-

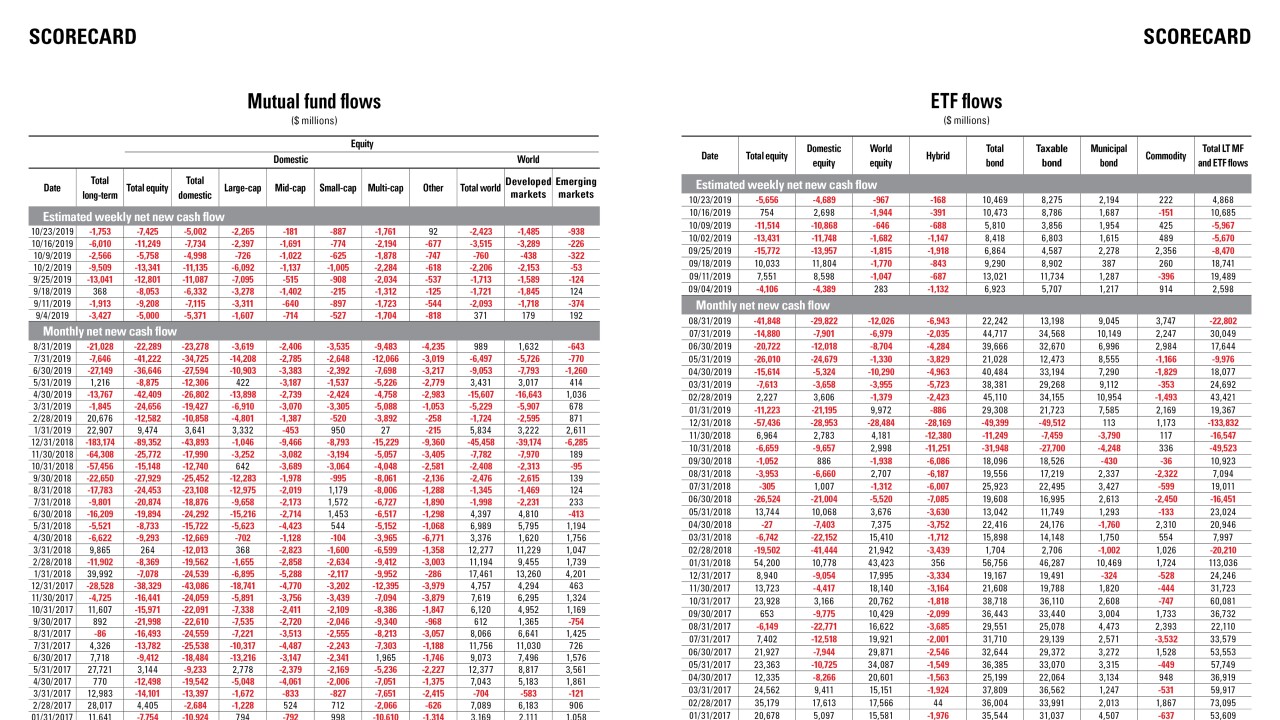

Data reported by the Investment Company Institute.

November 7 -

The SEC's recently passed ETF modernization rule is just one regulatory change industry leaders expect will impact asset management in the years ahead.

November 7 -

With an average gain of nearly 40%, the following mutual funds and ETFs are narrowly invested in the most attractive segments of the market.

November 6 -

As the sector grows to over $30 trillion in Europe, North America, Japan, Australia and New Zealand, one popular approach consists of excluding offenders.

November 5 -

The SEC’s recently passed ETF modernization rule, which expands choice in the market, “is probably the end of the mutual fund industry.”

November 1 -

Despite their high fees and double-digit returns, nearly all have even outperformed themselves so far this year.

October 30 -

Worries about the proliferation of new funds were high at the first Bogleheads conference without the company’s former leader.

October 30 Wealth Logic

Wealth Logic -

The top 20 nearly doubled their gains over the last year, data show.

October 23 -

The regulator’s expanding number of share-class cases fill in the details it says have been missing from Form ADV disclosures about conflicts of interest.

October 18 -

In a little-noticed rule change, mutual funds no longer disclose their shrinking BD commission load-sharing payments.

October 16 -

“Not every muni is trying to achieve the same thing,” an expert says.

October 16 -

Clients should consider paying more deductible expenses before year-end if their total itemizable deductions will be close to their standard deduction amount.

October 15 -

“The combination of low rates, curbs on state and local tax deductions, and consistent economic expansion have been a nice tailwind,” an analyst says.

October 9 -

Fee compression and commoditization of investment products over the past decade are threatening already slim margins in asset management.

October 9 Delta Data

Delta Data -

Since this March, almost 100 firms have settled with the regulator for approximately $173 million. Other cases are still pending.

October 8 -

At more than twice the price of the average fund, many with the even biggest gains still underperformed the broader market over the last decade.

October 2 -

Someone with a long-term investing horizon is generally not helped by bailing out of a well-diversified, multi-asset portfolio. Here are some options for them, and some talking points for you.

October 1 -

Deviation from the broader market has left more than half of these products with losses during a time the Dow and S&P 500 each posted double-digit gains.

September 25 -

Cash flow has subsided and market conditions have changed since the fund was closed to most new accounts in 2016.

September 25 -

At 84 basis points, the average expense ratio is over 40 basis points pricier than what investors paid on average last year.

September 18