As more clients make investments based on their personal values, there’s a growing interest in funds relating to gender equality.

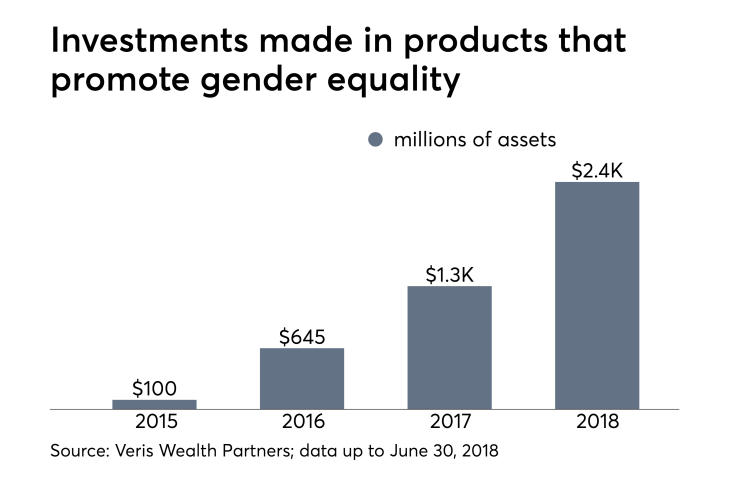

In the public market, assets put into these products grew from $100 million to $2.4 billion in the past four years, according to a

“This upcoming generation that’s inheriting somewhere between 30 or 40 trillion over the next decade really is looking to have choice in respect to their values and where they are putting their money,” says Alex Meek, co-founder of Newday, a values investing startup in San Francisco offering gender equality portfolios to investors.

But do these gender-focused products do what they promise, and do they perform? There’s a way to measure that now.

Factors including low interest rates may have contributed to success.

This week, corporate responsibility foundation As You Sow launched its fifth values investing tool —

But what the tool has revealed is that none of products available on the market, even ones that promote gender inclusion, such as the Pax Ellevate Global Women’s Leadership Fund (PXWIX), are getting high scores.

“The best fund ever, in all of our whole system gets a 68 [out of 100],” says Andrew Behar, CEO of As You Sow. “We still have a long way to go.”

The reason for the low scores has to do with how some of these products measure gender equality, says van Maasdijk.

“Just adding women to the board is not enough when it comes to creating a culture of justice and equality within a company,” she says. “It’s a very good first step, but it’s not enough.”

Additionally, not all 4,000 public companies on the system provide the gender data they need to do the rankings, according to Behar. Bigger companies have better scores initially, because they have the resources to find the information and fill out the surveys.

However, Behar expects the number of companies that fill out information to grow. At least, that’s how the other tools evolved.

Gender Equality Funds is the fifth, and newest, investment tool from As You Sow. The first was a fossil-free investment tool launched at the end of 2015 that gives funds badges, based on whether a fund included fossil fuel sectors in its offering.

Since its release, over a dozen fund managers have reached out to him, asking how they can improve their score. Sure enough, by the next month, their score improved.

“It happens in a number of days,” Behar says.

The number of socially responsible “five badgers” (the top score) went from 12 at launch to 62 by November 2018.

“I’m hoping that a lot of companies will realize they need to be transparent and disclose their gender metrics,” van Maasdijk says.

Along with investing in personal values, ESG investing will be more profitable in the long run, according to Newday co-founder Meek.

“In terms of overall risk mitigation of how you’re investing — it’s just the smartest way to invest,” he says. His company plans to release its own funds to asset managers and home offices within the next two years.

And for those clients who want to use their money to make a profit, and a difference, there is an opportunity for building stronger relationships, according to Behar.

If an advisor can place assets toward a client's passion, Behar says, "that person is going to think you’re a hero."

This article has been updated with corrected data from As You Sow to reflect that there are currently 62, not 400, socially responsible funds that have received five stars on the non profit's fossil-free investment tool.