Two seemingly contradictory trends are at work in the financial advice industry.

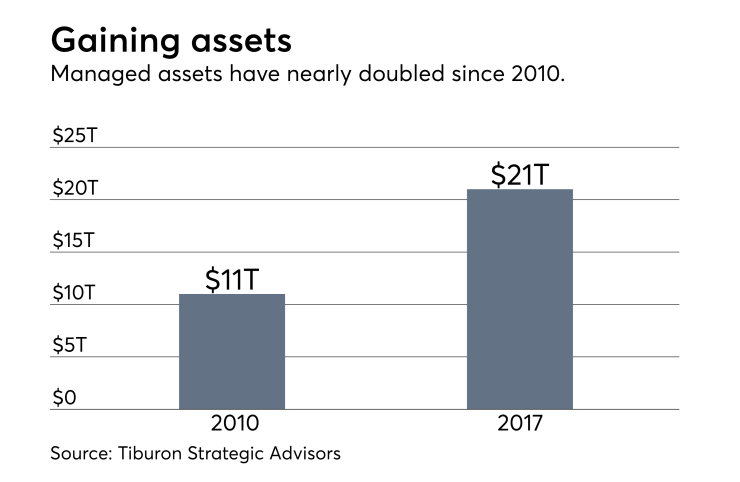

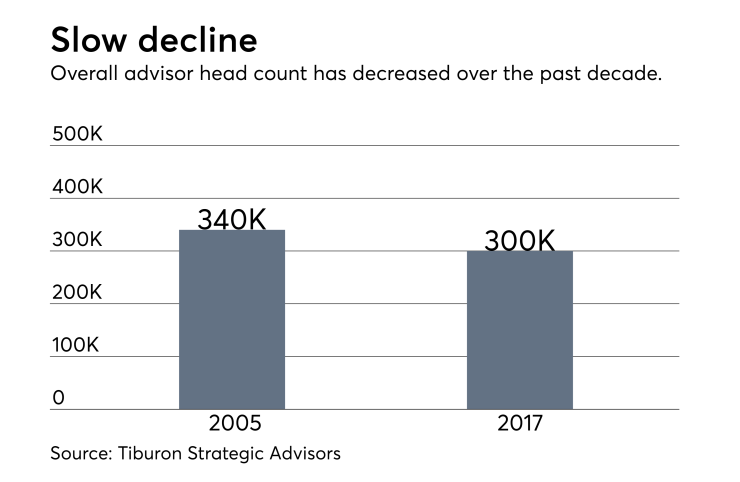

While advisors managed $11 trillion in client assets 2010, they now manage nearly double that, at $21 trillion. However, this explosive growth belies the slow slide in advisor head count nationwide, from about 340,000 at the peak in 2005, to barely more than 300,000 today.

In effect, a smaller advisor workforce is managing a far larger pool of assets.

That's according to the most recent industry statistics from Tiburon Strategic Advisors, a market research and consulting firm based in Tiburon, California. The result is that advisors need to work harder than ever before to win over clients, as more Americans take their assets to robo advisors and fintech offerings, as well as discount brokerages, says Tiburon founder Chip Roame.

"The value of advisors will be challenged over the next decade. I think that's good for the consumer,” Roame says. "The old world of the advisor knows all and the consumer knows nothing is gone. I don't think that necessarily means the number of advisors goes down, but they will have to up their games."

Different factors are to blame for eroding advisor ranks. Perhaps best known is the fact that there

Advisors who struggle with the marketing and technology sides of their practices or firms may need to turn to larger partners, such as aggregators like Focus Financial or HighTower to stay competitive, Roame says.

However, the aggregators represent just one choice. The most dynamic firms are offering advisors a multitude of different and changing business models to choose from, according to Roame. He points to Schwab's new franchise program, which allows advisors to open their own Schwab locations.

"I think you will see a lot of choices for advisors going forward," Roame says, adding that large firms "with the most models and the varieties of models will win."

In contrast, firms with fewer affiliation options, like wirehouses, may continue to lose advisors to various stripes of independence.

-

Advisors such as Greg Hersch have long found professional fulfillment by leaving wirehouses to start their own firms. But will they soon find that path cut off?

January 23 -

The trickle of brokers leaving wirehouses for greater independence is quietly becoming a flood.

May 22 -

The move marks the fifth new office added by the hybrid RIA this year.

June 11

"I think you will continue to see a flow of breakaway brokers every year," says Roame, pegging the rate in coming years at between 400 to 600 departing brokers annually.

The breakdown of the so-called Broker Protocol agreement probably will hasten this trend, he says.

The protocol, which brokerages signed into existence in 2004, smoothed the way for brokers to jump to competitors by allowing them to take some client data with them. However, Morgan Stanley and UBS recently left the protocol, causing some wirehouse advisors to preemptively depart their firms out of concern their employers might follow Morgan and UBS' lead.

As has been the case for years, RIAs represent a bright spot in the advisory industry, Roame says. They represent the only segment that has grown in recent years, Tiburon found.

Between 2008 and 2015, for example, the number of independent broker-dealers dropped by 6.8% and the wirehouses dropped by 2.8%, while the number of RIAs grew by 1.8% and dually-registered advisors, who by definition are also RIAs, grew the most, by 9%, the study says.