One of the oldest mutual fund companies in the country is transforming its independent broker-dealer with a new structure and a higher payout for advisors. At the same time, new leadership at the IBD remains intent on cutting costs and overall headcount.

On the day before Thanksgiving, suburban Kansas City-based Waddell & Reed Financial

Just a few days later, former Waddell & Reed CEO Henry Herrmann

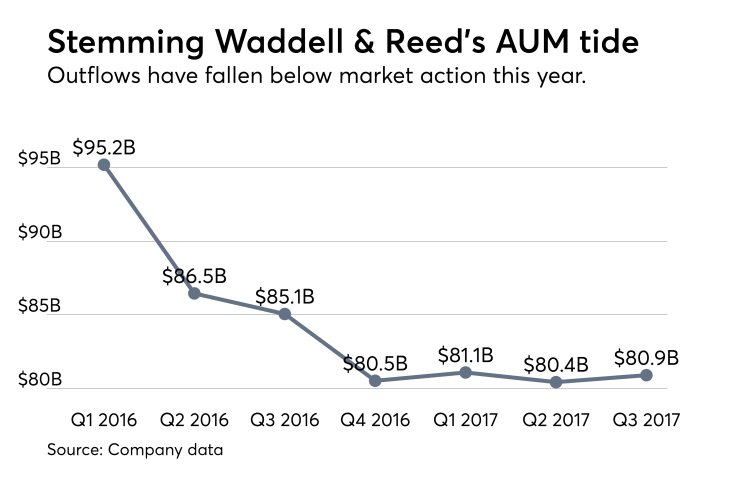

Outflows shrank by 43% year-over-year in the third quarter to $2.8 billion even as revenue, profits and advisor headcount also fell. The firm also reduced its dividend payment ahead of a $250 million share repurchasing program, and executives have planned to slash expenses this year by up to $40 million.

The cost savings will come from freezing Waddell & Reed’s pension plan, merging fund families and placing the IBD’s field structure under 30 complex managers, according to the Overland Park, Kansas-based company. Sanders calls the present time “a period of unprecedented change for our company.”

The firm refers to the IBD's evolution, which also includes compliance with the fiduciary rule, as “Project E.” The enhanced payout grid for advisors will come with greater minimum production requirements.

-

The IBD's longtime head stepped down as part of a plan to remake the firm.

November 28 -

Private equity-backed parent Advisor Group made the shakeup at a challenging time for IBDs.

September 13 -

The independent broker-dealer landed four recruits from Merrill Lynch, Edward Jones, Wunderlich Securities and Ameriprise.

October 11

A massive acquisition, the possible end of the Broker Protocol and other issues will shape the industry in 2018.

At the same time, the 80-year-old firm,

The reforms can’t come soon enough for Waddell & Reed’s advisors, says recruiter Jon Henschen.

“I would imagine the pain threshold for them is, ‘Are they behind the times?’ I think they are. They’re just not a broker-dealer that is on the cutting edge in any way,” Henschen says. “They’re just kind of a behind-the-times firm on many levels.”

In two transactions on Nov. 9 and 10, Butch

Roger Hoadley, a spokesman for Waddell & Reed, didn’t respond to requests for an interview with Butch, new IBD unit President Shawn Mihal, or a member of the executive team. The shake-up at the top further supports the company’s strategic changes,

Butch has acted as a frequent presenter on the firm’s earnings calls, and he earned $3 million in total compensation last year,

As part of the program, the firm converted Class A mutual fund shares in advisory accounts to institutional share classes without 12b-1 fees. The lower fees will cost the firm $15.4 million in reduced revenue this year, the firm estimates.

Waddell & Reed started “a holistic review of our business practices” last summer, Sanders wrote in a message included in the annual report, noting the strategic shifts across the company’s three business lines: its wholesale, IBD and institutional channels.

“In our broker-dealer, we are reviewing the way financial advisors interface with their clients and how advisors will be compensated,” Sanders said.

“While in the short to intermediate term these changes will pressure our margin, they are necessary to retain our competitive position. We believe that these actions will set the stage for our return to a strong competitive position in the future.”

The realignment of the IBD’s structure, which the firm completed last quarter, will save it $10 million per year, according to CFO Brent Bloss. Waddell & Reed’s headcount has fallen by 315 advisors in the past 12 months to 1,481 as it begins the four-year phase-in of a rule requiring $150,000 in annual production.

Executives have decided to focus on higher-producing advisors, and they don’t know for sure when the firm’s headcount will bottom out, Butch said on the company’s last earnings call. Advisor productivity grew 17% year-over-year in the third quarter to $69,000, still far below the four-year goal.

The firm is also moving toward a more open architecture, allowing advisors more choices for external fund families. Higher producers could also see increased payouts as the IBD allows them more leeway to choose the services most relevant to their practices.

Butch described the new grid during the firm’s second-quarter earnings.

“The shift in the manner we offer services to advisors allows us the flexibility to increase the dollars we are able to add to the enhanced payout grid,” Butch said, according to

Better grids and bulked-up recruiting deals and transition packages could help turn around the company’s fortunes, says Rob Blevins of Rowlette Executive Search Consultants. Cuts to advisors’ retirement and health benefits followed the steep asset outflows last year, he says.

“With that taking a big hit, it was really going to hurt their overall revenue,” Blevins says, noting the movement of a large number of Waddell & Reed advisors. “In the IBD space, you've got so many options out there.”

The firm’s earnings of $0.45 per share on revenue of $289.4 million last quarter beat analysts’ expectations even though its EPS fell by $0.20. Waddell & Reed cut the dividend payable Feb. 1 by $0.21 per share to $0.25.

The firm’s multi-pronged strategy should help it over the long term, says Bill Butterfield, a senior analyst for wealth management at Aite Group.

“This probably seems like a big effort for them, and I'm sure it has been. But they're not going to have to overhaul their business model every three to five years,” Butterfield says. “It positions them better for the future.”