-

Michael Jeppson generated about $1.8 million in annual revenue, according to his new firm.

May 3 -

The private equity-backed firm has added seven ex-wirehouse advisers so far this year.

May 1 -

UBS and Merrill lose four advisers in HighTower's seventh deal of the year.

April 25 -

Three wirehouse veterans are the latest to join Ameriprise, On Wall Street learns exclusively.

April 25 -

The broker is the latest to leave the wirehouse, which recently reported its headcount fell by 145 advisers.

April 20 -

The advisors left the wirehouse in a quarter that saw it lose 145 advisers.

April 20 -

A look at starting payouts for wealth managers under 2017 compensation plans.

April 20 -

Where can a wealth manager max out his or her pay? We take a look at starting payouts under 2017 comp plans.

April 19 -

The firm reported record revenues, net income and client assets for the first quarter.

April 19 -

Some brokers who recently left the wirehouse cited differences over its policy to cease offering commission-based retirement accounts.

April 18 -

A comparison of starting payouts under this year's compensation plans.

April 18 -

A look at starting payouts for elite wealth managers.

April 17 -

The new recruit's business focuses on Latin American clients.

April 13 -

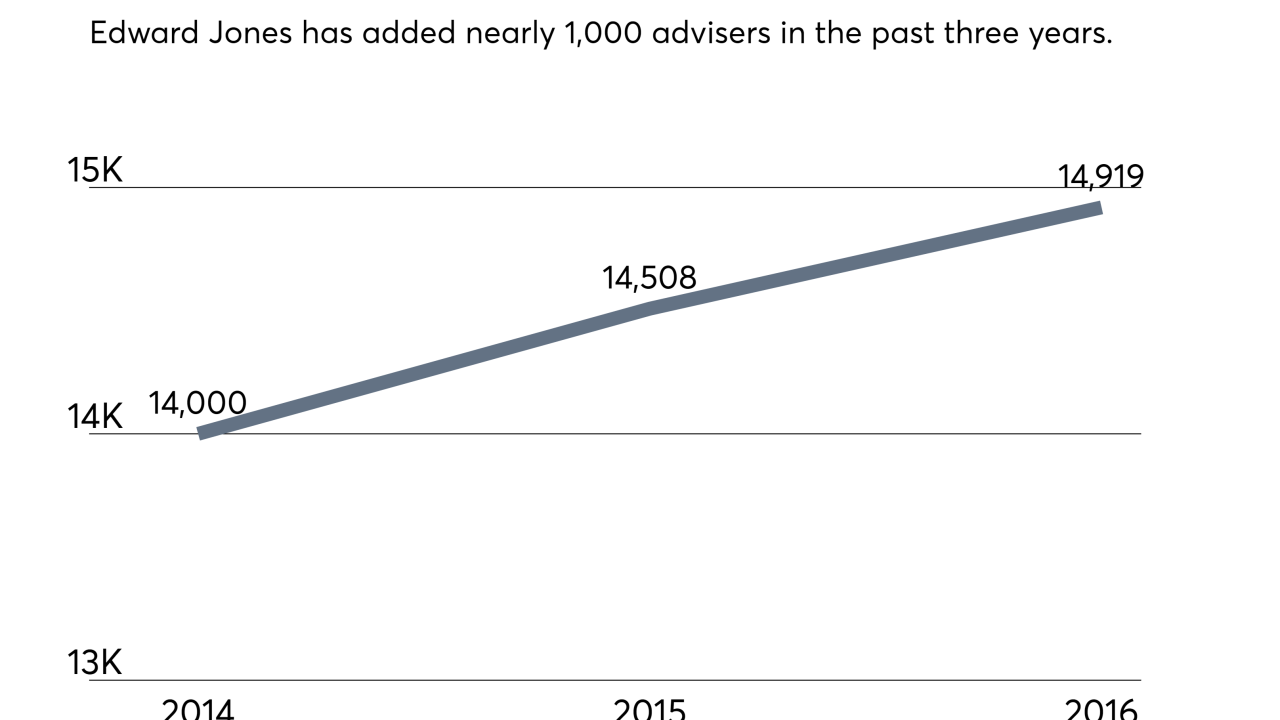

To grow, the firm is pivoting from its focus on training new brokers to poaching talent from rivals.

April 12 -

Which firms showed “meaningful progress” in improving client experience? And which one slipped?

April 11 -

A team joined the wirehouse from Wells Fargo Private Bank.

April 11 -

HighTower and Dynasty added big platform clients as wirehouse brokers continued to flee.

April 10 -

The wirehouse aims to grow its adviser ranks in a potential bid to surpass its larger rival Morgan Stanley, according to Andy Sieg, head of Merrill Lynch.

April 10 -

The firm's latest hire is an industry veteran of more than two decades.

April 7 -

A close look at what's driven the advisers at the top of this year's ranking.

April 6