-

The robo's fastest growing business now offers custom model portfolios in a bid to attract more wealth managers.

February 11 -

The private equity-backed firm’s deal could tack on some 900 advisors to its ranks.

February 8 -

As the No. 1 IBD rolls out M&A services to advisors this quarter and reels in record recruits, Dan Arnold says the firm is experimenting.

February 5 -

APIs, proprietary funds, customer service issues: executives explain what they’re planning as their company hits $6.7 trillion in client assets.

February 4 -

Despite the credit-positive reading by one agency, the IBDs are competing against less leveraged rivals.

February 1 -

The nearly 10,000 advisors affiliated with the firm grow 2.5 times as fast as their peers at rival brokerages, CEO Jim Cracchiolo says.

January 29 -

The capital injection is “a strong sign of confidence from investors that will help us continue to further serve our customers,” a company spokesperson said in a statement.

January 29 -

The increase comes as the recruiting market heats up.

January 28 -

The 2,500-advisor firm is sneaking up on larger rivals by adopting an approach that’s increasingly popular across wealth management.

January 27 -

Strong 2020 returns have given a boost to the Swiss bank's new CEO, Ralph Hamers, whose start has been overshadowed by a Dutch probe into his role in a money laundering scandal at his former employer.

January 27 -

A team that has grown through acquisitions dropped the No. 1 IBD after the institution purchased another one for more than $600 million.

January 27 -

The firm pivoted away from an aggressive hiring strategy in 2016 and has seen a substantial drop in costs associated with picking up experienced talent.

January 26 -

The results underscore the standout performance of the industry's largest firms in equities, a business where Europe’s banks have struggled to keep up in recent years.

January 26 -

BNY Mellon’s custodian is growing, even as it loses some major clients amid industry consolidation.

January 21 -

Eaton Vance and E-Trade deals expected to boost the firm’s performance.

January 20 -

Client acquisition was down compared to 2019, but still higher than in years past.

January 19 -

CEO Charlie Scharf’s long-awaited expense-reduction plan got a chilly reception from investors.

January 15 -

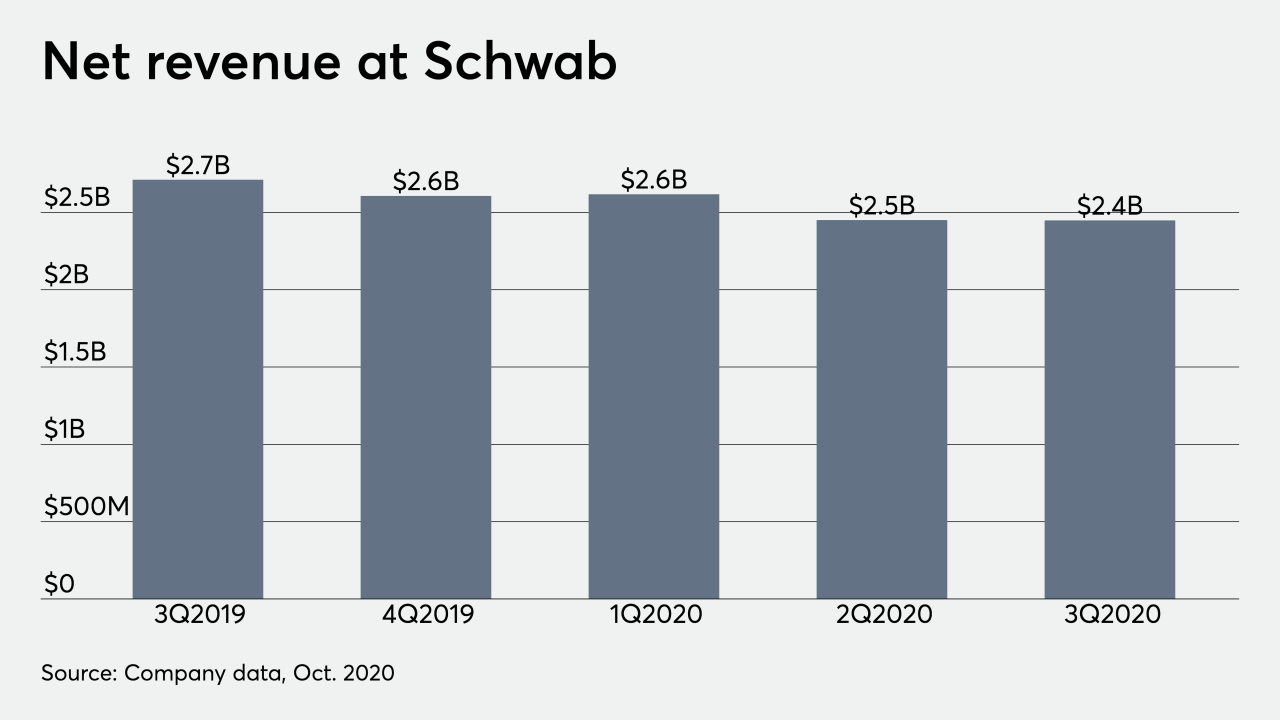

As the Federal Reserve strives to help the economy, wealth managers’ revenue takes a hit.

November 18 -

CEO Dan Arnold cites growth in traditional channels and in recently launched models that could bring even more opportunities.

November 3 -

Wealthy clients are the fastest growing segment of the company’s retail division.

November 2