-

In a compliance case, the SEC accused LPL of failing to verify conflicting information when it opened a customer account and processed wire transfers.

October 6 -

While the pandemic slowed down investigations and court cases, state regulators continued to chase financial scamsters, data shows.

September 29 -

A new report from PIABA says independent advisors are as bad as brokers when it comes to cheating investors and paying awards.

September 29 -

Brokerages that want to hire someone with a checkered past have to undergo a “consultation” with the watchdog and may have to try to renew their memberships.

September 2 -

‘Millions unaccounted for’ in an alleged 10-year fraud as court freezes assets of dually registered planner and his fund.

August 26 -

Defense cites a heart condition caused by a Brazilian parasite as a reason for lesser time.

August 16 -

Nearly 100 clients Mata allegedly defrauded for $14.5 million have received paltry restitution after exhausting every possible method.

July 22 -

FINRA arbitrators decided not to hold the major custodian liable for transactions prior to 2008, an attorney for the clients says.

July 15 -

John Robert Jones Jr. is accused of convincing two dozen financiers to invest in two private unregistered funds with false promises of growth and limited risk.

July 9 -

Former clients of Isaiah L. Goodman shared the financial losses and other harmful impact of the $2.3-million scheme.

July 6 -

The Advisor Group IBD missed 55 alerts suggesting suspicious disbursements by clients of Hector May, according to the SEC.

July 1 -

The judge declined the barred rep’s request for sentence reduction based on his “severe” bipolar disorder and restitution efforts.

June 4 -

The barred ex-rep funneled clients’ money into a shell company he falsely called a sub advisor, according to investigators.

June 4 -

The barred ex-Mutual of Omaha rep stole from 27 mostly older fellow members of his church, YMCA and local business organizations, investigators say.

June 4 -

After Brooklynn Chandler Willy recommended that the clients invest $100,000 into an LLC, its principals were arrested on federal fraud charges, the filing says.

May 20 -

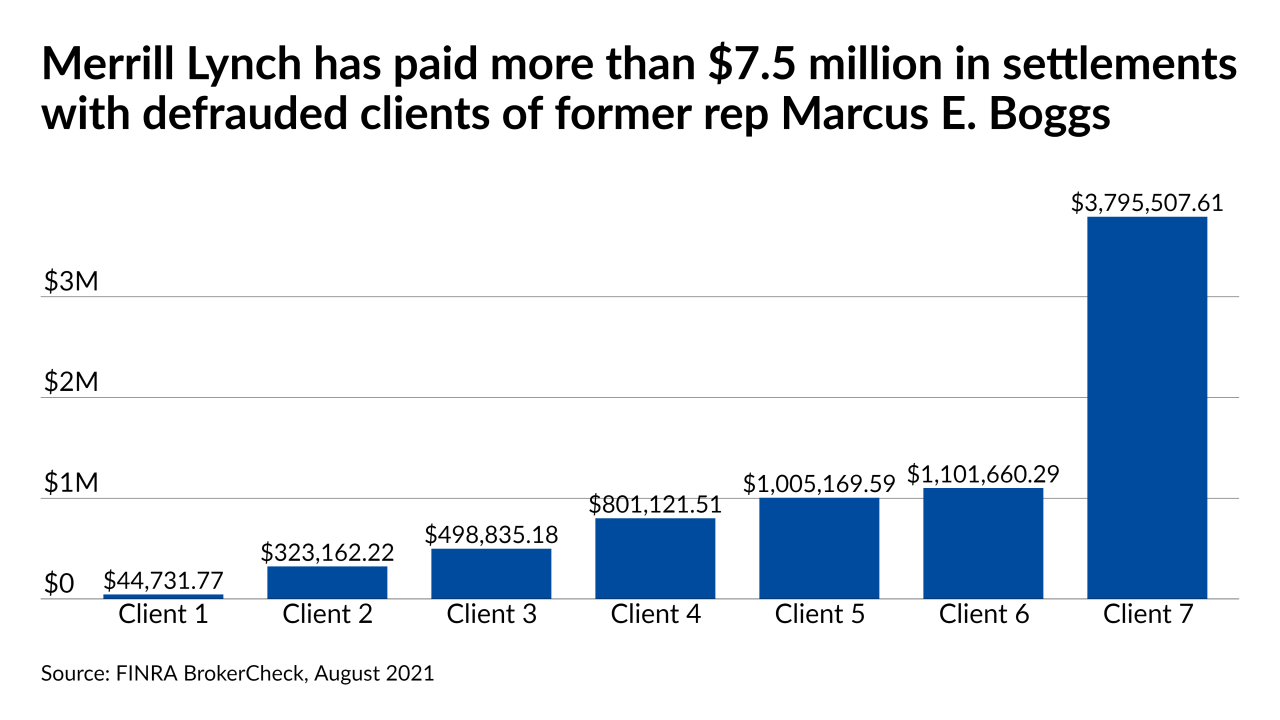

The wealth managers paid victims restitution prior to one barred rep’s guilty plea and another one’s sentencing.

March 23 -

The broker allegedly spent his client’s money on luxury items then pivoted to a Medicare fraud scam a couple of years later.

March 16 -

Three recent criminal cases raise concerns that wealth managers and regulators aren’t detecting alleged fraud quickly enough or disclosing basic information about crimes and disciplinary problems.

March 12 -

He allegedly used the money to pay gambling debts and credit card bills, according to federal prosecutors.

February 17 -

The 33-year-old advisor allegedly spent clients’ money on luxury items and business expenses for his startup.

February 11