-

Credit Suisse has discovered fraud at its international wealth management business, two years after it was criticized by a regulator in a similar case that rattled the bank and raised questions about controls.

August 28 -

While the money held in delisted products is a fraction of the overall exchange-traded market, analysts warn those billions could be time bombs.

August 18 -

A court ruling may also potentially help dozens of other advisors in their efforts to claim what they say is millions in deferred compensation they are due.

July 21 -

The industry outranked asset classes including private equity and venture capital, which have historically ranked higher in a Credit Suisse survey.

June 30 -

Talks had focused on plans to attract $15 billion of assets under management, mostly from wealthy Latin Americans, according to people familiar with the matter.

June 26 -

The firm plans to reshape how it lends to billionaire clients, especially loans that are backed by hard-to-sell assets.

May 29 -

The wealthiest clients require teams of professionals leveraging the highest touch service with a global reach, Markus Lammer, COO of Credit Suisse’s UHNW business in the U.S., explains in an episode of Financial Planning’s Invest Podcast.

May 14 -

A time to buy or a warning to avoid timing markets?

March 12 -

The client, Moises Cosio, is a filmmaker and the scion of a Mexican banking and real estate fortune.

March 5 -

The defeat is the most recent for Credit Suisse in an ongoing deferred compensation fight in which ex-advisors have won millions.

February 24 -

The bank's asset management arm will introduce products “where they exhibit efficiency advantages over index funds.”

February 10 -

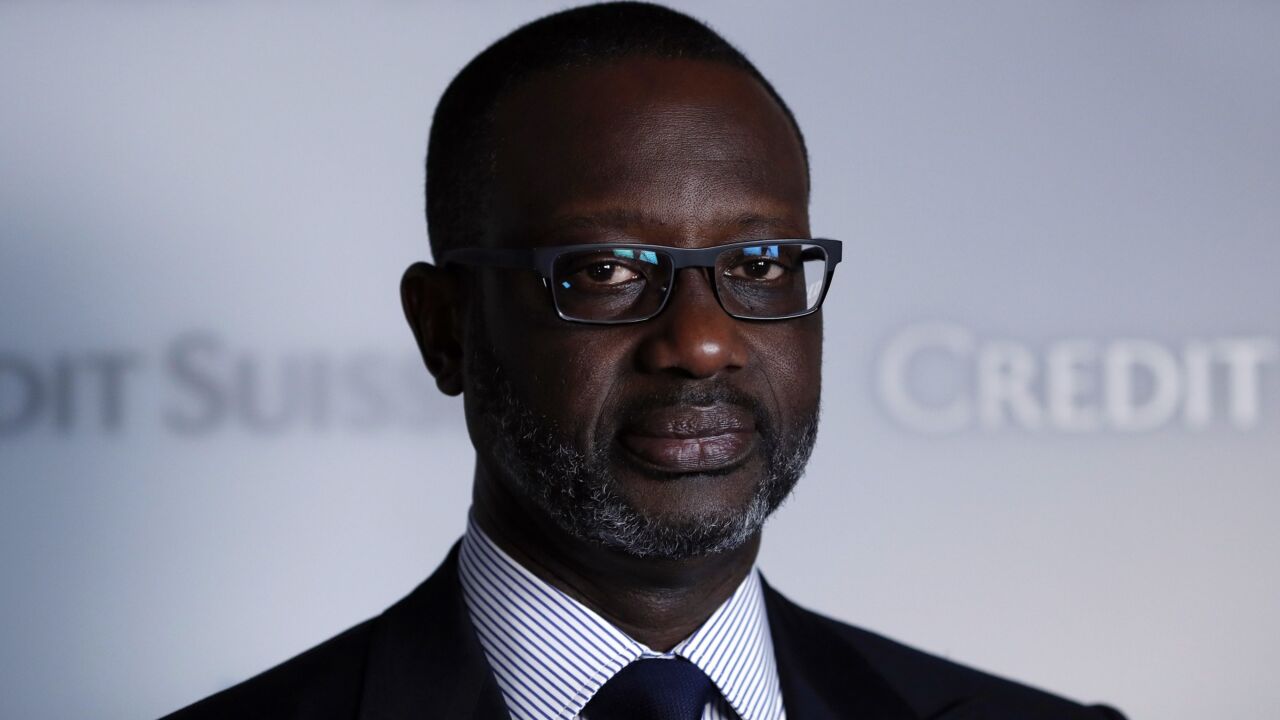

It took Credit Suisse’s chairman 19 meetings to woo Tidjane Thiam and one board meeting to say goodbye.

February 10 -

“We saw a deterioration in terms of trust, reputation and credibility among all our stakeholders,“ Urs Rohner said

February 7 -

There are indications that the bank may be looking to expand its toehold in the U.S. wealth management market after abandoning it in 2016.

January 28 -

The advisor switched firms only to see his new employer close shop 18 months later.

January 13 -

The top brass being unaware of this stuff happening on their watch doesn’t inspire confidence.

December 23 -

The advisors had won $1.6 million in back pay and fees in a case decided last month.

December 11 -

The move underscores wealth managers’ increasing focus on the not-yet-fabulously rich to boost profitability.

December 2 -

It’s the sixth time so far this year that former Credit Suisse advisors have won damages against the firm.

November 22 -

When an unusual recruiting deal between Credit Suisse and Wells Fargo went awry, years of broker frustration, severe attrition and litigation followed. Also at stake: Up to $245 million in back pay.