-

These expense ratios were closer to the average fund fee in 1996.

August 15 -

Gambling is fun, but it’s not a sustainable long-term strategy.

August 15 -

Fee wars are great for clients, but don’t judge a fund solely on its expense ratio.

August 14 Wealth Logic

Wealth Logic -

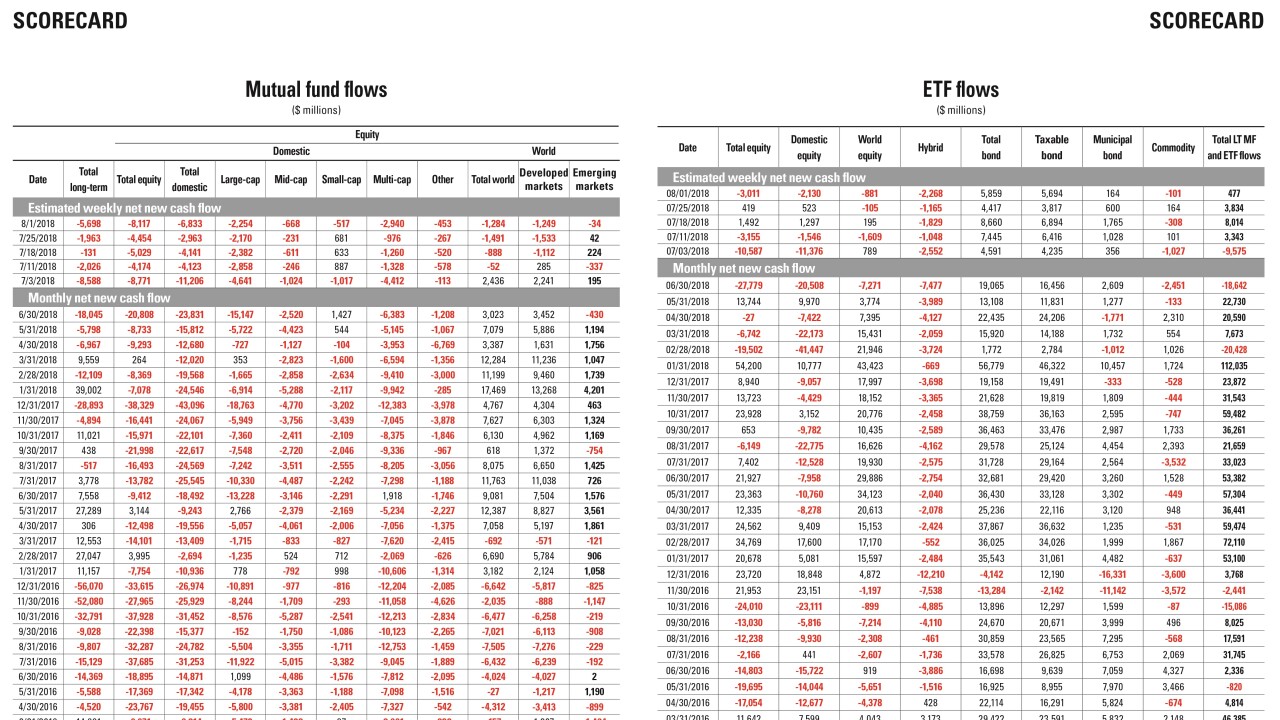

Data reported by the Investment Company Institute.

August 10 -

-

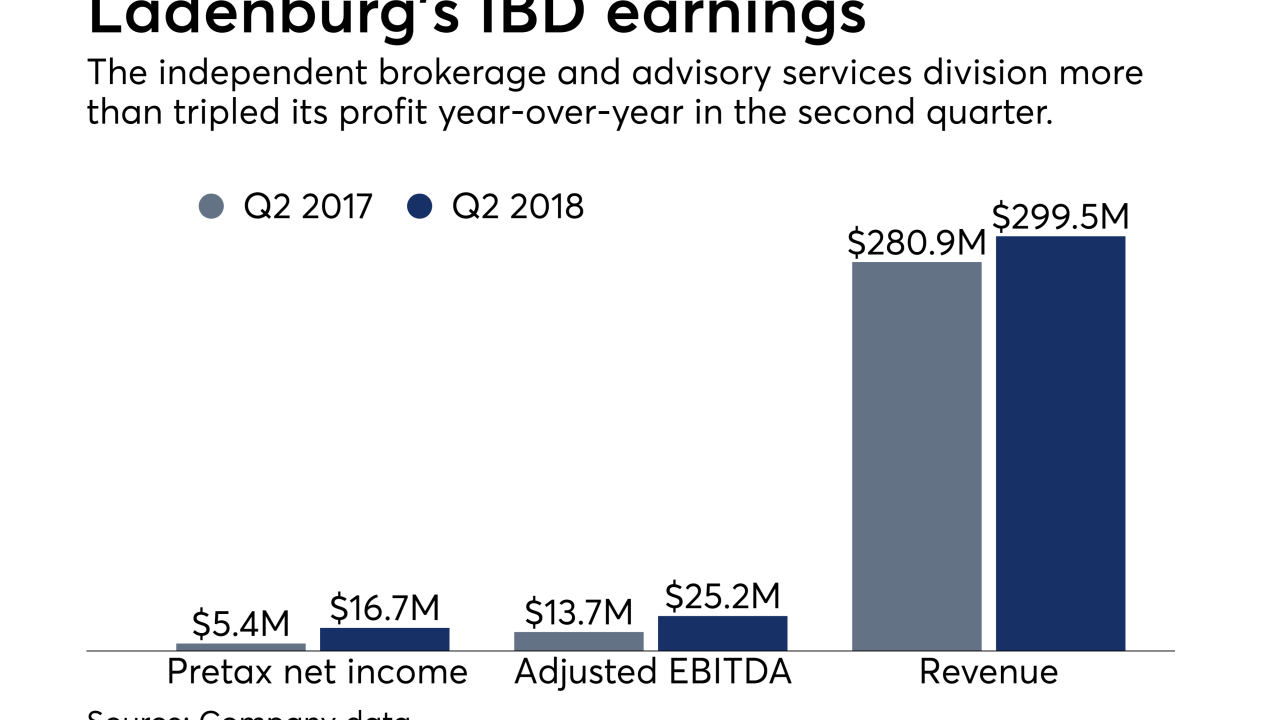

The IBD network disclosed the renewal of its clearing agreement, along with three firms’ intention to self-report possible mutual fund violations to the SEC.

August 8 -

Many sectors have rallied the past decade, but tech and health care outperformed.

August 8 -

The difference between 0.03% and zero will prove to be bigger than three basis points.

August 3 -

The biggest losers so far? High yield bond and large value products.

August 1 -

The firm says it's likely to benefit from the strategy by luring new clients and earning fees on securities lending.

August 1 -

The firm remains in transformational flux, but the results of its "Project E" evolution are beginning to show.

August 1 -

A large portion of the company’s 100 million-plus Prime subscribers fit the same profile as mutual fund buyers, Sanford C. Bernstein analysts say.

July 25 -

Some funds that were in the black still turned in a poor performance — it’s all relative.

July 24 -

Inflows have slowed? Actively managed funds would like to have that problem.

July 19 -

A 20% gain sounds good, until you find out the category returned 30%.

July 18 -

Data reported by the Investment Company Institute.

July 13 -

Passive funds attracted new cash even if their returns were negative.

July 12 -

The asset manager's flows are down 42% year-over-year. The industry: 50%.

July 6 -

The framework targets so-called plain vanilla funds, yet leaves in place a more laborious path for firms wishing to list complex products.

June 28 -

Volatility has returned in 2018, while easy stock gains have vanished.

June 27