ETF closures have hit a record.

There were 186 funds shuttered in 2018 - 83 of them occurred within the last two weeks of December. This far outpaces the 134 funds closed in the year-ago period.

What does this mean for the future of the ETF industry? Not as much as you might think.

Despite the number of closures reported by Morningstar, the space is still swelling. Inceptions of ETFs are still widely outpacing the number of funds shuttered, as they have done for well over a decade.

There were 326 ETFs that were launched last year, according to Morningstar. That number marks the most fund openings in a one-year period ever, according data from to Cerulli Associates. The second was in 2015, with 271 launches.

Passive vehicles are set to match — or outpace — active fund market share in 2019 for the first time, according to Bloomberg News. There are now nearly 2,900 ETFs available to investors.

"The barriers to launching ETFs just aren't that high," says Daniil Shapiro, associate director of product development at Cerulli Associates. With current regulatory proposals, it might become even easier, he adds.

OPPORTUNITIES FOR NEW PRODUCTS

Last year, the SEC

The rule will allow most ETFs to operate without requiring exemptive orders, which will save time and increase competition in the space.

-

Issuers want the regulator to go further and make it easier for managers to choose the securities they add or subtract when they issue and redeem shares.

June 21 -

Commission staffers are probing how broker-dealers are handling ETFs and the extent to which investors understand the risks of the funds.

May 20 -

Six fiduciary groups call on advisors press SEC to clarify the differences between advisory and brokerage business models.

June 28

Many fund companies such as BNY Mellon, BlackRock and Virtu Financial are enthusiastic about the proposal, according to

"[This rule] will] lead to significant cost savings for issuers and dramatically reduce the time frame for product launch," Douglas Yones, Head of ETFs at the New York Stock Exchange, said in a comment regarding the SEC proposal aimed at ETFs organized as open-end funds.

As barriers to entry could be getting lower, there are still a lot of opportunities for new products.

"There's about 8,000 mutual funds out there," says Daniel Prince, head of iShares U.S. wealth advisory product consulting. "We think, over time, you will see more of those traditional non-transparent strategies poured into the [transparent] ETF structure because of the efficiencies."

But as more ETFs become available, some products will be shuttered. Differentiation can make picking up traction more difficult, according to Matt Merritt, an associate analyst at Cerulli Associates.

"If you're launching multi-factor strategic beta products, there's an inherently higher probability of that shutting down, just because it's more difficult to understand than something like an old-school index fund," he says. "As products become more differentiated, the probability of failure almost has to go up with it."

ETFs will continue to close for a reason that they always have — failure to gain enough assets over a long period of time.

There could be a whole host of causes for this: competition, marketing support or even state of the market, according to Shapiro. There really is no specific trend.

The market was extremely volatile in 2018, and some products, such as

"You also just have some products that naturally close," Shapiro says.

Products such as defined maturity ETFs are intended to close and distribute net assets to shareholders on a specific date. The Invesco BulletShares 2018 Corporate Bond ETF (BSCI) and BulletShares 2018 High Yield Corporate Bond ETF (BSJI) closed — as intended — at the end of December.

NO CAUSE FOR CONCERN

However, while unplanned ETF closures might be standard, this isn't to say they are meaningless — especially for those who own shares of the product. When a fund closes, it

Either option necessitates taxes. Selling early will likely see an increase in the bid-ask spread. Waiting for liquidation will mean absorbing costs related to the closure. Some asset managers pick up the tab for legal costs and filing fees. Others don't.

But overall, the number of closures is no cause for concern in the industry, and it's not upsetting asset managers.

"I think the pickup in closures we've seen over the past couple years for ETFs is actually a healthy development," says Rich Powers, head of ETF product management at Vanguard. "It's a recognition by sponsors that products that they brought to market didn't resonate with a broad universe of investors."

One thing is certain: As more funds open and close, the landscape of the ETF industry is shifting, too.

BENEFITING FROM ALTERNATIVES?

ETFs originated as products that would mirror broad market indexes, rather than try to beat them. Passive products stem from the reality that outperforming the S&P 500 can be an uphill battle. Less than 24% of funds have managed to beat the market in a five-year period, according to the

Since the first ETF was launched in the early 1990s, there have been at least 1,100 ETFs that track an index launched into the market, according to Cerulli Associates.

Fees were nearly half the price of the top-performing active funds.

ETFs started simple, and their strategy was straightforward. No longer.

Asset managers are turning to new alternatives: non-index and strategic beta ETFs. Both products carry an opportunity for differentiation, as well as a higher price tag, according to Shapiro and Merritt.

Non-index ETFs are essentially actively managed products. They are not tied to an index, and they have portfolio managers who are actively seeking alpha, according to Merritt. However, they still offer the benefits of an ETF.

"The ETF is bringing transparency and low cost and tax efficiency to traditionally actively managed strategies," Prince says.

Others are skeptical.

"We'll see if that actually sticks," Powers says.

Strategic beta ETFs maintain a passive strategy and track an index, but they tilt toward certain factors, or follow a set of rules, seeking to enhance returns or minimize risk relative to a traditional benchmark. As active managers often emphasize the same factors, the funds can offer a lower-cost alternative to related mutual funds.

-

Concerns came into focus when a $1.9 billion exchange traded note lost 90% of its value in a single day.

February 15 -

The standard process for launching exchange traded funds is flawed, argues Allan Roth. He proposes a better way.

November 15 -

There are 148 ETFs focused on dividends. We looked at the eight cheapest, and then whittled even further.

June 14

Still, there is often misunderstanding between asset manager and advisor regarding these products. Issuers often position strategic beta ETFs differently than how advisors use them, according to Shapiro and Merritt.

Issuers often focus on factor exposures, suggesting they will deliver alpha, while advisors harness them for downside risk protection and reducing portfolio volatility, Shapiro and Merritt say.

As much as 61% of advisors state that they aren't using strategic beta at all — they are either unfamiliar with the strategies or cannot determine that the products will produce alpha or outperform active management, according to Cerulli Associates.

Despite this level of misunderstanding about the products, smart beta is getting popular. There were 845 strategic beta funds in 2017, according to Morningstar, representing 13% of passively managed fund assets — and they're growing faster than the average passive fund.

"Our data shows we're going to see more launches of strategic beta and active products," Shapiro says. "And as advisors get more and more comfortable with them, they are going to use more and more of them."

Part of the attraction has to do with cost. While they may bear similarities to mutual fund counterparts, these ETFs certainly don't carry the same price tag.

In 2017, the asset-weighted average fee for U.S. equity strategic beta funds was 0.18%, well below that of active fund competitors (0.73%), according to Morningstar.

WHAT'S DRIVING DOWN FEES?

Fees are lower than ever, and in some cases, non-existent. The growth of ETFs has necessitated a pinch on price tags.

A traditional cap-weighted passive fund now has an average fee of 0.09%, according to Morningstar — an average that has been plummeting for nearly a decade.

The asset-weighted average expense ratio fell by 8% year-over-year in 2017 — the largest annual drop in cost for investors since Morningstar's annual fund fee study began in 2000.

"We estimate that investors saved roughly $4 billion in fund expenses [in 2017]," the study said. The decline in fees was driven by $949 billion in assets that were invested into the cheapest of funds.

Now, 83% of all assets invested in mutual funds and ETFs are directed at products in the bottom 40% of cost, the study said. The competition has placed pressure on both active and passive funds alike, according to the study.

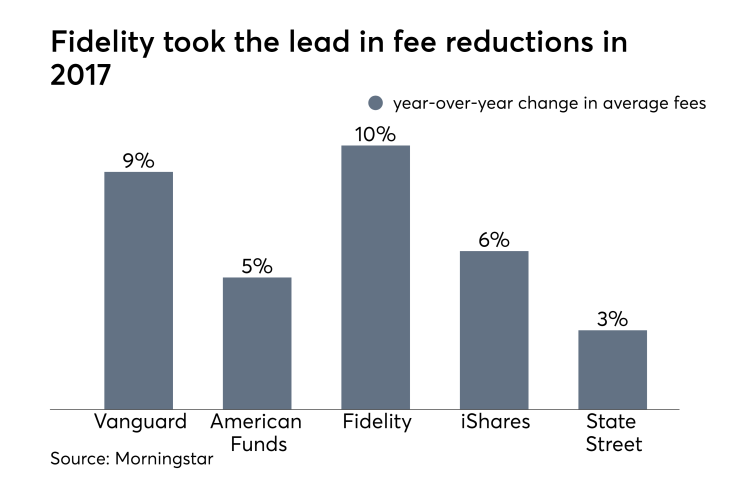

Asset managers are slashing prices. Leading the charge is Fidelity, which lowered its average fee by 10% in 2017, according to Morningstar. The asset manager launched over 80 lower-cost share classes in two years.

Vanguard, which continues to offer the lowest fees on average, dropped its asset-weighted average fee by a cumulative 25% in the past three years, according to the study. Meanwhile, more asset managers are grabbing their own slice of market share.

NEW SOURCES

"When you look at the record number of openings of ETFs, it's noteworthy [they] are coming from a lot of different firms that did not offer ETFs and traditionally had active mutual funds," Prince says.

In January of last year, American Century debuted its first two ETFs, American Century STOXX U.S. Quality Value ETF (VALQ) and American Century Diversified Corporate Bond ETF (KORP). PGIM Investments, owned by Prudential Financial, launched its first ETF, PGIM Ultra Short Bond ETF (PULS) in April.

There are a lot of firms, and a lot of funds, competing in the ETF space, and it doesn't look like this will be shrinking in the near future.

As more ETFs close, even more are opening. Investors are demanding more. "We don't think that the key drivers of trying to more finely tune [a] portfolio are going away soon," Prince says.

An earlier version of this article reported there were 126 fund closures in 2017. That number has been updated to 134, which now includes ETNs.