Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

The wirehouse exodus continues, as a team of Wells Fargo advisors jumps ship for the independent firm.

April 17 -

Advisors may be upset due to the high-handed attitudes of the larger firms, but pulling down six zeroes a year can offset a lot of irritation, says On Wall Street’s annual recruiters roundtable.

April 16 -

The brokerage ranks shrank by 258 from the year-ago period.

April 13 -

The firm warned Friday that it may take a charge of as much as $1 billion to settle a U.S. probe of its consumer business.

April 13 -

One of the biggest notable losses came from Merrill Lynch, which lost a team managing $1 billion to the independent space.

April 11 -

BMO Wealth Management aims to modernize its investment service and give planners better equipment. Others offering automated advice solutions include UBS, Wells Fargo and JPMorgan.

April 9 -

A recent report about bad incentives for brokers "did not accurately reflect how we do business and serve our clients," said Jon Weiss, head of wealth and investment management.

April 6 -

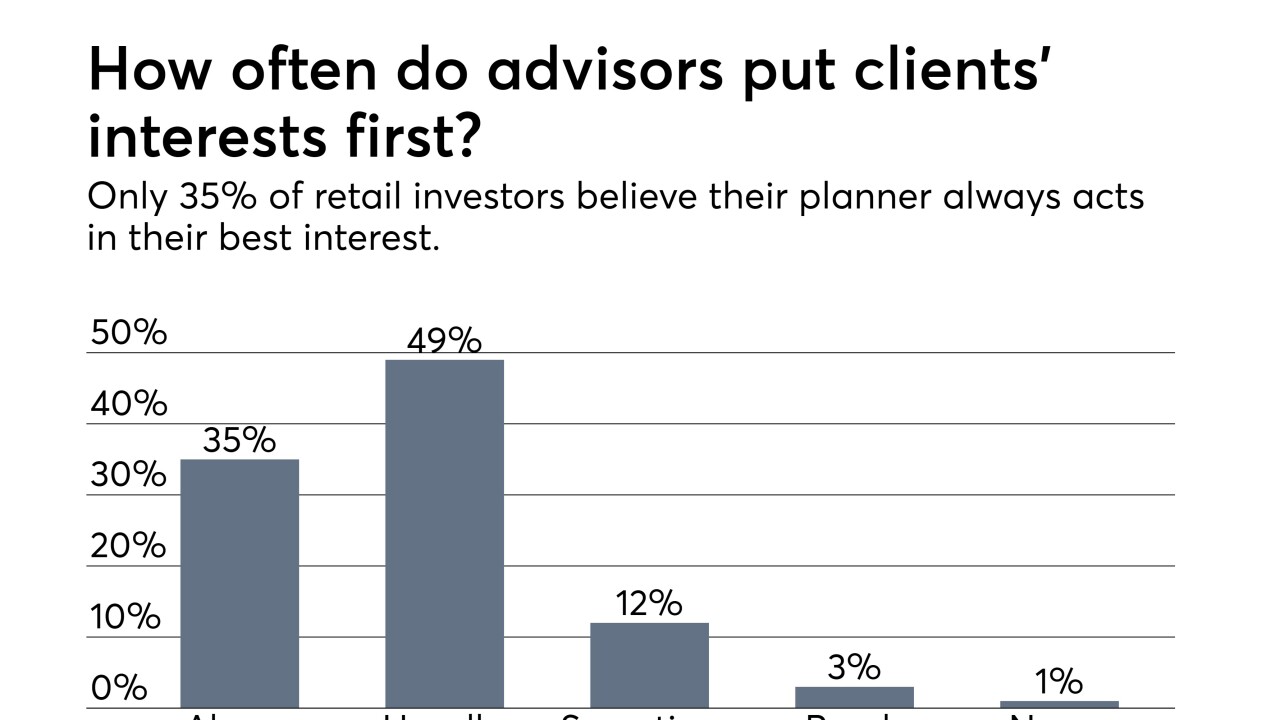

A new survey finds that investors prize full and upfront disclosures about fees and conflicts of interest, but advisors fall short.

April 6 -

Clients were allegedly steered into investments maximizing revenue for the bank and employees.

April 5 -

Need a gut check on your career? Read what top recruiters have to say about the big and small firms in the industry.

April 3 -

The firm falsely claimed on his Form U5 that he deliberately changed a customer’s address from California to New Hampshire to facilitate the sale of an annuity, the broker alleged.

April 3 -

Pet owners are seeking guidance on funding alternatives, drafting detailed pet-care instructions and leaving significant sums of money that can run into the millions of dollars.

March 26 -

The departure is the latest in a string for the wirehouse, whose broker ranks have shrunk by more than 300 over the last year.

March 21 -

The FBI has reportedly interviewed employees at the bank’s wealth management unit.

March 16 -

FINRA accused the advisor of unlawfully "structuring" a total of $77,560 by depositing cash into his bank accounts in amounts just below the $10,000 reporting threshold.

March 12 -

Massachusetts is probing whether the firm's wealth management unit steered clients toward inappropriate investments and high-cost accounts.

March 8 -

It's a sign the firm is still selectively hiring despite leaving the Broker Protocol last year.

March 8 -

Religious groups threaten to withdraw shareholder proposal on the bank’s decision.

March 7 -

The move comes at a bad time for the firm, which amid scandals and mounting regulatory scrutiny has lost more than 300 advisors in a year.

March 6 -

One recruiter says, "If I'm an advisor at Wells Fargo right now, I have to ask myself is this the firm I want to tie my future to?"

March 2