Advisor headcount fell again at UBS Wealth Management Americas, though broker productivity hit a high point as the wirehouse continues its transformation under President Tom Naratil.

The firm's U.S.-based wealth unit

Since Naratil took command in 2016, UBS has slashed recruiting efforts in a bid to shift resources to other parts of the operation. The company has made other changes, such as revamping its compensation plan and

-

CEO Jim Cracchiolo reported record client assets and a sharpened focus under the fiduciary rule.

October 25 -

The company also said that its advisor ranks are growing.

October 19 -

As a result of CEO James Gorman’s strategic moves, the firm earns the biggest share of revenue from wealth management of the six biggest U.S. lenders.

October 18 -

The firm's advisor ranks increased slightly during the third quarter, ending three consecutive periods of decline.

October 13

With an emphasis on retention over recruiting, the firm's brokerage force has been steadily shrinking, dropping to 6,861 advisors from 7,087 in the year-ago period ― though that still falls within the target range of 6,500 to 7,000 brokers that executives have said they are aiming for.

The reduction in recruiting is showing up in the firm's financial statements. Recruitment loans to newly hired advisors are down 16%, falling to $2.6 billion from $3.1 billion. Meanwhile, compensation commitments with recruited advisors fell to $187 million from $201 for the year-ago period, a decline of 7%.

At the same time advisor productivity has continued to rise; revenue per FA increased to a record of $1.24 million from $1.12 million.

This surpasses that of rivals such as Morgan Stanley and Merrill Lynch, which recently reported revenue per advisor of $1.07 million and $994,000, respectively.

Independent and regional firms have been maintaining strong appeal with new recruits.

RECORD AUM

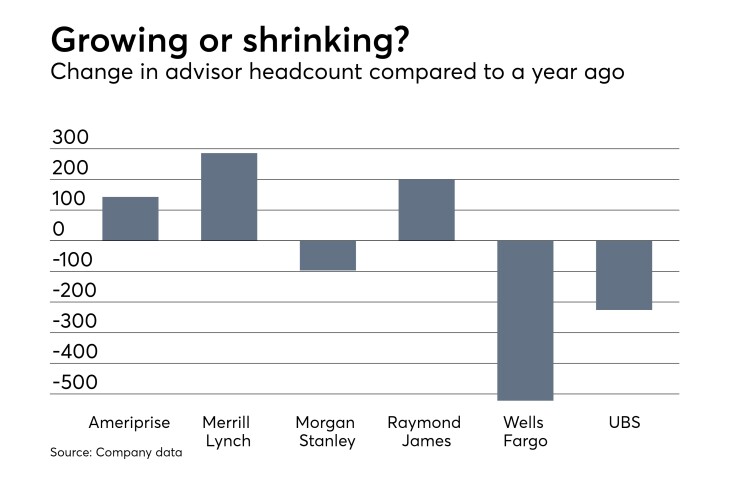

UBS isn't alone in taking a less aggressive approach to recruiting. Morgan Stanley and Merrill Lynch adopted similar policies earlier this year. Independent and regional firms, meanwhile, have stepped up their efforts, and it's showing up in their earnings results.

Advisor headcount at Raymond James topped 7,300 for the first time, the company recently reported.

Recruiters have questioned how long the three wirehouses can pursue such an approach, noting that hiring advisors is usually a quicker path to growing a firm's AUM.

"The reality is, in my opinion, I don't see how these firms can go forward without a lot of organic growth," says recruiter Bill Wills. "Furthermore, if you want to grow organically, that's a longer term process. It doesn't happen in a matter of months."

Strong markets, meanwhile, have lifted several firms to record highs, including Merrill Lynch and Morgan Stanley. UBS also reported record client assets of $1.25 trillion, up 8% from $1.16 trillion.

And even as UBS's expenses related to recruiting fell, overall costs rose as a result of higher advisor pay. Total operating expenses increased to $1.8 billion from $1.66 billion, up 8%. Revenue rose 7% to $2.1 billion, boosted by higher net interest and recurring net fee income.