-

Failing to enroll in a health care plan and taking on a hefty student loan debt are just two of the most common blunders younger clients should avoid.

December 11 -

Despite the exodus, all of the mutual funds and ETFs on the list posted net gains for the year.

December 11 -

Brokerage firms that sell the funds must determine whether clients understand their risks — a requirement that could discourage offering them at all.

December 6 -

“There’s less performance chasing than you saw in the past, and that’s a positive thing,” an expert says.

December 4 -

The planned launch from Cornerstone Capital would be the firm’s first stock fund for individual investors with social and environmental goals.

December 3 -

Fund industry Darwinism should be seen as healthy and natural in a thriving — albeit brutal — market, an expert says.

December 2 -

Funds' past performance is no guarantee of future performance — but if planners don't evaluate the past, how can they best communicate investment decisions to clients? Here's how to balance on that tightrope.

November 26 -

After a recent policy switch, many clients at the wirehouse can no longer use balances from their deposit accounts to purchase shares in these funds.

November 20 -

Double-digit gains produced by the mutual funds and ETFs with the most AUM were not enough to best the broader market.

November 20 -

-

The fact that it’s impossible to track the amount of revenue sharing kickbacks demonstrates the problem, says the research firm’s lead policy wonk.

November 18 -

Clients overpaid more than $12 million because of operating flaws and coding failures in an automated device advisors relied on for executing mutual fund orders.

November 14 -

Equity funds tracking the sector are the second-most popular asset class after U.S. government bonds this year, BNP Paribas says.

November 14 -

Those that shorted the market suffered “steep losses,” while market-neutral products posted “modest gains.”

November 13 -

Asset managers who flocked to safety in utilities and dividend stocks at the end of 2018 have seen their pain compounded by the latest risk-on rally.

November 8 -

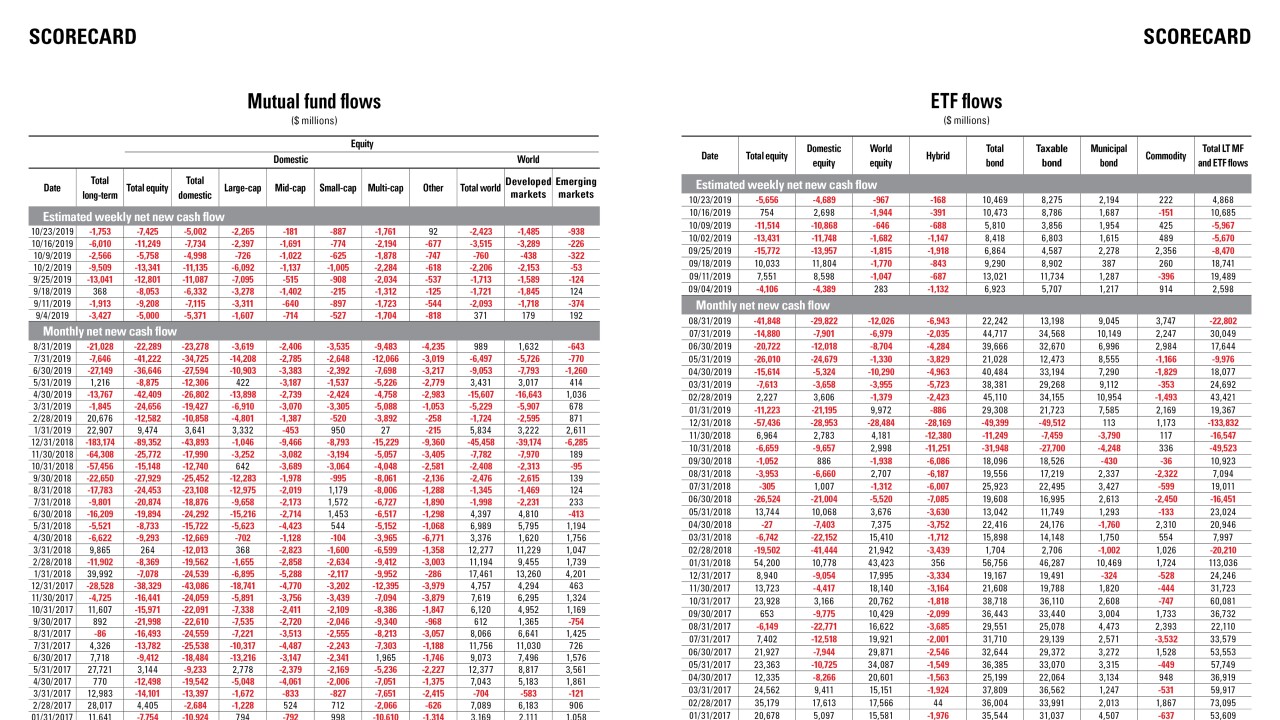

Data reported by the Investment Company Institute.

November 7 -

The SEC's recently passed ETF modernization rule is just one regulatory change industry leaders expect will impact asset management in the years ahead.

November 7 -

With an average gain of nearly 40%, the following mutual funds and ETFs are narrowly invested in the most attractive segments of the market.

November 6 -

As the sector grows to over $30 trillion in Europe, North America, Japan, Australia and New Zealand, one popular approach consists of excluding offenders.

November 5 -

The SEC’s recently passed ETF modernization rule, which expands choice in the market, “is probably the end of the mutual fund industry.”

November 1