-

The firm is “looking to aggressively compete” by lowering and simplifying the fees on its advisory platforms, a top executive says.

June 10 -

The No. 1 IBD aims to triple its potential target market reach, in part by adapting some aspects of employee services to independence.

June 7 -

The new rule package will require firms to take a hard look at their compliance programs.

June 7 -

Activist investors have taken large stakes in at least 100 of the products so far this year.

June 7 -

Consumer advocates may turn to state regulators in hopes they’ll pass more stringent rules.

June 5 -

Brokerages would rather have an SEC chief appointed by a President Trump set policies than take its chances with what might happen should a Democrat win the White House in 2020.

May 30 -

The JPMorgan chief executive said he couldn't understand why Wells Fargo could have CEO Tim Sloan step down without a successor ready to go.

May 28 -

"You should buy into IPOs to hold them, because you believe in the company," James Gorman said.

May 23 -

The approved legislation relaxes rules for retirement savers.

May 23 -

CEO Dan Arnold presented details of the firm's mounting ambition after announcing the acquisition of a brokerage and RIA with $3 billion in client assets.

May 22 -

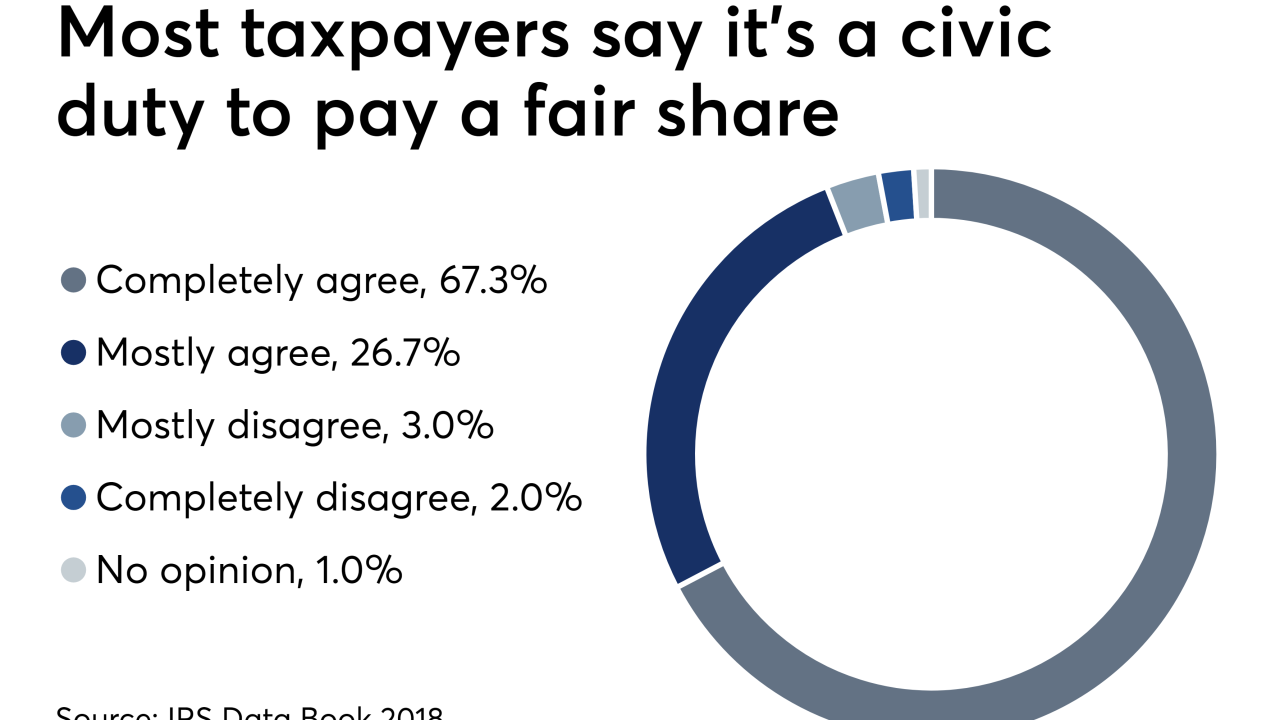

The agency processed more of every major type of form during FY 2018 than during the prior year, with the exception of estate tax returns.

May 22 -

Despite the win, a proxy adviser had raised concerns that the bank’s compensation committee uses too much discretion when determining total pay.

May 22 -

The ride-hailing platform’s IPO may test how wealthy clients react if they don’t fare so well.

May 13 -

In a bid to further enhance its capabilities for advisors, the firm is also slashing ETF transaction fees on select funds later this year.

May 3 -

Bank critics and some lawmakers quickly seized on a tone-deaf posting by JPMorgan Chase that was designed to tout the virtues of saving money.

April 29 -

Previous Republican and Democratic presidents have declined to assert authority over independent agencies, partly because the legal issue isn’t simple.

April 25 -

The firm, along with the broader asset management industry, is focused on ways to expand its global reach amid mounting pressure for growth.

April 24 -

Shelley O’Connor, who co-led the unit with Andy Saperstein, will now oversee two bank entities.

April 24 -

With the board still conducting a hiring search, the strategy for fixing past problems and returning to revenue growth remains in flux.

April 22 -

The proposed rule will need substantial revisions before it wins the support of the commission's sole Democrat.

April 22