-

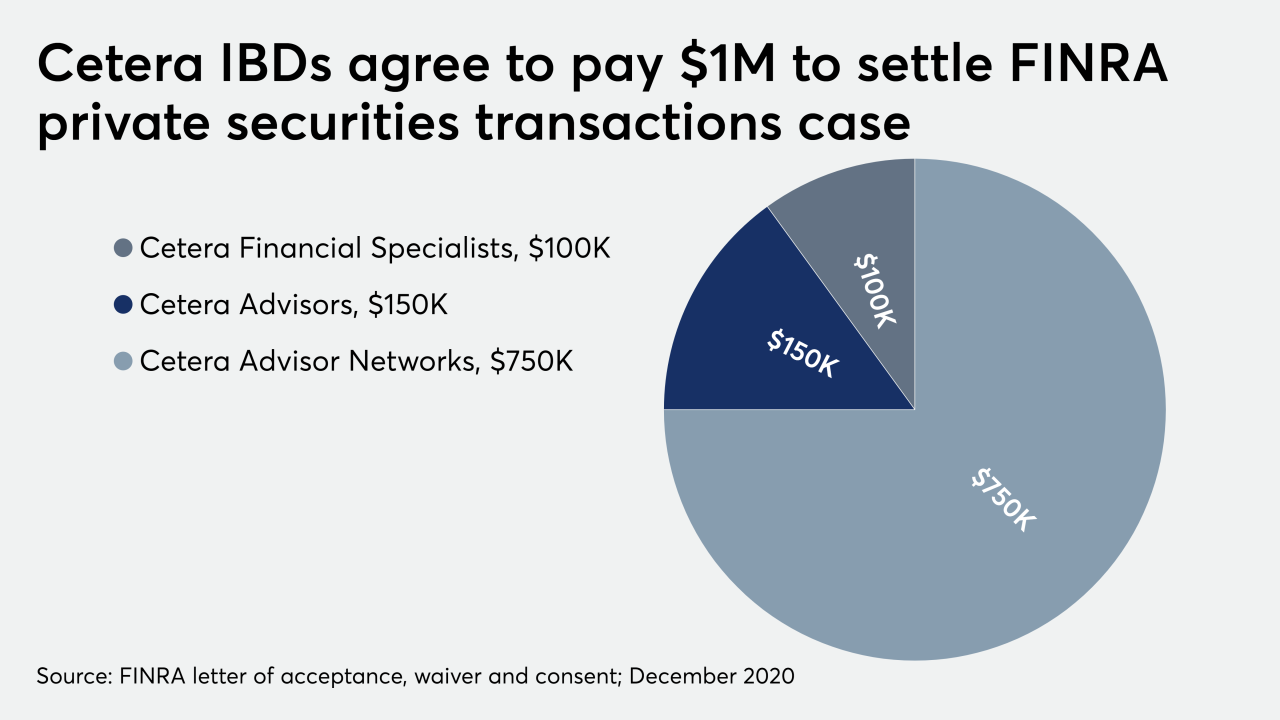

Despite pledges, the IBD network didn’t collect enough data for suitability reviews of the outside transaction for more than five years, according to the regulator.

December 22 -

Like its largest rivals, the wirehouse kept grids at par after a tumultuous 2020.

December 17 -

Waddell & Reed had been working in recent years to transform its “proprietary broker-dealer into a fully competitive independent wealth manager.”

December 10 -

Funding is getting tighter as advisors look towards marketing automation as an engine for growth.

December 9 -

Brian Truscott oversaw more than $330 million in client assets.

December 8 -

Nate Angelo will be responsible for 137 advisors who manage roughly $20 billion in assets.

December 4 -

The firm’s investment management division is bringing 55ip under its roof just two months since launching a partnership with the fintech firm.

December 4 -

The No. 1 IBD is responsible for nearly half of the dozen mega-moves in its sector this year.

November 24 -

As the Federal Reserve strives to help the economy, wealth managers’ revenue takes a hit.

November 18 -

It’s another big get for a bank that has been busily luring away top talent from the wirehouses.

November 17 -

Executives provided advisors an update. The company has separately said it cut more than 200 retail branches at the end of last month.

November 12 -

The 40-advisor OSJ brings more than double the assets of any other new group unveiled across the IBD network in 2020.

November 11 -

CEO Jamie Price says the change will reduce potential conflicts of interest related to transaction fees and come with lower prices in wrap accounts.

October 29 -

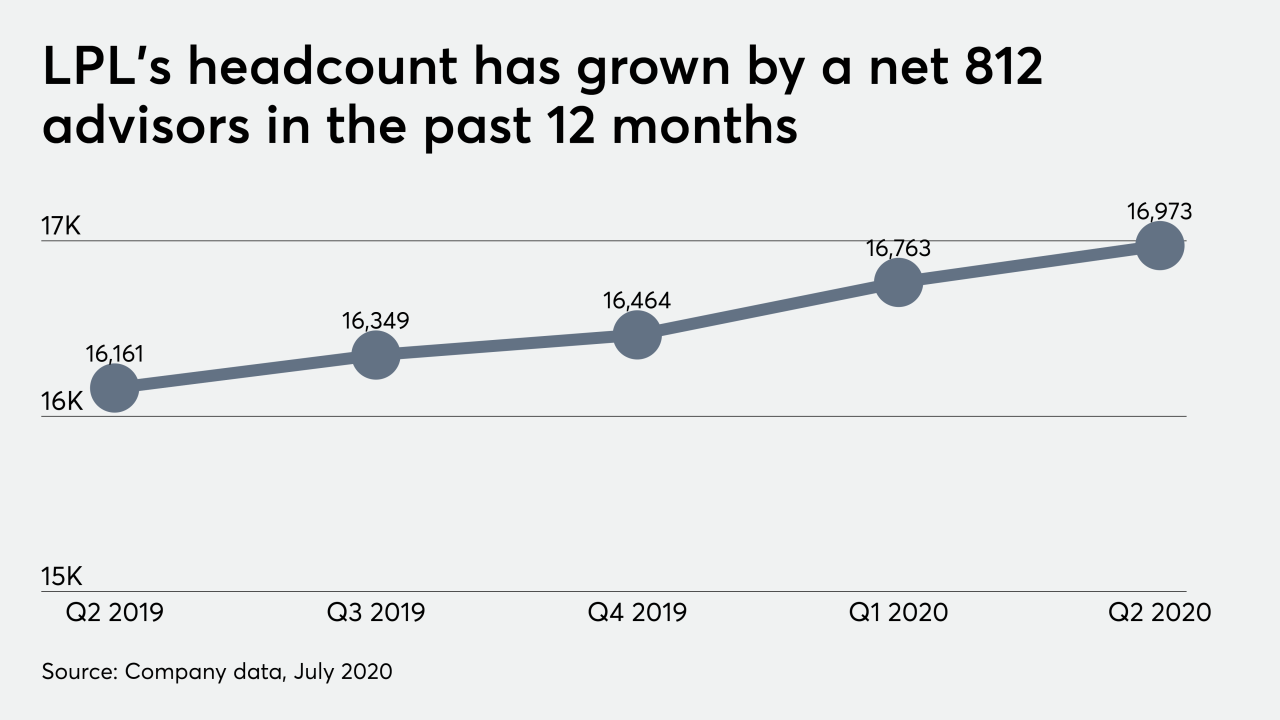

The No. 1 IBD is keeping up the recruiting momentum that’s sustaining record headcounts and billion-dollar moves.

October 23 -

If approved for an IPO, the blank check company will face stiff competition among the growing ranks of RIA acquirers.

October 22 -

The move represents the third largest out of the IBD channel in 2020, according to company recruiting announcements tracked by Financial Planning.

October 20 -

New ownership of the popular platform could open the door for new tech leadership, but don’t count Schwab out yet.

October 19 -

Genstar Capital Managing Partner Tony Salewski spoke openly with advisors about the firm’s investment strategy for the IBD network.

October 15 -

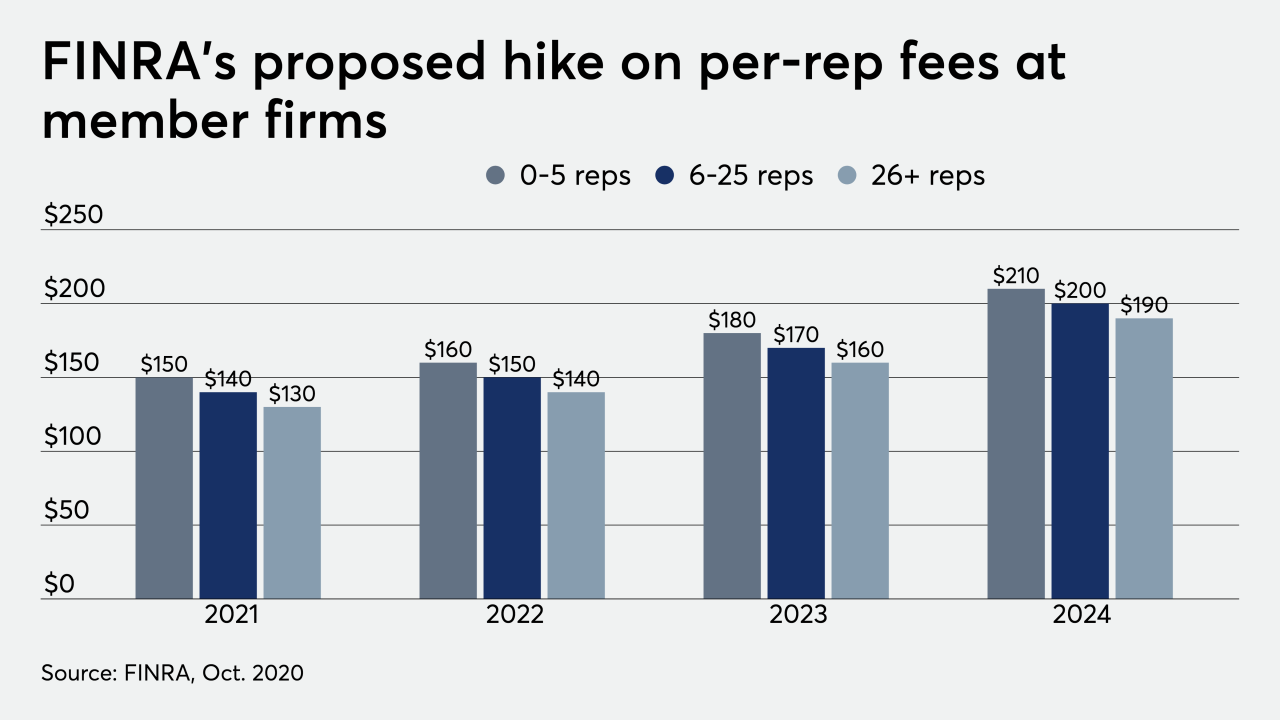

The regulator would generate an additional $225 million per year from the fee increases.

October 9 -

The No. 1 IBD’s 2,500-advisor bank channel will add 285 more reps when two massive investment programs affiliate next year.

October 9