-

Nearly 2 million Americans aged 50 to 64 had Parent Plus loans last year, and 200,000 retirees aged 65 and older carrying the same type of loans.

February 28 -

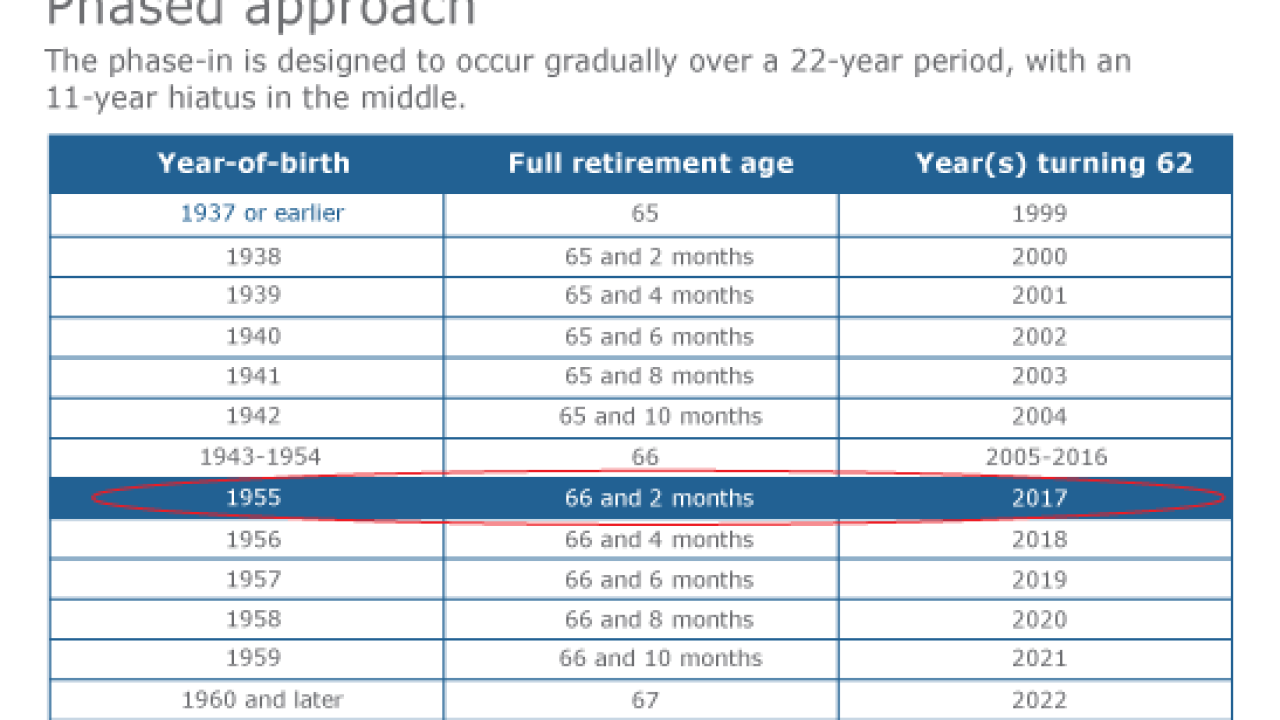

Changes can substantially reduce the value of delaying widow(er) benefits for surviving spouses.

February 21 -

An adviser at the firm squandered the aging clients' retirement money on oil and gas investments and Puerto Rico bonds, their lawyer said.

February 16 -

-

There are some situations where delaying is neither feasible nor prudent. Here’s how to weigh them.

February 2 -

There are ways around having to pay as much as a 50% penalty. Plus, inheriting Roth IRAs and designing more efficient retirement portfolios.

January 31 -

Moving investments into these accounts may optimize returns and boost savings. Plus, know your IRAs and the impact of Trump's proposals on income brackets.

January 25 -

The fee is “like a cash-printing machine for plan administrators," said one expert, and there’s very little clients can do about it.

January 23 -

For years, it seemed that a decline in monthly benefits was a long way off. Now it may be sooner than expected. Here’s what advisers need to know.

January 23 -

A majority of people still lack basic knowledge about Social Security. Be sure to educate your clients so they're not part of that scenario.

December 28 -

It turns out that common cognitive shortfalls apply to Social Security planning as much as investment strategies.

December 27 -

Clients can withdraw claims and re-apply at a future date, with some restrictions.

December 9 -

Although some income is withheld, benefits can be higher down the road.

December 7 -

Here are key takeaways from a Department of Labor fact sheet.

November 10 Beaumont Capital Management

Beaumont Capital Management -

Tell clients in this situation to make sure they know key dates and review their statements to confirm the amounts are accurate.

November 4 -

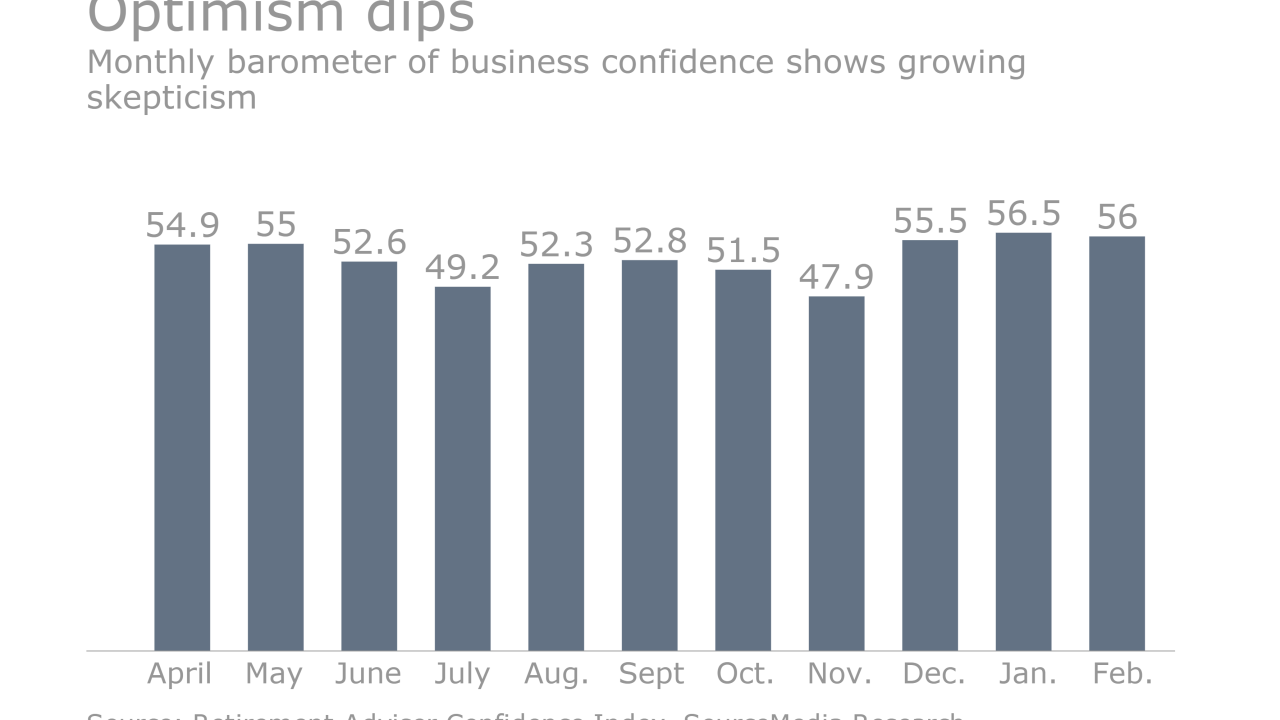

The likelihood of periodic volatility is concerning to retirees, but it's important to try to keep clients calm.

October 20 -

Tiny COLA increases set for 2017; taxable earnings threshold also raised, making tax less regressive.

October 18 -

Failed marriages for aging baby boomers has doubled, forcing them to work longer and impacting financial planning, sometimes in the wrong way.

October 18 -

Working 30 years instead of 29 will yield a fractional monthly benefit increase — "like by 1/29th" — says an expert, who also notes how get a good idea of future benefit

October 17 -

More small businesses are motivated to provide 401(k) plans by technological advances as well as an expense war among mutual fund companies.

September 22