LPL Financial’s hybrid RIAs are retaining more than 70 advisors managing $3.3 billion in client assets ahead of a peer’s closely watched exit from the firm to launch its own broker-dealer.

The move by Bill Hamm of Independent Financial Partners to start a new BD in 2019 has drawn cordial farewells from all sides, but also

Robert Russo’s Independent Advisor Alliance, a hybrid RIA and OSJ based near LPL’s Charlotte-area campus, has

Hamm plans to open the new IBD formally on April 1, which his Tampa, Florida-based firm is calling its “independence day.” At least 70 of IFP’s advisors have submitted paperwork to leave the firm, Hamm says, noting he expects to have 200 to 250 advisors at launch and up to 350 by the end of its first year.

The total could reach 600 after a year and a half if IFP attracts the number of recruits Hamm anticipates and completes two or three possible IBD or RIA acquisitions. However, Russo’s OSJ network has added three ex-IFP teams with $630 million in combined assets in only the last two weeks, he says.

“Some of the advisors were plugging along and were happy with their relationship with LPL,” says Russo, identifying it as the main driver, while crediting a “service model that provides that boutique feel, even though we’re leveraging the largest independent broker-dealer.”

While exits by large OSJ enterprises

-

Bill Hamm’s Independent Financial Partners has grown more than fivefold in 10 years with the No. 1 IBD.

April 10 -

While the No. 1 IBD has retained a significant portion of the hybrid RIA’s advisors, its founder says the firm has major outside recruiting opportunities.

October 1 -

Robert Russo says the Independent Advisor Alliance has recruited nearly three dozen IFP reps, and other large enterprises have also made inroads.

August 28

Dynasty, Raymond James and Stifel are among the biggest beneficiaries of recent advisor moves.

Independent Advisor recruited in 63 advisors with $3 billion client assets this year, with 51 advisors managing $2.3 billion from IFP, according to Russo. His OSJ spans 170 advisors in 94 practices, with about $8 billion in assets under supervision.

In addition to the newly recruited advisors, Russo’s firm has more than doubled its home-office staff to 19 employees by hiring 10 more this year. In the past two months, Independent Advisor has tapped a director of strategic solutions

The 22 IFP advisors decamping to John Hyland and Pat Sullivan’s Private Advisor Group are bringing more than $1 billion in assets under management, according to chief marketing officer Abby Salameh. A half dozen other teams have also given “strong indication” that they’ll follow, Salameh wrote in an email.

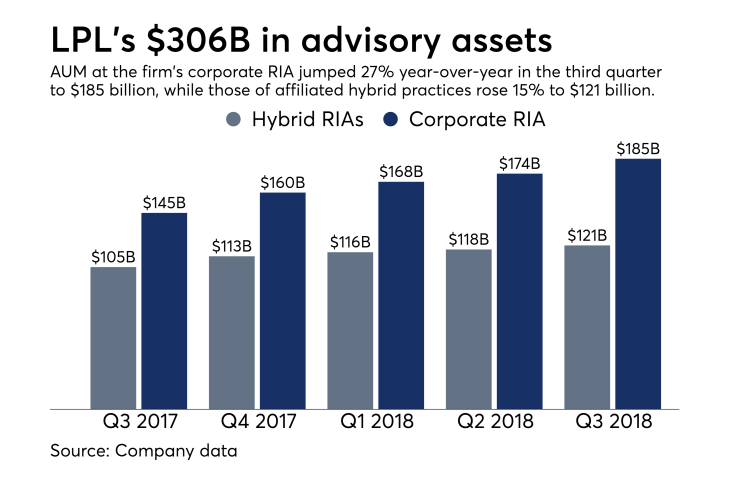

In LPL’s third-quarter

“What we've been doing and what they've been doing is just making sure that the advisors know their options, so they can make an informed choice about how they think about their affiliation going forward,” Arnold said. “There's work to do, but I think, so far, we see a good trend.”

Hamm dismisses Arnold’s figures — which would mean about 170 IFP advisors are staying with LPL — as speculative until the new IBD opens. Several LPL hybrid RIAs and outside practices have expressed interest in joining IFP, to the tune of a pipeline of $30 million in production, according to Hamm.

About 230 advisors have committed verbally to affiliate with the new IBD, which Hamm describes as an ancillary part of his 80%-advisory OSJ. He says most advisors staying with LPL just want as little disruption as possible, and he knows many

“I’ve always been a contrarian. When people are going one way, I’ve always seemed to be inclined to go the other,” Hamm says, adding that the most common answer among advisors exiting IFP is “we’re not saying ‘no,’ we’re just saying, ‘not now.’”

Hamm calls the competitive recruiting fight “the nature of the beast,” while Russo says he’s also OK with competition and wouldn’t be surprised if Hamm reaches out to advisors in his network.

Russo’s RIA has custodial agreements with LPL, Charles Schwab, TD Ameritrade and Fidelity, according to the firm’s SEC Form ADV. The RIA manages $3.1 billion in advisory assets under management across more than 15,000 accounts.

Independent Advisor pays 5% of its advisory fees to LPL for oversight in cases where clients select outside custodians, though the firm decides which representatives can offer them based on experience, production and other criteria. An additional 5% fee to the OSJ could apply, as well.

Since 2015, the OSJ has also used flat annual compliance rates of $30,000 for the first advisor in any audit location and $10,000 for each additional rep, rather than the traditional pay grid, according to Russo.

“It allows us to partner with advisors in the field if they want to grow out an office,” Russo says, noting that the structure also helps avoid pressures related to stock-price volatility. “If we can keep our advisors happy, we know what our revenue’s going to be.”