Raymond James poached a Morgan Stanley manager to oversee its largest complex after its previous chief resigned in the wake of a major immigrant investment fraud case.

Charles “Bert” White started Monday atop Raymond James’ South Florida Complex, which includes 13 branches from Jupiter to Key West and two branches in Miami set to merge into one, White says. Morgan Stanley’s former Boca Raton West complex manager replaced

Amigo resigned April 11 after 16 years with the firm, according to a company spokeswoman. One of Amigo's subordinates, former branch manager Joel Burstein, enabled a developer's "fraudulent use of investor funds" in the purchase of a Vermont ski resort called Jay Peak, according to an SEC-appointed receiver's lawsuit.

Raymond James agreed

The receiver had named Burstein, the onetime manager of the firm’s Coral Gables branch, as a defendant but omitted naming Amigo as one in the initial May 2016 complaint.

‘MOVING FORWARD’

The firm’s Private Client Group, which includes its 7,222 independent and employee advisers,

“We’re moving forward. We have some of the best financial advisers that exist anywhere in the business here in South Florida,” says White, 48. “This business will grow geometrically for years to come. Thankfully, I’m blessed with excellent financial advisers coming into this.”

A spokeswoman for Morgan Stanley declined a request for comment on White’s departure.

The firm had appointed him complex manager in 2007, following three years as a Smith Barney branch manager. Morgan later promoted the 25-year industry veteran to managing director, with 178 advisers with $18 billion in assets under management and $140 million in annual revenue reporting to him.

White, named to On Wall Street’s Branch Managers of the Year four times, will lead a reorganization of the St. Petersburg, Florida-based firm’s branches in the southeastern section of the state, according to regional director Patrick O’Connor.

Most of the Florida East Coast Complex merged into the South Florida complex under the change, which made the 13 offices Raymond James’ largest in the country by annual revenue, O’Connor says. The Miami branch, slated for consolidation in two weeks, will be the firm’s highest earning single branch.

-

Raymond James & Associates' branch manager of the year has grown his complex's annual revenue to $32 million from $4 million and boosted client assets to $5 billion.

January 23 -

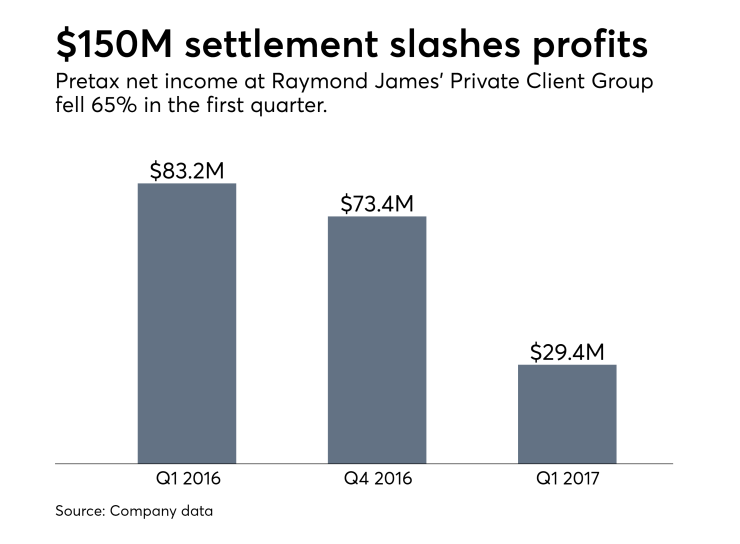

The firm's Private Client Group saw pretax profits drop to $29 million from $83 million for the year-ago period.

April 27 -

The settlement is the third major regulatory payment the BD has incurred in the past year. A branch manager associated with the Jay Peak case has also left the firm.

April 17 -

The firm is preparing for the fiduciary rule and contesting a lawsuit alleging that Raymond James allowed a $350 million fraud to be perpetuated.

January 26

The advisers oversaw nearly $900 million in combined AUM, and moved to Morgan Stanley, Raymond James and HighTower.

FALL FROM GRACE

Amigo had also played a prominent role with the firm, having been named

Amigo had oversight responsibilities for the Coral Gables branch, where Burstein allegedly helped his former father-in-law, developer Ariel Quiros, set up his accounts at Raymond James.

Quiros steered $200 million invested through the federal EB-5 program for immigrant investors toward personal expenses and other misappropriated uses, according to

The developer purchased Jay Peak in 2008 with financing from a margin loan provided by Raymond James, the receiver’s complaint shows. Quiros used the investors’ funds as collateral for a loan to make the $25.7 million purchase, in violation of investors’ limited partnership agreements, according to the document.

Efforts to reach Amigo were not successful Wednesday. A lawyer listed as representing him in the case did not return a phone call and email seeking comment.

An SEC spokeswoman declined to discuss whether Amigo faces any current investigations, and the lawyer acting as receiver in the case, Michael Goldberg, declined to comment on Amigo’s role in the scheme.

The Raymond James spokeswoman did not elaborate on Amigo’s departure beyond saying in an email that he had resigned. In unveiling news of the settlement last month, the firm disclosed that it had made a “considerable investment” in beefing up its anti-money laundering controls.

SHORT-TERM DENT, LONG-TERM GAINS

The proposed settlement, set to be examined in a June 30 approval hearing in Miami federal court, cut into the company’s profits in the first quarter. The Private Client Group, however, still took in record quarterly revenues of $1.09 billion and added 94 advisers to its ranks.

White says the firm’s more than 100 quarters in a row of profitability, good leadership and approach to clients figured in White’s decision to join Raymond James. Executives broached the idea of an expanded complex when the two sides began discussing his potential move roughly two months ago.

“This opportunity was just too good from a scale standpoint, too good from a location standpoint and a perfect fit from a cultural standpoint,” White says. “It is a distinct pleasure to be here.”