This report is a breakdown of the breakaway movement; which firms have been losing advisers, where are they choosing to go independent and how many assets are going with them.

The data is based on announced moves from 2014 to today. Moves between independent firms have been excluded.

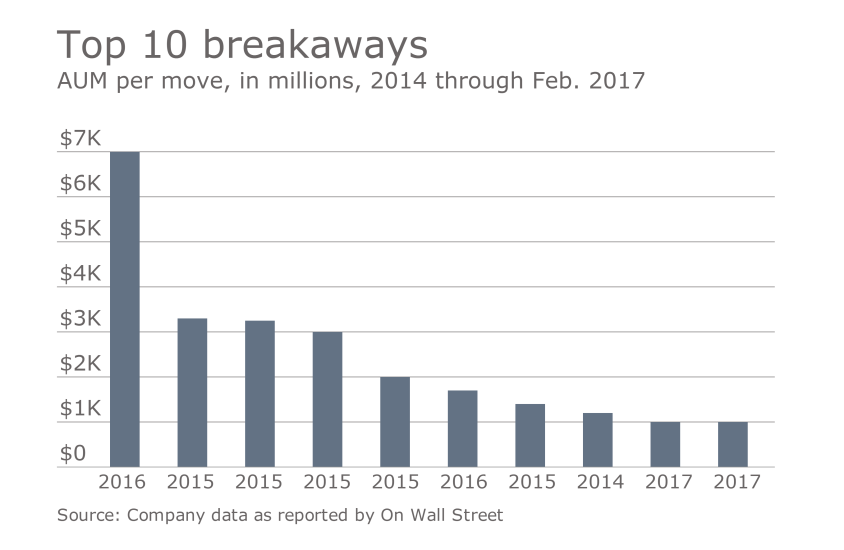

That dwarfs most breakaways. Over the past three years, the average AUM per breakaway adviser was $326.9 million.

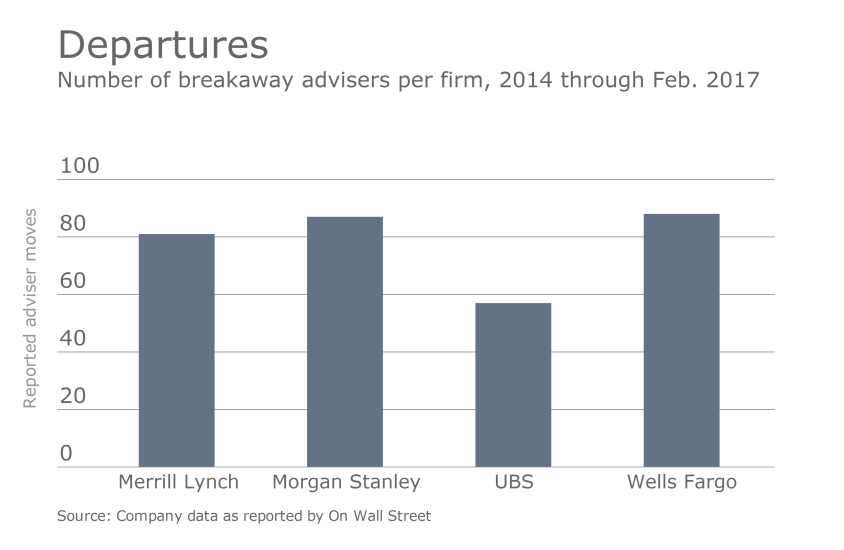

It's also important to note that while these figures represent departures, they do not necessarily represent a net decline in headcount. For example, Merrill Lynch reported that its adviser ranks had grown by 129 year-over-year to reach 14,629 for the fourth quarter of 2016.

For its part, Morgan Stanley says the firm's losses to independents have been stable over the past few years. The average size of those breakaways is also "substantially smaller than our average FA," the firm says.