A Cetera Financial Group firm plans to dissolve as a broker-dealer and add its 200 advisors to its parent firm’s largest BD in a move executives say was prompted by challenging times.

Girard Securities will bring its $7.7 billion in client assets to the country’s

Girard’s new IBD has

“It necessitates a different way of looking at our business that is different from the traditional IBD model,” says Tietjen, who will become director of the new Girard Region at the IBD. “Cetera has recognized that we’re at a key inflection point.”

She adds of the firm’s move, “It’s not driven by anything other than to improve and elevate the advisor experience.”

KEY DELIVERABLES

Cetera acquired Girard back in 2014, when RCS Capital and its chief, Nicholas Schorsch, still controlled the firm. Following an accounting scandal and subsequent bankruptcy, Cetera’s ownership changed hands into a privately-held entity called Aretec Group —

More than 2,500 advisors operate through Cetera Advisor Networks, out of nearly 9,000 at its member firms. Pershing will become the full custodian of Girard’s assets under the move, having previously acted as a dual custodian alongside Fidelity’s National Financial Services, Tietjen says.

Directly held assets, roughly split down the middle between brokerage and advisory accounts, comprise about 60% of Girard’s client assets, she notes. Pure brokerage assets make up the rest. Executives expect Girard’s termination as a BD to begin in early November, pending FINRA oversight.

-

Large data pulls required in stepped-up SEC exam are not related to ongoing troubles at Girard parent RCS Capital or American Realty Capital, CEO says.

January 30 -

The advisors come from a firm reported to manage over $5 billion in assets.

August 3 -

Implementation of fiduciary rule could drive more IBDs to seek safe harbor with large partners.

June 22

Raymond James grabbed five multi-million teams in a month. Other firms to see big transitions include Wells Fargo and Ameriprise.

Advisors with Girard will merge on to Cetera’s advisor and client systems, which include a new investment platform the firm

“Those are some of the key deliverables that their advisors will get on Day One,” says Cetera Advisor Networks President Tom Taylor.

OPTIMISM AMID CONTRACTION

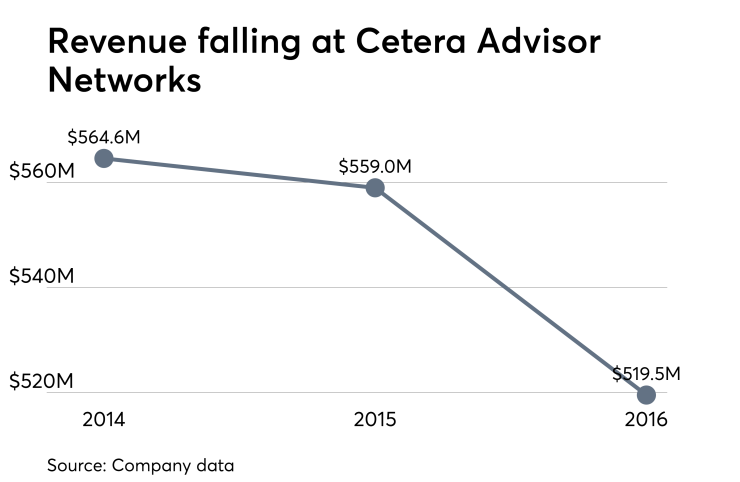

Revenues at the Top 50 IBDs in the country

Girard, however, marks the El Segundo, California-based IBD’s second new region in the past three months created by absorbing another firm. HBW Partners, which has 55 advisors, also gave up its own BD in late June,

The Girard move represents yet another example of

“We have a very robust pipeline and continue to have numerous conversations with small to midsize broker-dealers,” he says. “Our recruiting is as strong as it’s ever been.”