-

New firm FallLine Securities caters exclusively to advisers serving ultrawealthy clients.

June 19 -

Overall, the nation's wealthy are expected to add to their growing fortunes in the years ahead.

June 15 -

The restructuring of the business following the May 2011 acquisition of Wilmington Trust is largely over, enabling it to grow.

June 8 -

The new offering would enable the firm to serve "more than their traditional wealth management needs," an executive said.

May 24 -

The firm previously shuttered a wealth management unit last year that failed to take off despite some high profile hires.

March 7 -

Exclusive: Advice Period, the newest RIA platform model, offers star power and IBD qualities. Is it enough?

January 9 -

The new exec will advise wealthy individuals and families on tax and estate planning, investing, private banking, financial reporting and fiduciary services.

January 6 -

Here are the moves advisers can make to serve larger, wealthier and more-profitable clients.

December 22 -

The great wealth transfer might be here, but the top 1% of the 1% are in jeopardy.

October 17 -

Aging billionaires are expected to transfer approximately $2.1 trillion to their heirs over the next 20 years, according to a new study by UBS and PwC.

October 13 -

The wirehouse's latest hire will help ultrawealthy clients with estate planning and other services.

October 12 -

The executive will oversee the delivery of advice and services for many of the firm's most prominent client families.

September 30 -

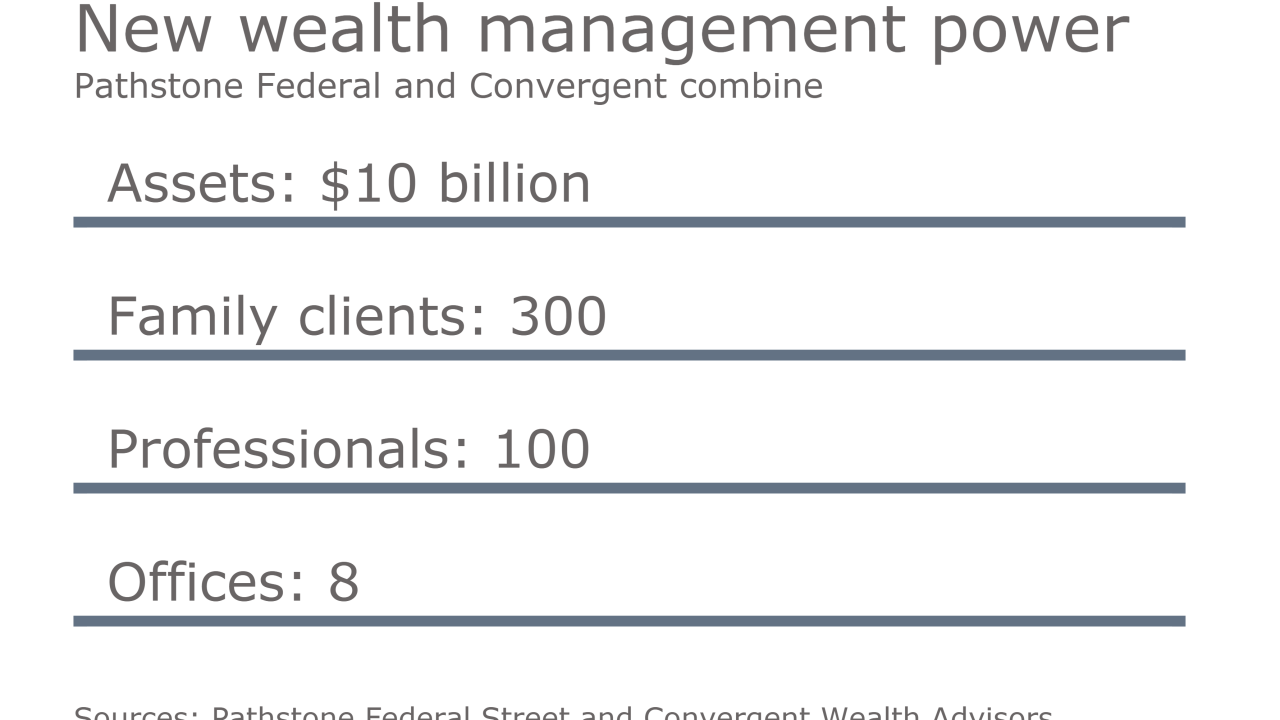

Pathstone Federal Street-Convergent combo forms a new $10B UHNW powerhouse.

August 26 -

The firm was "cut out" from an entire class of advisers, says CEO Alexandra Lebenthal.

August 12 -

Assets under advisement were said to be $13 billion. The AUM was much less.

August 10 -

The goal is to make clients appreciate the value of services being offered.

July 11 -

The wealthier the family, the trickier it can be to interpret their finances. A modern investment management platform can alleviate the need for manual number-crunching.

June 1 Biltmore Family Office

Biltmore Family Office -

The wirehouse will consider the move if “conditions remain as they are or grow worse,” CEO Sergio Ermotti says.

May 10