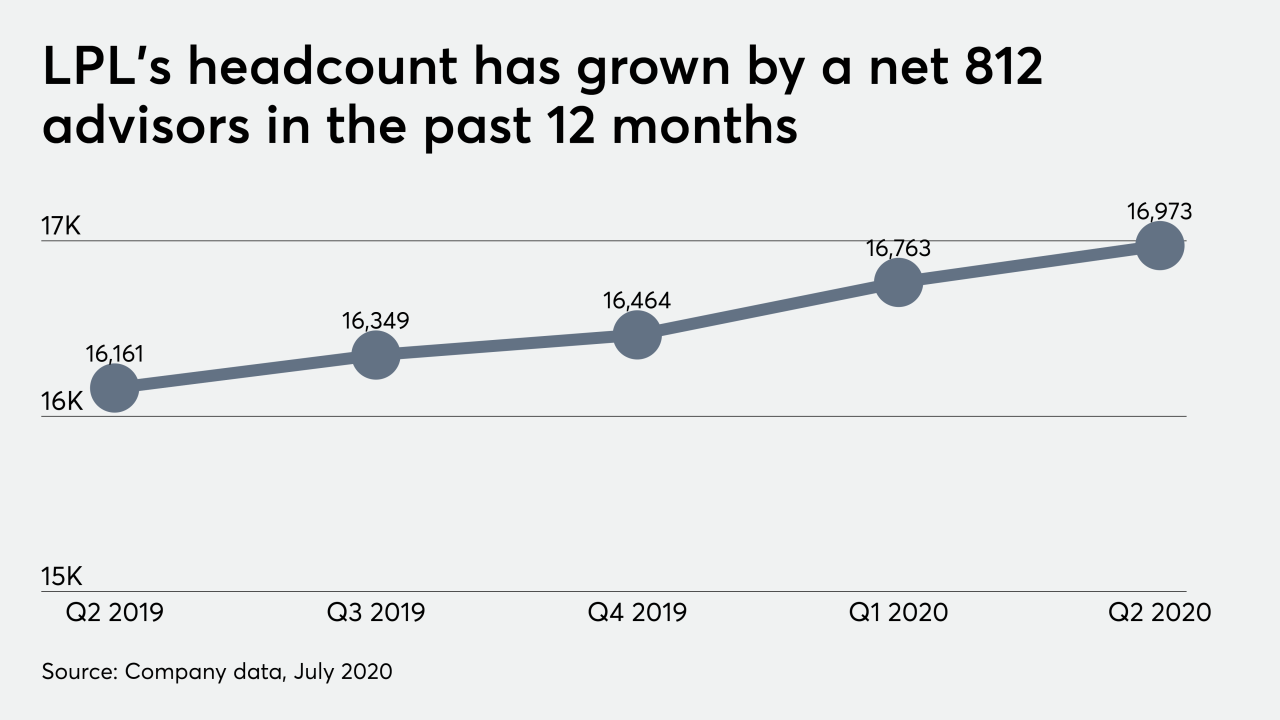

The No. 1 IBD is keeping up the recruiting momentum that’s sustaining record headcounts and billion-dollar moves.

October 23 -

Here’s how RIAs are falling short in their support for pregnant and new mothers and what they can do to change it, according to advisor Rianka Dorsainvil.

October 21 -

Meanwhile, the wirheouse’s advisor headcount ticks down and recruitment loans drop, again.

October 21 -

In order to avoid treating DEI as a fad, #DoingTheWork in wealth management ought to start with these critical steps, financial advisor Lazetta Braxton writes.

October 20 -

The move represents the third largest out of the IBD channel in 2020, according to company recruiting announcements tracked by Financial Planning.

October 20 -

The advisors are reuniting with a former Smith Barney colleague in one of the firm’s largest hires of the year.

October 16 -

Firms' legal brawls with departing advisors don’t exactly enhance their stature among clients. But there's reason to think this may become a thing of the past, writes recruiter Mark Elzweig.

October 16 -

Genstar Capital Managing Partner Tony Salewski spoke openly with advisors about the firm’s investment strategy for the IBD network.

October 15 -

Renewed recruiting efforts and pumped-up tech are boosting headcount and fee-based assets.

October 15 -

The additions are expected to include financial advisors and customer service agents, and represent a 15% increase in associates who focus on clients.

October 14 -

The No. 1 IBD’s 2,500-advisor bank channel will add 285 more reps when two massive investment programs affiliate next year.

October 9 -

The wirehouse plucked the trio from Wells Fargo

October 8 -

The regional BD picked off teams from Merrill Lynch, UBS and Raymond James in a (mostly) September sweep.

October 8 -

The company plans to expand services to the high-net-worth by doubling the number of its advisors, its wealth management head says.

October 6 -

The multigenerational group includes a grandfather, father and son.

October 5 -

The new recruits came at the expense of Merrill Lynch, UBS and Wells Fargo.

September 30 -

Charlie Scharf’s insensitive and factually incorrect remark perpetuates a damaging trope, financial advisor Lazetta Braxton writes.

September 29