-

The No. 1 IBD is reaping the benefits of learning the lesson that it “can never move away from the advisor,” according to its head of business development.

February 11 -

With competition heating up, the IBD is offering advisors better technology and higher pay.

February 11 Elite Consulting Partners

Elite Consulting Partners -

Under the deal, private equity-backed Wealth Enhancement Group would make its 10th acquisition in the past five years.

February 1 -

CEO Dan Arnold pledged new tech-enhanced support for advisors as part of a larger cultural transformation.

February 1 -

The No. 1 IBD requested that other variable writers “contractually reaffirm their commitments to protecting trails,” an executive says.

January 24 -

The leak included information on about 12,000 advisors who are clients at LPL Financial.

January 23 -

Private Advisor Group unveiled a new team with $175 million in client assets, while Integrated Financial Partners says it grew by $900 million in 2018.

January 23 -

The leak affected advisors who do business with the asset manager’s iShares ETF unit.

January 22 -

An analyst expects “solid” recruiting figures for the fourth quarter after the No. 1 IBD added the five-advisor group plus an ex-Raymond James bank program.

January 17 -

The retirement plan-focused group’s new OSJ had left the No. 1 IBD in 2017 and will grow to 160 advisors under the move.

January 11 -

Private Advisor Group is “cautiously optimistic” it could recruit a dozen teams with about $500 million in AUM each this year, an executive says.

January 10 -

Advisors report what they love — and hate — about tech at companies holding client assets.

January 4 -

The No. 1 IBD is marshaling transition assistance, technology and other resources toward recruiting success across the firm and its bank channel.

January 4 -

The advisors joined the firm’s employee and independent broker-dealer units.

December 24 -

“I don’t want to call a helpline, I want a partnership,” the advisor says of her move to the firm, which expects to hit record gross recruited production.

December 21 -

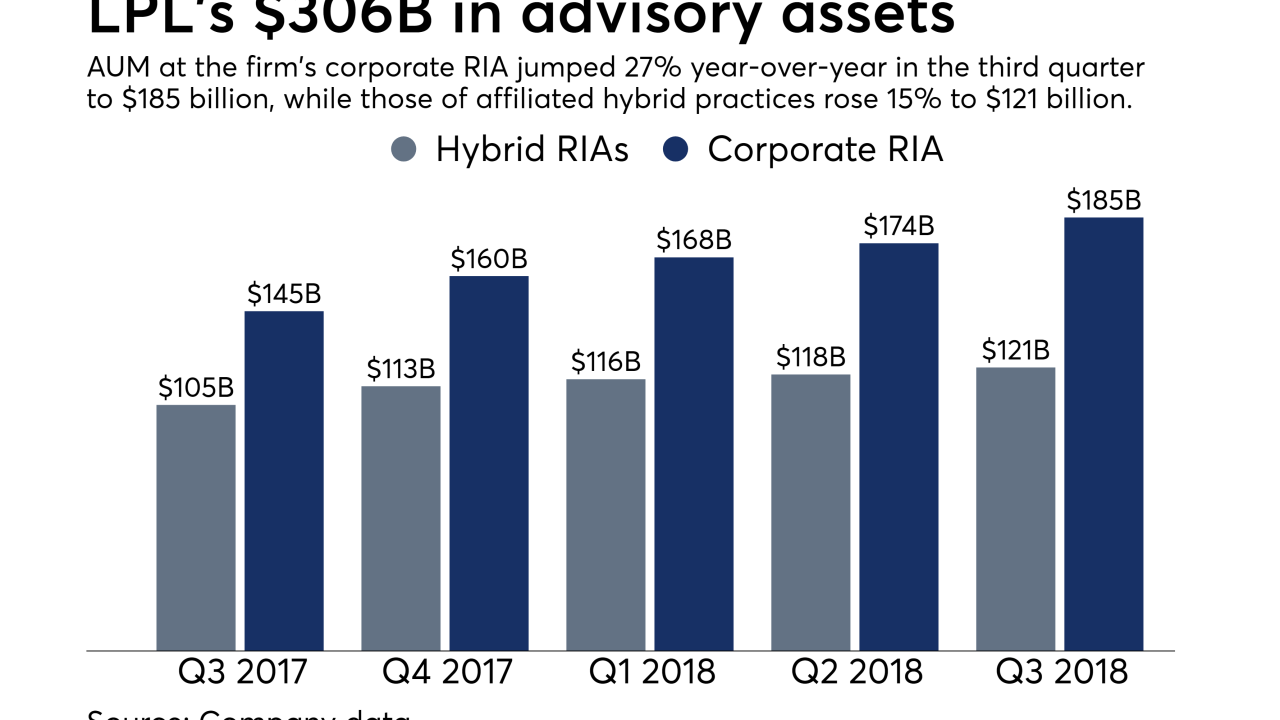

The No. 1 IBD’s advisory AUM flows show results from the company’s efforts to reward advisors for choosing its custody instead of outside firms.

December 19 -

The 50 largest teams and OSJs to change their affiliations show both the threat to incumbent firms posed by RIAs and the scale afforded by acquisitions.

December 17 -

Independent Advisor Alliance and Private Advisor Group — two of the firm’s largest hybrid RIAs — say they’ve added billions in clients assets from IFP.

December 13 -

Here we conclude the fourth and final segment of the Top 100 Bank Advisors. You can see all the other rankings (1-75) in our corresponding slideshows.

December 5 -

Here we present the third segment of the Top 100 Bank Advisors. You can see the top 50, as well as those who ranked 76-100, in our corresponding slideshows.

December 5