Regulation and compliance

Regulation and compliance

-

Here's what I've realized since I penned my original missive to the commission.

August 17 -

Missouri legislators inadvertently passed a law that would outlaw the Certified Financial Planner credential.

August 16 -

'Tax Reform 2.0' could be a boon for retirement savers

'Tax Reform 2.0' could be a boon for retirement saversThought we were done with the tax overhaul? Think again.

August 16 -

Clashes over the Labor Department's fiduciary rule have carried over into the debate on the SEC's proposed regulation.

August 14 -

Advisors must be wary of “making permanent decisions based on a temporary law,” an expert says.

August 14 -

Violating this FINRA rule has extremely serious consequences including termination and disciplinary action.

August 14 -

The bank disclosed earlier this month that it faces a U.S. inquiry into its purchase of low-income housing credits.

August 13 -

Tightening regulations and digital innovations are among the most important issues facing distribution channels, executives say.

August 13 -

Part of the problem stems from how slow regulators have been to define their views of virtual currencies.

August 13 -

"The process has become enervating and exhausting and to the point where you don't even want to look at it anymore," an expert says.

August 9 -

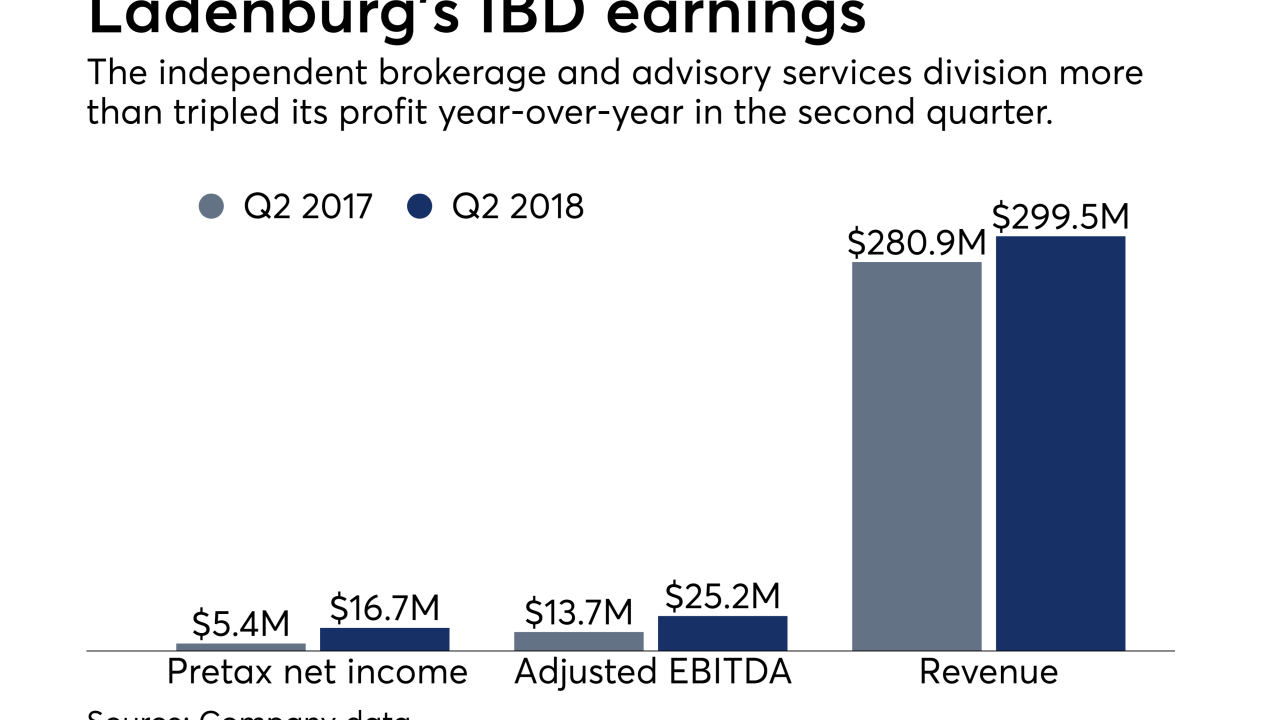

The IBD network disclosed the renewal of its clearing agreement, along with three firms’ intention to self-report possible mutual fund violations to the SEC.

August 8 -

Many small firms still don't offer this important benefit to their employees, but it’s time for that to change, says advisor Douglas Boneparth.

August 8 -

Firms designated as “taping firms” due to the high number of brokers they hired from disciplined firms may soon have their status as taping firms disclosed in BrokerCheck.

August 8 -

An overreliance on disclosure isn't enough to protect clients from bad brokers, the investor advocacy group says.

August 7 -

“The industry has not done any favors to young advisors,” says independent advisor Douglas Boneparth.

August 7 -

The rep accepted two loans while employed at Robert W. Baird and later neglected to disclose them to Citigroup Global Markets, FINRA claimed.

August 7 -

It's not too late for the the SEC to fix its flawed proposal before it issues its final rule, says the Democratic senator from Massachussetts.

August 6 -

The commission’s draft fails miserably as a consumer protection measure for the public and actually makes matters worse.

August 3 -

It will host public forums in nearly two dozen cities over the next 16 months.

August 1 -

The case offers a new look at decisions made inside one of the nation’s largest home lenders before the financial crisis, and the evidence that executives saw of mounting trouble.

August 1