Earnings

Earnings

-

CEO Dan Arnold describes the firm’s tech-fueled advisor strategy.

January 31 -

To accommodate its burgeoning brokerage force, the firm opened 42 new branches last year.

January 31 -

Jim Cracchiolo predicts the number of advisors will go back up, but he says the firm places more importance on boosting the size of their businesses.

January 31 -

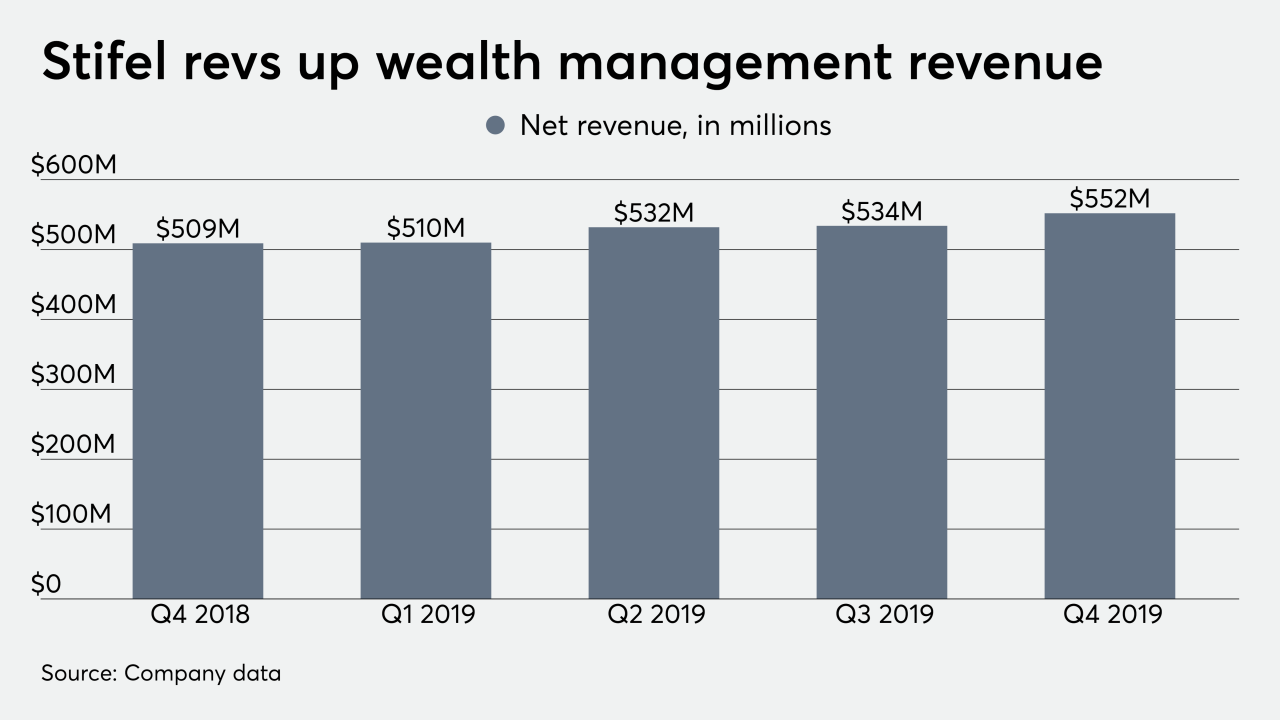

The firm is drawing heightened interest from advisors generating between $1 million to $5 million, according to CEO Paul Reilly.

January 23 -

The wirehouse boosted profitability even as advisor headcount dropped.

January 22 -

The custodian has made three big announcements. The connection between the three may not be obvious, but together, they indicate what I think could be a brilliant strategy.

January 22 -

The firm plans to entice new customers through its stock plan administration and financial wellness businesses.

January 16 -

When the world’s wealthy look for a bank to entrust with their personal fortunes, Goldman Sachs isn’t necessarily on their speed dial.

January 16 -

The firm typically trains its own advisors in lieu of recruiting talent from the competition.

January 16 -

The firm added 40,000 new accounts last year and hit a record $3 trillion in client balances.

January 15 -

Fueled by a rebound in trading, especially in fixed income, the company said profit jumped 21% in the fourth quarter.

January 15 -

The bank continues to struggle with attrition due to scandals, regulatory scrutiny and a graying workforce.

January 14 -

The firm hasn’t made any decisions about advisor retention bonuses, but some top shareholders will earn tens of millions of dollars once the deal closes.

November 19 -

The Reverence Capital Partners-backed network would expand into nine subsidiary brands with 11,500 advisors under the deal, taking the selling firm private.

November 11 -

Fresh off rebranding its wealth management business to Avantax, the firm aims to support its smaller but more productive force.

November 7 -

The wealth management unit took in lower revenue from the year-ago period — but executives say its transformation is going according to plan.

November 4 -

The network of five IBDs with 4,400 advisors hasn’t made a final decision, according to Bloomberg News.

October 30 -

CEO Dan Arnold described the firm's multipronged strategy for further growth.

October 25 -

Strategies may include building out RIA channels and cash sweep programs in efforts to make up for revenue declines.

October 25 -

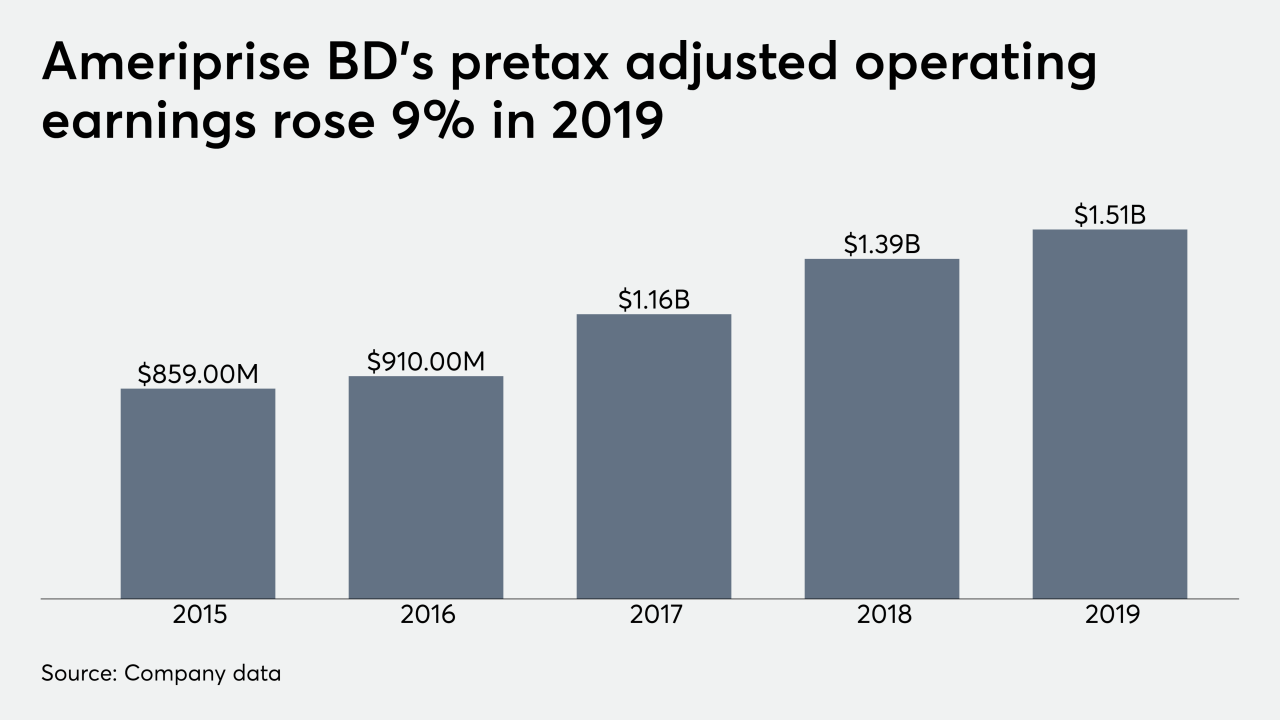

CEO Jim Cracchiolo says the firm is focused on “holistic advice rather than a free trade” after wealth management client assets reached a new high.

October 24