A former Barclays broker agreed to pay the firm $450,000 in a settlement his attorney says displays the effects of an investigation into overbilling by the firm.

A FINRA panel earlier this month found Marc Karetsky liable for the stipulated award after Barclays accused him of a breach of promissory note, according to a copy of the decision. The firm had sought $625,000 from Karetsky plus interest and fees, but the two sides agreed to the settlement in late May.

-

"I lose years of my life. They can settle, write a check and move on," says an adviser whose book of business dropped by $40 million after he alleges he was wrongfully terminated.

December 19 -

A federal judge ruled that the ex-Barclays advisor had been unfairly forced into FINRA arbitration, where a panel had ruled against him.

March 27 -

The bill was for 220 hours of attorney's work, which the judge called "excessive on its face" for a case that included no oral arguments.

July 13

The deal pushed arbitration winnings this year by Barclays, which

On the other hand, a fourth ex-Barclays broker won dismissal of

“They are very concerned about how these failures will have an impact on these loan cases where [wealth] managers were compelled to move before they went to Stifel or elsewhere,” says Karetsky’s lawyer, Jonathan Sack of New York-based Sack & Sack.

Karetsky “never would have imagined that they would have shut the business down without warning or explanation” when he signed the promissory note upon starting employment at Barclays back in 2008, Sack added.

-

The firm won a rejection of her $1 million claim, promissory note damages, legal fees and interest.

April 13 -

The former Barclays broker still owes more than $460,000, a FINRA arbitration panel ruled.

April 4 -

A federal judge ruled that the ex-Barclays advisor had been unfairly forced into FINRA arbitration, where a panel had ruled against him.

March 27 -

The regulator accused the firm of collecting excess mutual fund fees by steering clients into more expensive share classes.

May 11

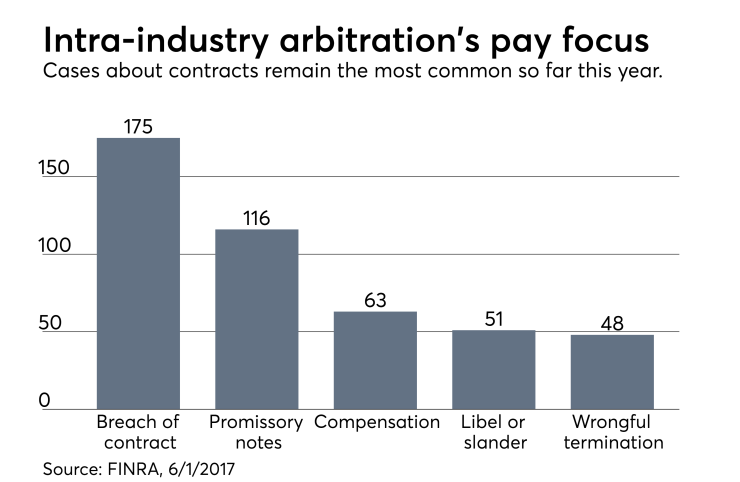

Stocks and Puerto Rican bonds are the focus of many cases among clients, advisers and firms.

CLAWBACK TRACK RECORD

A spokeswoman for Barclays declined to comment, as did the lawyer who represented the firm in the case.

Karetsky, contacted at the New York City offices of his Morgan Stanley Private Wealth Management practice, didn’t respond to requests for comment. His partner, fellow ex-Barclays broker Sylvia Gort, sought $1 million for breach of contract, retaliation and violations of labor law from the firm in arbitration, only to have Barclays win a $221,000 clawback in April.

Barclays filed its claim against Karetsky in January 2016, five months after he left the firm, according to BrokerCheck. Karetsky denied the firm’s allegations and accused Barclays in a separate filing of breach of contract and a violation of New York labor laws, among other allegations.

In its June 14 decision approving the settlement, the New York City arbitration panel denied Karetsky’s counterclaim. In a case the following day, a FINRA panel in Boston approved a confidential settlement between Barclays and another former broker the firm accused of an unpaid promissory note.

Karetsky and his lawyer opted for the settlement in light of that track record and his new post at Morgan Stanley, Sack says.

“We cut the deal,” he says. “He’s up and running and moving on with his life.”