-

The nearly 10,000 advisors affiliated with the firm grow 2.5 times as fast as their peers at rival brokerages, CEO Jim Cracchiolo says.

January 29 -

A team that has grown through acquisitions dropped the No. 1 IBD after the institution purchased another one for more than $600 million.

January 27 -

The firm pivoted away from an aggressive hiring strategy in 2016 and has seen a substantial drop in costs associated with picking up experienced talent.

January 26 -

Eaton Vance and E-Trade deals expected to boost the firm’s performance.

January 20 -

Client acquisition was down compared to 2019, but still higher than in years past.

January 19 -

Nearly three decades after launching their practice, the two founders say they’re looking forward to spending more time with clients.

January 13 -

Whitnell & Co. changed hands in a deal with a regional bank that also struck a strategic partnership with the wealth manager.

January 11 -

SEC cases that go beyond faulting firms for their failure to disclose conflicts of interest have drawn pushback from the industry.

December 30 -

The wealth manager whose parent firm also owns an insurer and asset manager settled its third case involving the same time period.

December 23 -

Without market-leading, high-yield savings accounts, cash management at Betterment and Wealthfront isn’t as attractive as it was in 2019.

December 23 -

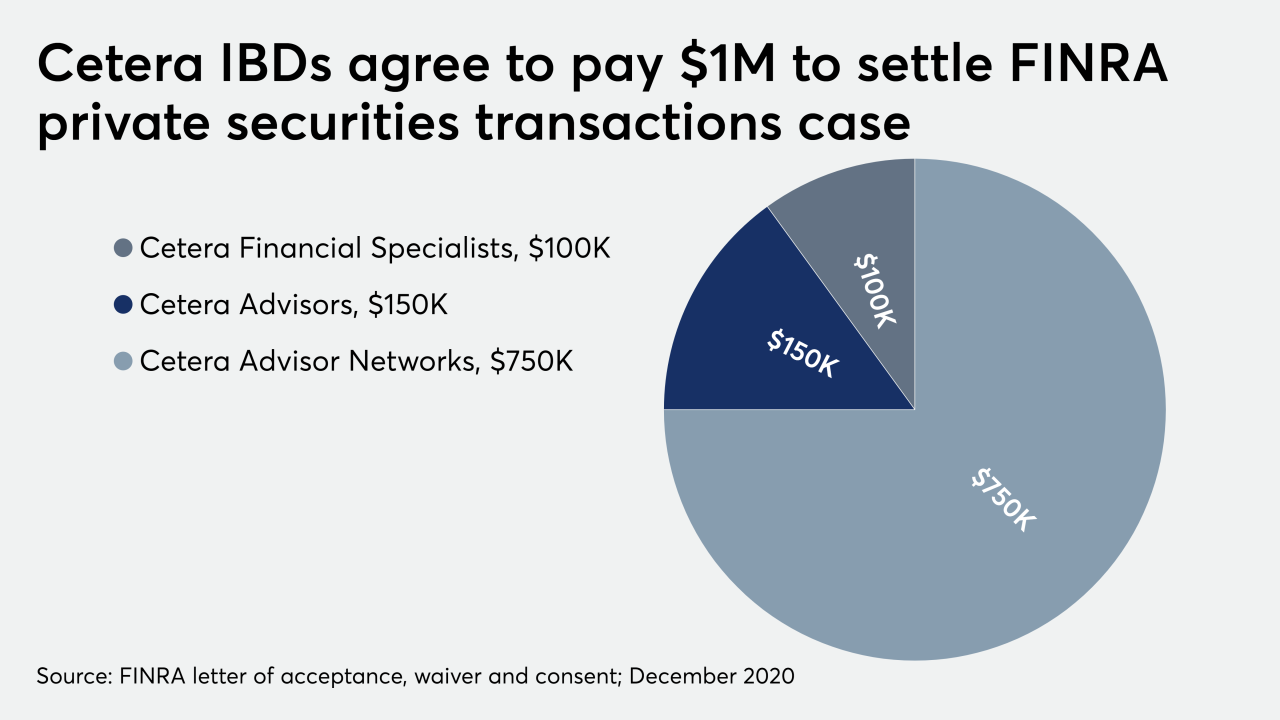

Despite pledges, the IBD network didn’t collect enough data for suitability reviews of the outside transaction for more than five years, according to the regulator.

December 22 -

Like its largest rivals, the wirehouse kept grids at par after a tumultuous 2020.

December 17 -

Waddell & Reed had been working in recent years to transform its “proprietary broker-dealer into a fully competitive independent wealth manager.”

December 10 -

Funding is getting tighter as advisors look towards marketing automation as an engine for growth.

December 9 -

Brian Truscott oversaw more than $330 million in client assets.

December 8 -

Nate Angelo will be responsible for 137 advisors who manage roughly $20 billion in assets.

December 4 -

The firm’s investment management division is bringing 55ip under its roof just two months since launching a partnership with the fintech firm.

December 4 -

The No. 1 IBD is responsible for nearly half of the dozen mega-moves in its sector this year.

November 24 -

As the Federal Reserve strives to help the economy, wealth managers’ revenue takes a hit.

November 18 -

It’s another big get for a bank that has been busily luring away top talent from the wirehouses.

November 17