-

The move is one of the largest of the year.

August 24 -

Gifting embedded loss assets can avoid a step-down in basis and preserve capital losses. Here's how to go about it, under several scenarios.

August 24 -

Do RIAs still have a clear advantage when it comes to modern planning software?

August 12 -

Tax-rate arbitrage is one approach, but it’s far from the only one, according to contributor Michael Kitces.

August 4 -

Any tax increases on high-income individuals and corporations would be offset by massive spending packages targeted at accelerating the country’s recovery from the coronavirus, according to the firm.

July 31 -

Procyon Partners, which caters to UHNW clients and retirement plans, had a rocky separation from the same former firm.

July 28 -

Perceptions on relationships, health, and lifestyle have also changed.

July 28 -

The move follows efforts to reduce expenses in the company’s global wealth management business.

July 23 -

“They’re now realizing: Let’s actually get the contingency plan in place,” said Dominic Volek, head of sales at Henley & Partners, the world’s biggest citizenship and residency advisory firm.

July 20 -

“What this tool does uniquely is it takes the depersonalized delivery of benefits and really helps the individual determine how best to get the most out of their benefits,” says Voya’s Andrew Frend.

July 17 -

At home or under a socially distanced beach umbrella, these diverse titles will help while away this singular season.

July 16 -

Startup Breakaway Bookkeeping & Advising is building a network of finance professionals to act as virtual CFOs for small-business clients.

July 13 -

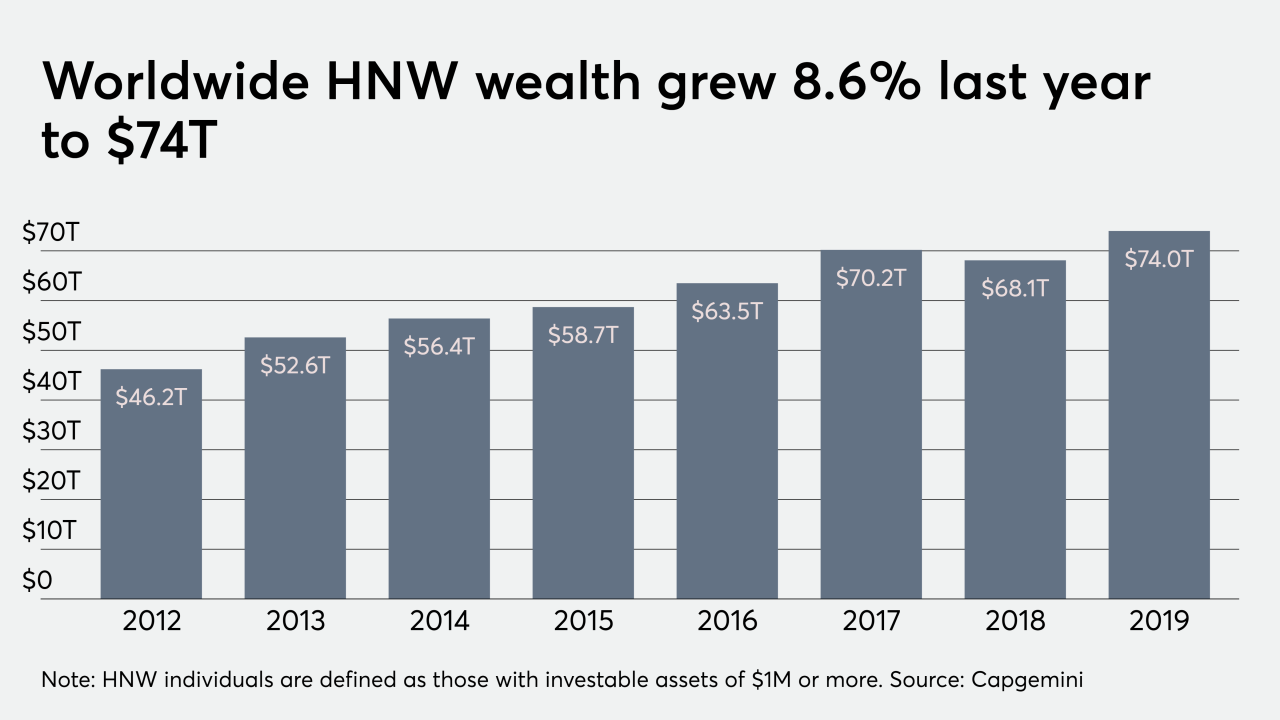

Affluent investors are concerned about transparency, performance and value, according to a new report by Capgemini.

July 9 -

Talks had focused on plans to attract $15 billion of assets under management, mostly from wealthy Latin Americans, according to people familiar with the matter.

June 26 -

As much as $16 trillion of global wealth may be wiped away this year as a result of volatility and economic fallout from the pandemic.

June 25 -

The wirehouse says it wants to simplify pricing for separately managed accounts and expand client choice.

June 23 -

“The stocks that I hadn’t heard of three months ago all of a sudden are the most active — that’s not where investors go, that’s where traders might go or hobbyists might go,” says a private wealth advisor at UBS.

June 19 -

About 6% of the country’s family offices have more than $5 billion of assets under management, while roughly a third control $500 million or less.

June 16 -

Major donor-advised fund providers said they’re using webinars, podcasts, social media and emails to nudge clients to give.

June 12 -

The central bank’s own data show that slightly more than half of U.S. households own stocks. But that doesn’t come close to telling the whole story.

June 9