A team of 46 advisors with $10 billion in assets under administration moved between two of the largest enterprises at two of the largest independent broker-dealers.

Retirement Benefits Group, which has nearly $1 billion in assets from direct wealth management clients, began looking into a new affiliation last year, after Bill Hamm of Independent Financial Partners decided

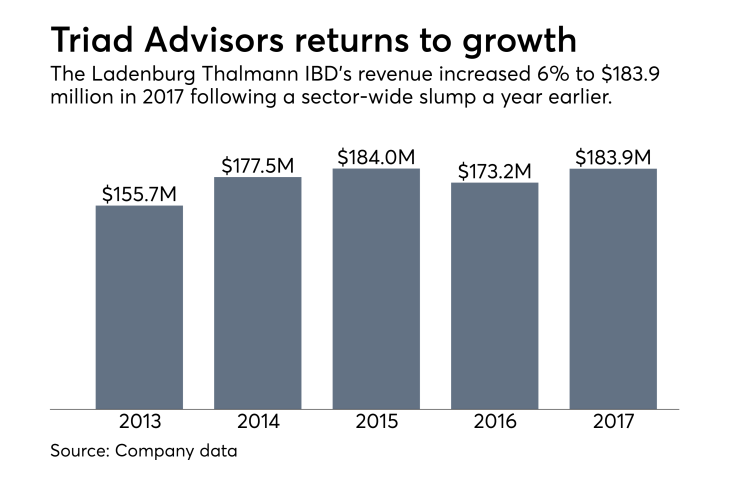

The San Diego-based group opted to join Resources Investment Advisors, a hybrid RIA and office of supervisory jurisdiction with Ladenburg Thalmann’s Triad Advisors which had itself left LPL in 2017. Retirement Benefits formally joined Triad on Jan. 2, following

Hamm’s new IBD, which is expected to launch April 1, has triggered a recruiting fight among Independent Financial and LPL’s other large enterprises. At least 70 advisors

-

The group opted to join the corporate RIA at the Ladenburg IBD with an eye toward greater independence with some outsourced tasks.

November 1 -

Affiliating with a bigger platform is often a helpful and necessary step for indie advisors.

October 29 -

At least six RIAs have left since the No. 1 IBD announced a change in policies last November.

May 31

Macroeconomic trends and matters of convenience will move advisors, assets and markets next year in the ever-changing wealth management space.

Retirement Benefits met with “many different companies,” including OSJ networks at LPL and those at other IBDs, Ciemiewicz says. The similarities between the employer-plan focused networks “played a big part in our decision to go to them,” he says.

The leadership team at Retirement Benefits and Vince Morris, the founder of the Overland Park, Kansas-based Resources Investment, have known each other for a long time and spoken in the past about “potentially joining forces together,” Morris says. Resources Investment will grow to 160 advisors after the move.

“Our experience of having done it ourselves and countless other advisors over the past two years really adds to that story of our success in the marketplace when we're out recruiting prospective advisors to join our team,” Morris says.

Representatives for LPL didn’t return a request for comment on Retirement Benefits’ exit, but Hamm’s son Chris, the COO of Independent Financial, issued a statement wishing the group all the best in the new OSJ.

“They’re great friends of ours, as are Vince Morris and the folks at Resources,” he said, adding that the two practices “have always had a strong relationship” and Independent Financial’s exit “gave RBG the opportunity to analyze what’s best for the future of their firm.”

Ciemiewicz echoed the statement for his part, saying that he thinks Independent Financial is “going to be very successful in what they do.” In addition to its 46 advisors in 15 offices, Retirement Benefits has 22 other staff members. The firm services more than 580 retirement plans.

“An organization as large and dynamic and as innovative as RBG, they don't take a transition lightly. They went through a significant due diligence process,” says Nate Stibbs, the chief strategy officer at Triad. “They were looking for an organization that could deliver more of a boutique partnership model.”

Atlanta-based Triad made two of the