Regulation and compliance

Regulation and compliance

-

The IBD trade group launched a public campaign after more than 80 cases this year alleging inadequate disclosure of mutual fund fees and compensation.

September 5 -

Planners' fears of violating privacy stops them from taking action. If implemented, a new model act might help.

September 4 -

Advisors may need to alert clients as to when these checks will be taxable.

September 4 -

The SEC published more than 1,300 pages of regulatory information. Here's what advisors need to know.

September 3 -

The first-of-its-kind product is cleared and features the same creation-and-redemption process common with traditional offerings.

September 3 -

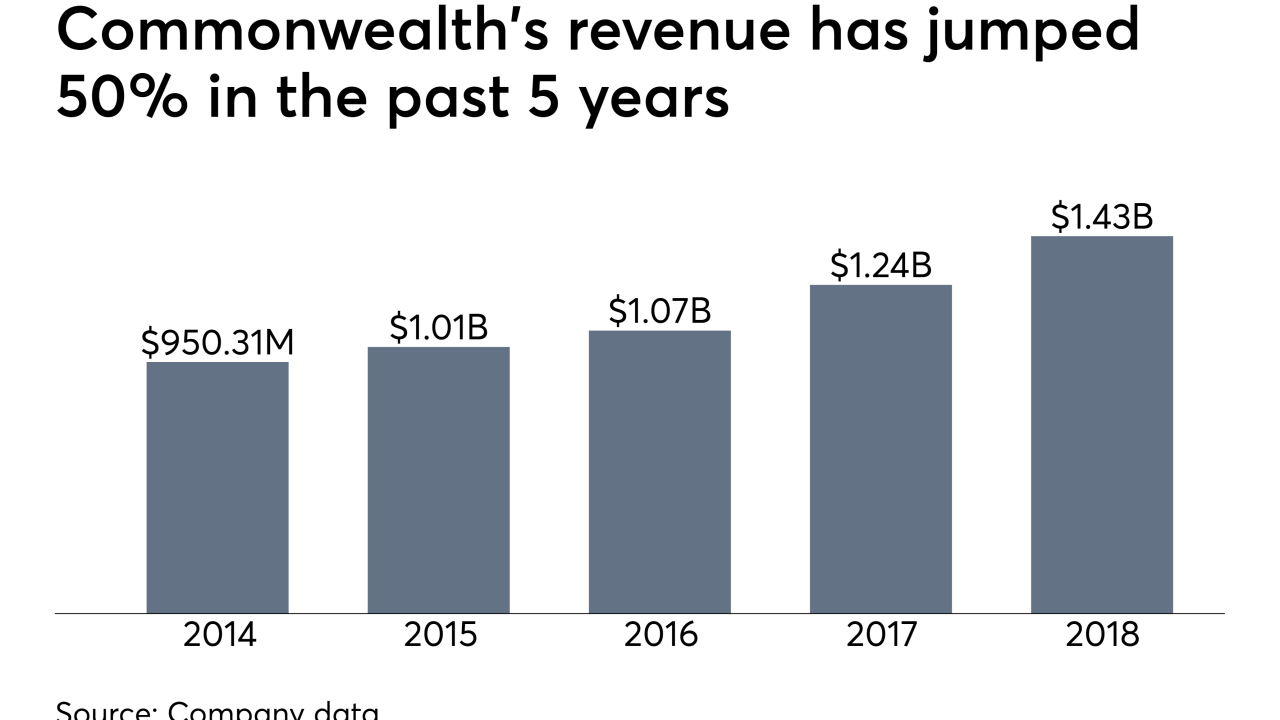

The IBD failed to adequately disclose conflicts of interest to clients related to receiving $10.8 million from mutual funds and its clearing broker, the SEC says.

August 30 -

Due to a 2010 FINRA rule change the answer is — with difficulty.

August 30 -

While the agency has publicly detailed key focus areas, some planners still don't know how it evaluates firms.

August 28 -

Judging from what promoters of insurance products can say in their marketing materials, not so well, writes Ethan Schwartz.

August 28 -

The insurgents won seats allotted to represent small and large firms.

August 21 -

To stand apart from broker-dealers, advisors may not need tougher rules, but smarter marketing.

August 16 -

IFS has notified regulators about the alleged illegal trades, which sources say cost the firm more than $10 million.

August 15 -

Brokerage shops get to weigh in later this month on challengers promising reforms at the industry regulator.

August 14 -

The regulator postponed until October a ruling on whether listing rules can change to allow two cryptocurrency funds to start trading.

August 13 -

Critics reject the notion that disclosure alone is sufficient for reigning in conflicts — but the charges against Commonwealth have put BDs on notice.

August 12 -

Reports of the death of fiduciary differentiation have been greatly exaggerated, contends fiduciary advocate Knut Rostad.

August 12 -

Prosecutors said Robert Shapiro used investor money for his $6.7 million home and $3.1 million for chartering planes and for personal travel.

August 9 -

A barred and terminated former Securities America advisor’s conduct was “appalling, reprehensible and evil,” according to a federal judge.

August 8 -

An RIA owner accused the custodian of aiding his chief compliance in setting up a competing firm.

August 7 -

The panel has had 13 public meetings since the Massachusetts senator’s last appearance, in May.

August 6